Going Broke? Here Are The 8 Best Ways to Avoid Cash Flow Problems

Going Broke? Here Are The 8 Best Ways to Avoid Cash Flow Problems

In the early 2000s, BlockBuster was at the peak of their business. People were going crazy to rent VHS tapes and DVDs from them.

However, in 2007, Netflix went digital, and Blockbuster’s business suffered. Among other problems, BlockBuster was stuck in a cash flow crisis. As a brick-and-mortar store, its sales declined compared to Netflix’s.

We have not given any business lectures in the past. We want to tell you that cash flow problems are one of the key reasons businesses fail.

If you are going through similar problems or want to avoid them, here, we’ll break down the 8 best ways to avoid cash flow problems. Let’s dive into them.

How Do Cash Flow Problems Usually Start?

Say you own a Squeezy Lemonade stand. Your sales are going well, but the catch is people aren’t paying you right now. They’ll pay you a week later. However, you need to pay for lemons and sugar upfront. You start running out of cash to support your business, and with no cash flow model in place, you may close down the business.

This is just one example of how cash flow problems usually start. The most interesting aspect of this is you feel like everything is fine; what are you doing wrong? However, these problems don’t come out of nowhere, and 82% of businesses fail due to cash flow problems. So, how do these problems occur? Let’s find out!

Not Having Enough Cash

This is one of the basic problems of cash flow. Many businesses think they have enough cash flow. However, when things go south, they don’t have enough cash.

Startups should have three to six months of operating expenses. However, many businesses don’t have this safety net, and even a minor crisis can lead to a disaster.

Too Much Inventory

Too much inventory is one of the main causes of cash flow problems. It’s because your cash locks up unsold products, and you need to pay other costs, such as payroll and bills. This creates a cash flow crunch.

BTW talking about unsold products, you can check out our guide on how to keep products flying off the shelves.

One reason Toys “R” Us’s business suffered was too much inventory. They bought too much physical inventory while consumers were shopping online, resulting in a major cash crunch.

Poor Financial Planning

You don’t need a great IQ to know that if you plan poorly, you’ll end up with losses. Many small business owners don’t have proper financial planning. They don’t have an idea of inflows (cash coming in) and outflows (cash going out), and that’s why they can’t recognize the deeper problems.

Growing Too Fast

Yes, you read that right. Growth can be awesome, but expanding too quickly can cause trouble if you don’t have enough cash to support it. This is exactly what happened to Jonna, an e-commerce entrepreneur we talked about recently.

This sort of situation happens with many businesses. As their business scales, managing increased expenses can become stressful, as the cash coming in tops the cash going out.

Late Payments

Charlie Munger once said that he hated sending invoices to other people. Delayed payments or non-payments can quickly dry up cash reserves. When your accounts receivable pile up, you can’t reinvest in your business or cover any operational costs.

British construction giant Carillion went out of business due to late payments and other issues.

8 Best Ways to Avoid Cash Flow Problems

We discussed some of the cash flow problems, but how can you avoid them? Let’s find out.

1. Create Cash Flow Forecasting

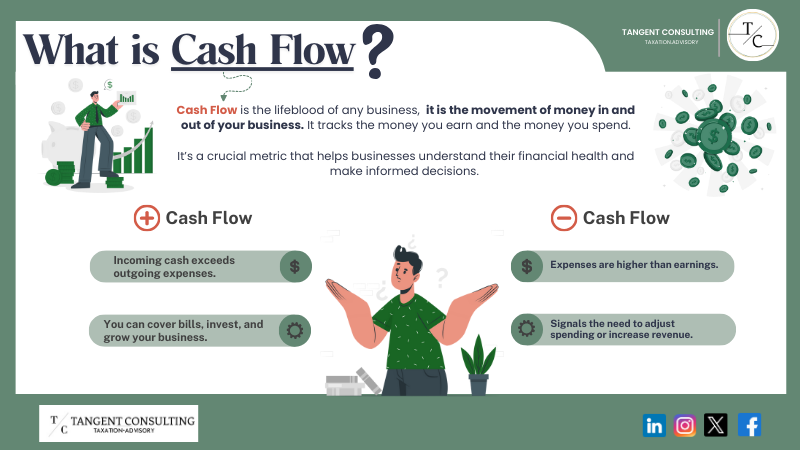

Cash flow forecasting tracks the cash coming into and out of your business in all areas. It helps you anticipate when you’ll receive the money and when you’ll use it for expenses.

The good thing is you can create short-term and long-term cash flow forecasting. Short-term forecasting is for one month, medium-term can be for one year, and long-term forecasting can be for up to five years or longer. By creating a forecast, you get a complete picture and avoid cash flow problems.

One thing we have to mention is that creating a cash flow forecast can be difficult, as you need accurate data from multiple sources. But that shouldn’t stop you. You can use Tangent Consulting’s fractional CFO services so we can create accurate cash flow forecasting.

We care about your sleepless nights trying to create cash flow forecasting 😊

2. Shorten Payment Time

One of the simplest ways to avoid cash flow problems is to shorten your payment times. For instance, if you receive payment in 30 days, ask clients to pay within 15 days or even 10 days. You can offer early payment discounts to sweeten the deal.

However, remember that businesses or clients may ask you for payment extensions. By invoicing them on time, you can reduce these excuses.

3. Use Invoice Discounting

Invoice discounting is getting your money in advance without waiting for the invoice process. When your company is as rich as Apple, you can wait for 30, 60, or 90 days for payments. However, as a small business owner, you can’t wait for payment to be cleared.

Invoice discounting allows you to sell invoices to a lender for immediate cash. Companies can lend up to 95% of the invoices’ face value.

4. Cut Unnecessary Costs

It doesn’t take a genius to understand that when you cut down unnecessary costs, your positive cash flow increases automatically. For instance, you pay for office expenses when you know your team can work remotely. You can identify these recurring expenses and cut them down.

A good example of cutting unnecessary costs is Airbnb. When the pandemic hit, they cut $1 billion in marketing to keep the business going.

5. Monitor Cash Flow

If you treat cash flow like that friend you only check on occasionally, your business will not look cool. Monitoring cash flow daily allows you to identify potential problems before they get out of hand.

The good thing is you don’t need to do all of this yourself. You can use software like QuickBooks to analyze cash flow statements.

You would be happy to know that Tangent Consulting partnered with QuickBooks to offer 80% off the first six months of an annual subscription. This offer also includes a 30-day free trial. So, grab a deal now before it’s too late.

6. Build Cash Flow Reserves

When things are going well, it’s important to build your cash reserves. You can use extra cash to build an emergency fund or for unexpected expenses. This rainy-day fund should have enough cash to cover three to six months of operating expenses.

7. Negotiate

As a small business owner, sometimes channeling your inner haggler is better. You can negotiate better payments with suppliers. Most of the suppliers will accept your negotiation skills. This way, you can get longer payment windows and discounts on bulk purchases.

8. Get Financing

If you are facing a cash flow problem, you can get financing through business loans, credit, or venture capital. However, this should be your last resort, as getting into debt when you are already facing cash flow problems can be a bit risky.

Tesla leveraged financing to fund its growth in its early years but carefully managed repayments to avoid liquidity issues. So, it’s important to have a clear repayment plan in place.

Final Thoughts

Cash flow is the center of the business, and the key to avoiding cash flow problems is to monitor it and adjust if errors are found.

The strategies we’ve covered here are essential, but you may be unable to identify the core issues beneath the business surface. So, when the cash flow problem occurs, remember Tangent Consulting isn’t just a service; we become your finance department to give you more sleep at night, no matter what comes your business’s way 😉

FAQs

Why improve cash flow?

Having an improved cash flow means you don’t need to worry about unexpected expenses or business emergencies.

How do I increase my cash flow?

Cutting down costs and creating additional revenue streams can be a good way to increase your cash flow.

Is cash flow a profit?

There are differences between cash flow and profit. Cash flow is the money that goes in and out of your business, while profit is your revenue after costs.