5 Best Accounting Software for Multiple Businesses in 2025

5 Best Accounting Software for Multiple Businesses in 2025

Have you read The Richest Man in Babylon (we are assuming you did)?

There’s a guy called Arkad, the richest man in Babylon. He was the ultimate business mogul of his time. He invested and grew wealth by using simple techniques.

If Arkad were alive in 2025, he would be the richest man in the world. That’s because 2025 offers a far better solution: powerful accounting software built to manage multiple businesses. Instead of relying on clay tablets, he could automate transactions, track expenses, and get instant financial insights.

If you are running multiple businesses and don’t want any financial chaos, stick with us for the next 15 minutes. We’ll break down the 5 best accounting software for multiple businesses. So, let’s dive in.

What is Multi-Entity Accounting Software?

Managing multiple businesses or having multi-entity accounting software is about managing everything from one platform. You can manage approvals and payments and get financial clarity.

For example, you own Batcave Construction Company. You have multiple projects running simultaneously in different cities. Each site has its expenses, invoices, payroll, and vendor payments. Without multi-entity accounting software, tracking cash flow across projects would be impossible.

In addition, since upper management isn’t on-site every day, fraud and financial mismanagement can slip through the cracks. You need a system that:

- Tracks individual project expenses

- Prevents duplicate or fraudulent invoices

- Automates approvals and payments

With the right accounting software, you can see the numbers for each project separately while still keeping a bird’s-eye view of your entire business.

5 Best Accounting Software for Multiple Businesses

When you are managing invoices, taxes, and payroll for all businesses, it can create so much confusion and errors. But using the best accounting software, you can get clear financial insights.

Here are the 5 best accounting software for multiple businesses:

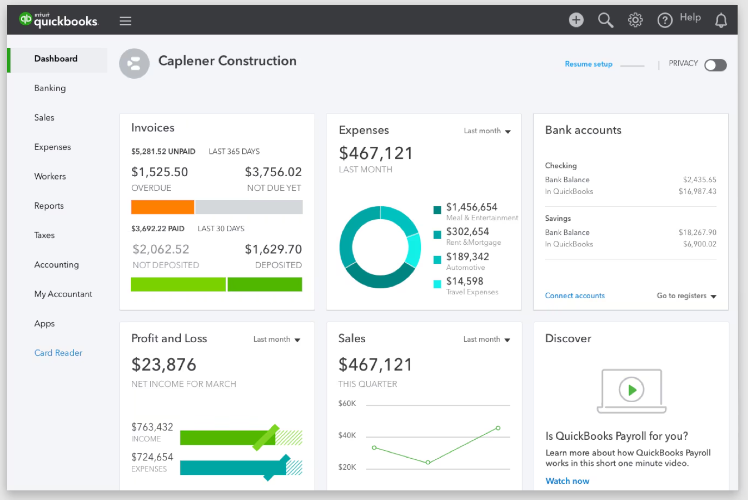

1. QuickBooks

QuickBooks Online allows you to manage multiple businesses in a single account, making it a go-to solution for entrepreneurs managing multiple entities. Each company requires its subscription, but you can switch between them with a single login, keeping everything organized and accessible.

Why Choose QuickBooks?

QuickBooks is ideal for business owners who need separate financials for each company while maintaining easy access to all accounts. Its cloud-based system ensures real-time updates, making multi-entity management hassle-free.

What Makes It Stand Out?

QuickBooks offers a clean and intuitive interface that allows users to toggle between businesses effortlessly. It also integrates with hundreds of third-party apps, making automation and financial tracking smoother across multiple ventures.

| Pros | Cons |

| Easy to manage multiple businesses under one login | Requires a separate subscription for each entity |

| User-friendly dashboard with real-time financial tracking | Can get expensive for businesses managing several companies |

| Extensive app integrations for automation | Limited multi-entity financial consolidation options |

If you want to dive deeply into QuickBooks, you can check out our detailed guide here.

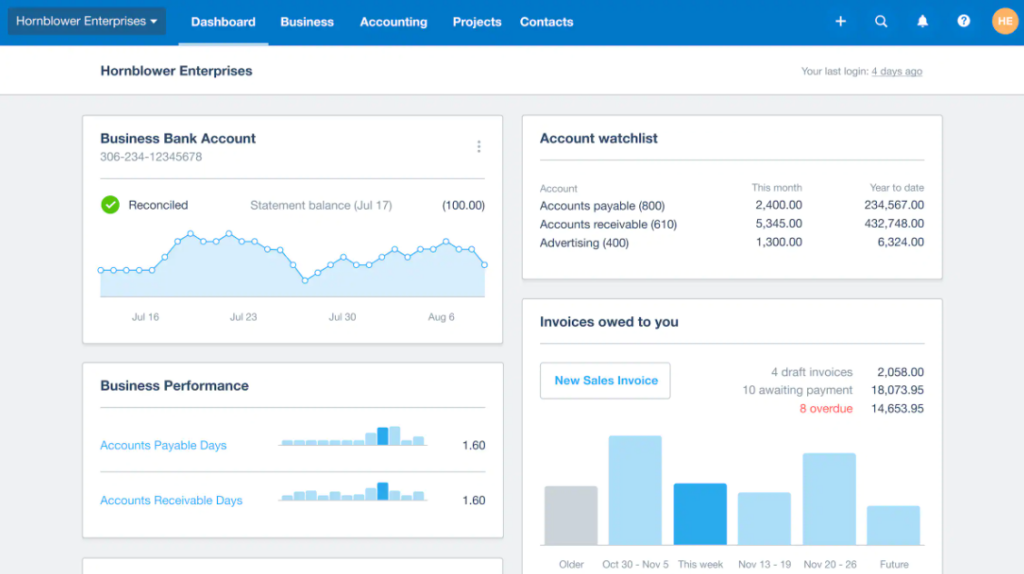

2. Xero

Xero is a cloud-based accounting software designed for businesses that need clear financial separation between multiple entities while maintaining easy access under one login. Each company operates independently within Xero, making it ideal for businesses that require distinct financial tracking without overlap.

Why Choose Xero?

Xero is perfect for business owners who manage multiple businesses but don’t want financial chaos. It provides separate books, tax reports, and outstanding task management for each entity, ensuring every business stays on track while remaining accessible from a single dashboard.

What Makes It Stand Out?

Unlike some competitors, Xero prioritizes real-time collaboration, making it a strong choice for businesses with accountants, bookkeepers, or remote teams. Its automated bank feeds, reconciliation tools, and AI-powered insights help streamline accounting across different ventures.

| Pros | Cons |

| Single login access to multiple businesses | Each entity requires a separate subscription |

| Real-time collaboration and role-based access control | Multi-entity reporting is less robust than enterprise solutions |

| Automated bank feeds and reconciliation tools | Learning curve for those new to cloud accounting |

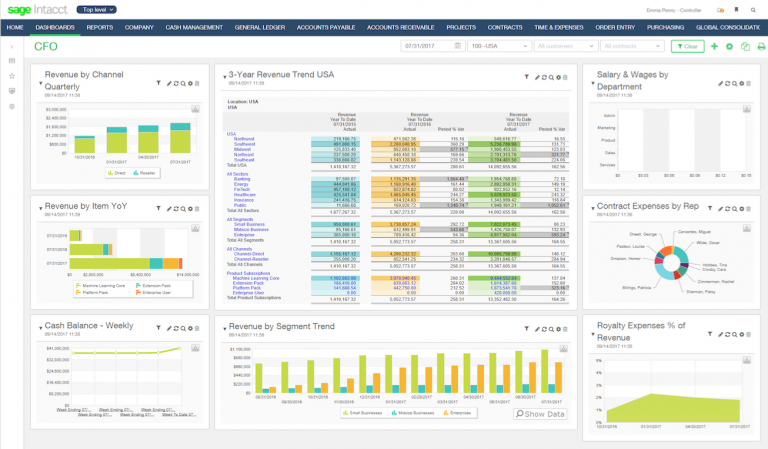

3. Sage Intacct

Sage Intacct is built for businesses that need advanced multi-entity financial management with both consolidated and individual reporting. It’s an enterprise-level solution that provides real-time insights, automation, and deep financial analytics, making it a great fit for companies scaling across multiple locations or industries.

Why Choose Sage Intacct?

Sage Intacct is ideal for businesses with complex financial structures that require robust consolidation, automation, and compliance features. It allows you to track individual performance while maintaining a high-level financial overview.

What Makes It Stand Out?

Sage Intacct offers multi-dimensional reporting, allowing businesses to see both aggregated and entity-specific financials. Its automation features reduce manual accounting work by easily handling currency conversions, intercompany transactions, and compliance tracking.

| Pros | Cons |

| Advanced multi-entity consolidation and reporting | Higher learning curve compared to simpler accounting software |

| Automated intercompany transactions and currency management | Pricing is on the higher end, making it less ideal for small businesses |

| Strong compliance and audit-ready financial controls | Requires setup and customization for optimal use |

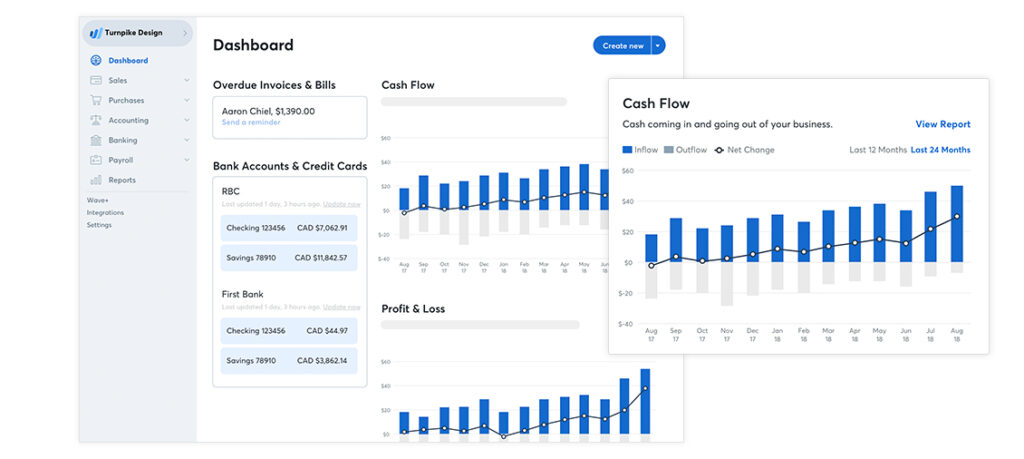

4. Wave

Wave is budget-friendly accounting software for small businesses, freelancers, and solopreneurs. It provides free invoicing, expense tracking, and accounting tools, making it ideal for business owners who need an affordable yet functional solution. Wave also allows users to manage multiple businesses under one account without additional costs.

Why Choose Wave?

Wave is perfect for small business owners who need basic accounting features without a big price tag. It’s especially useful for freelancers or entrepreneurs managing multiple ventures who want separate financial tracking within a single platform.

What Makes It Stand Out?

Unlike most competitors, Wave offers completely free accounting and invoicing tools, with optional paid add-ons like payroll and payment processing. Its receipt scanning and bank reconciliation features help streamline bookkeeping while organizing financial data across multiple businesses.

| Pros | Cons |

| Free invoicing and accounting tools | Lacks advanced multi-entity financial reporting |

| Supports multiple businesses under one account | No automation for intercompany transactions |

| Simple and user-friendly interface | Limited integrations compared to premium accounting software |

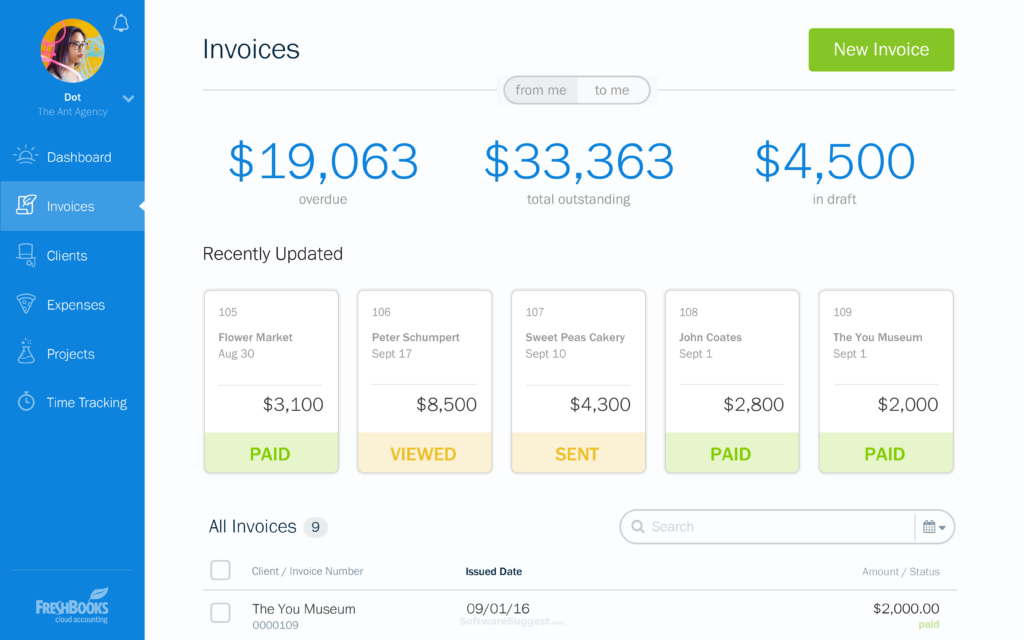

5. FreshBooks

FreshBooks is a user-friendly accounting software designed for small business owners, freelancers, and service-based businesses. It simplifies financial management with automated invoicing, expense tracking, and time tracking, making it ideal for businesses that rely on project-based billing.

Why Choose FreshBooks?

FreshBooks is a great choice for entrepreneurs who need a simple yet effective way to handle invoicing, expenses, and financial reporting. It’s particularly useful for service-based businesses that track billable hours and project costs.

What Makes It Stand Out?

FreshBooks offers automated invoicing, client payment reminders, and expense tracking in one easy-to-use dashboard. Its time-tracking feature is a major plus for freelancers and agencies who bill clients based on hours worked.

| Pros | Cons |

| Simple and intuitive interface | Not ideal for complex multi-entity financial management |

| Strong invoicing and payment tracking features | Limited automation for intercompany transactions |

| Built-in time tracking for project-based businesses | Higher-tier plans required for advanced features |

Comparison Table of Best Accounting Software for Multiple Businesses

Going through all the above-mentioned software may have made your head spin. To help you stay focused as you work through your software selection process, here’s a comparison table to keep in mind:

| Software | Best For | Multi-Business Management | Key Strength | Automation Features | Pricing |

| QuickBooks | Small to mid-sized businesses needing separate financials under one login | Yes, but requires separate subscriptions | User-friendly, widely used, and strong integrations | Automated bank feeds, invoicing, and expense tracking | Subscription-based, separate for each business |

| Xero | Businesses needing real-time collaboration and task management | Yes, each entity needs its own subscription | Excellent task management and collaboration tools | Bank feeds, smart reconciliation, and integrations | Subscription per entity, various pricing tiers |

| Sage Intacct | Growing businesses with complex multi-entity financials | Yes, with consolidated reporting and automation | Advanced financial reporting and automation | Advanced automation for intercompany transactions and compliance | Premium pricing, best for scaling businesses |

| Wave | Freelancers and small businesses looking for a free accounting solution | Yes, supports multiple businesses under one account | Free accounting and invoicing tools | Basic automation with receipt scanning | Free with optional paid add-ons |

| FreshBooks | Service-based businesses, freelancers, and project-based billing | Limited, best for managing a single entity with multiple clients | Best for invoicing and project-based billing | Automated invoicing, payment reminders, and time tracking | Affordable plans with scalable features |

How to Choose the Best Accounting Software for Multiple Businesses?

When selecting the best multi-company accounting software to include, you need to consider business needs and pain points like managing multiple entities efficiently and consolidating financial data.

1. Look for Customizability

Your accounting software should adapt as your business grows. Approval workflows, access permissions, and reporting structures should be flexible enough to evolve with your operations. A rigid system only holds you back when you need to scale or restructure.

2. Evaluate Reporting Options

Decisions about hiring, expanding, or optimizing costs rely on accurate financial insights. The best accounting software should offer:

- Entity-specific reports for tracking each business individually

- Consolidated financial overviews for a bird’s-eye view

- Shared general ledger options to maintain complete control

3. Explore Pricing

Multi-entity software often charges per business or user, which can add up quickly. You need to assess whether the cost matches the value it provides in terms of saved time, financial clarity, and reduced manual errors. While pricing can be a pain point, the right software pays for itself by preventing inefficiencies and mistakes.

4. Check for Integrations

Your accounting software should integrate with:

- Tax compliance tools

- Expense management systems

- Accounts payable automation

If you already use financial tools like QuickBooks or other platforms, ensure the new software fits into your existing tech stack to avoid unnecessary labor.

5. Access to Additional Resources

Managing multiple businesses is all about strategizing. Look for software providers that offer:

- Educational materials on multi-entity accounting

- Masterclasses or webinars to train your team

- A strong support system to troubleshoot challenges

Final Thoughts

One thing is certain: If Arkad, the Richest Man in Babylon, were alive today, he wouldn’t be manually tracking his gold on clay tablets. He’d be using multi-entity accounting software to oversee his growing empire. The right accounting software eliminates financial blind spots, streamlines reporting, and accounts for every dollar.

Speaking of accounting for every dollar, isn’t it good to have a partner who can understand your financial requirements?

Tangent Consulting has years of experience as a CFO, business coach, and tax consultant. With us, you don’t need to hire an accountant or business coach separately; you can get both in one place.

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

How many companies can I run on QuickBooks Online?

You can have multiple companies under one QuickBooks Online account, but each business requires a separate subscription. You can easily switch between them using the same login.

What is the most commonly used accounting software?

QuickBooks is the most widely used accounting software for small and mid-sized businesses, followed by Xero and Sage Intacct for multi-entity management.

Is Excel accounting software?

Excel can be used for manual bookkeeping, but it lacks the automation, integrations, and financial reporting features of dedicated accounting software.