Here’s How to Cure Your Business Headaches

Here’s How to Cure Your Business Headaches

Did you experience a situation when your phone’s battery dies right when you needed it the most? The situation can be chaotic as you run to find the charger.

Now think about it: a business having cash flow problems, overdue invoices, and lack of management is like that phone about to shut down. Many businesses face such situations and find themselves in the dark. However, there’s a solution to cure a business headache.

If you are having business headaches, stick with us for the next 10 minutes, and by the end of this guide, we are hoping that your headaches can be reduced.

What is a Business Headache?

Before we move to the cures, we first need to define what exactly a business headache is. To analyze this, grab a piece of paper and answer these questions:

- Are you having cash flow issues?

- Are your employees causing more stress than solutions?

- Do you feel like the only way to get clients is by offering the lowest price?

- Are you stuck doing all the work yourself?

If any (or all) of this sounds familiar, we have good news and bad news.

The good news is most business headaches don’t require groundbreaking solutions. In fact, they can often be fixed with simple shifts in mindset, strategy, or execution.

The bad news is many business owners refuse to adapt. They stick to “the way we’ve always done it,” ignoring better strategies until they hit a breaking point. But if you’re open to rethinking your approach, you can turn things around faster than you think.

Now, let’s talk about how to cure these business headaches.

5 Business Headaches and How to Cure Them?

If your business can’t run without you, you don’t own a business—you own a job. And if things aren’t improving, it’s not because the economy is bad or your industry is just tough—it’s because the way you’re running things is holding you back. With that said, here are the 5 biggest business headaches and their cures:

Headache #1: Lack of Goals and Vision for the Business

You don’t know where your business will be in 3, 5, or 10 years. Your employees are just clocking in and out with no real understanding of the bigger picture. It’s like getting in a car with no idea where you’re going.

The Cure

- Set a Clear Vision – Ask yourself: What does success look like in 5 years? More revenue? A bigger team? Stepping back from daily operations? Define it. Write it down. Make it real.

- Break it Down into Actionable Goals – Big visions don’t happen overnight. Set yearly, quarterly, and monthly goals that get you closer to where you want to be.

- Communicate it with Your Team – If your employees don’t know where the business is headed, they won’t help you get there. Regularly share goals, progress, and updates so they stay engaged and aligned.

- Measure and Adjust – Goals aren’t set, and forget it. Review them regularly, adjust strategies when needed, and make sure you’re always moving forward.

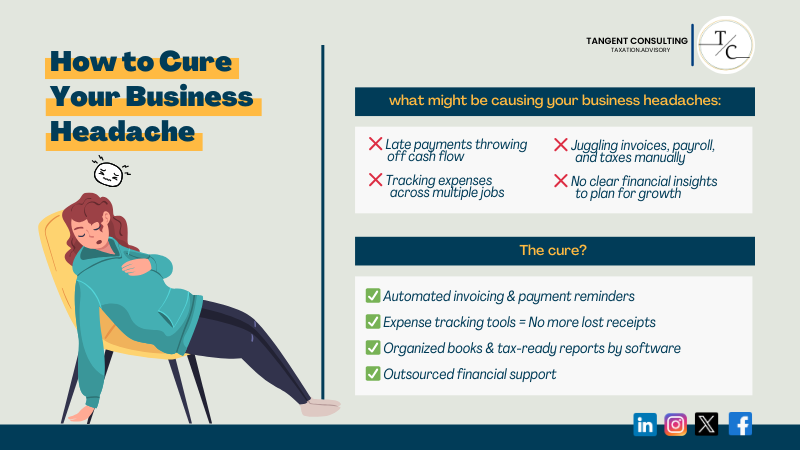

Headache #2: Lack of Financial Planning

A lot of business owners think they know their numbers until a cash flow problem hits, and they can’t even pay bills. A profitable business can still fail if it doesn’t have a financial strategy in place.

The Cure

- Create a Cash Flow Plan – Know exactly where your money is coming from and where it’s going. Track your revenue, expenses, and profit margins so you can make informed decisions—not just gut-based guesses.

- Build a Safety Net – If your business relies on today’s revenue to survive tomorrow, you’re walking on a financial tightrope. Aim to set aside at least 3–6 months of operating expenses for emergencies.

- Outsource Your Financial Headaches – You didn’t start your business to become an accountant. A fractional CFO, bookkeeper, or outsourced accounting service can take the burden off your plate and give you real financial insights.

Headache #3: Lack of Management

A lack of effective management means things don’t run smoothly unless you’re personally overseeing everything. And that’s a recipe for burnout. Great businesses aren’t built on heroic effort; they’re built on smart management.

The Cure

- Stop Micromanaging, Start Leading – If every decision depends on you, your business is handcuffed. Empower your team to make decisions within clear guidelines.

- Document Processes – Create SOPs (Standard Operating Procedures) for daily tasks. When employees know exactly how things should be done, you reduce confusion, errors, and unnecessary questions.

- Put the Right People in the Right Roles – Define roles clearly, set expectations, and hold employees accountable.

Headache #4: Lack of a Targeted Marketing and Selling Strategy

Customers keep your business alive, but not all customers are good customers. If you’re constantly competing on price, slashing your margins just to land a deal, or attracting clients who drain your time and energy, you don’t have a sales problem; you have a marketing problem.

The Cure

- Identify Your Ideal Customer – Not every customer is worth your time. Define who your best clients are—the ones who value quality over price, pay on time and fit your business model.

- Position Your Business as the Authority – When you’re seen as the go-to expert, price becomes secondary. Use content marketing, testimonials, and case studies to showcase your expertise.

- Stop Attracting Bargain Hunters – If your messaging says “affordable,” “cheap,” or “budget-friendly,” that’s the type of customer you’ll attract. Instead, focus on value, quality, and results.

- Have a Sales Process That Filters Out Bad Clients – Not every lead deserves a proposal. Qualify your prospects before investing time in them.

Headache #5: Not Using Business Tools

We’ve all managed to figure out social media, online shopping, and even Netflix. Yet, when it comes to business tools, many owners avoid them. The irony is that the right tools can save you hours of work, reduce errors, and make your business way more profitable.

The Cure

- Start With the Essentials – Don’t overwhelm yourself with 50 different apps. Begin with the basics:

- Accounting software (QuickBooks, Xero) to track cash flow.

- CRM systems (HubSpot, Jobber) to manage clients.

- Project management tools (Trello, Asana) to keep work organized.

- Build Daily Habits Around Them – Schedule time to use your business tools. For example, review your financial dashboard every day at lunch to track invoices.

- Automate What You Can – Set up automatic invoice reminders, payment processing, and email sequences.

Final Thoughts

We hope your business headache may have been reduced by reading this guide. You need to know that whether you’re running a six-figure small business or a nine-figure corporation, nothing changes until you decide to change it.

The key is to get the right help. That means outsourcing your finances, hiring a business coach, implementing better systems, or adopting business tools. The good thing is you don’t need to open a new tab to get the right help.

Tangent Consulting has years of experience as a CFO, business coach, and tax consultant. With us, you don’t need to hire an accountant or business coach separately; you can get both in one place.

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

What is the main problem of business?

Lack of clear goals, poor financial planning, ineffective management, weak marketing, and not using the right tools.

What are the 5 key factors in the success or failure of a business?

Vision, financial strategy, strong leadership, targeted marketing, and leveraging business tools effectively.

What is the key to business success?

Consistently improving systems, making data-driven decisions, and surrounding yourself with the right people.