How to Do Rental Property Bookkeeping (Without Losing Your Mind)

It might sound ridiculous, but we have been missing a Nike Air Max 90 since 2022. We checked every corner of the house but couldn’t find it. It disappeared like some sort of magic trick (painful 🙁).

We know you must be thinking, great, I have clicked on another clickbait. But wait, you haven’t. The reason for telling you this story is if you don’t keep track of your property finances, the money will disappear like our shoes.

That’s where rental property bookkeeping comes in. It can help you manage your finances, stay organized and make better decisions.

So, let’s jump right into rental property bookkeeping and tell you all you need to know.

How to Do Bookkeeping for Rental Property?

Nobody gets into real estate because they’re excited about spreadsheets and ledgers. We know bookkeeping isn’t glamorous, but it is one of the key pieces that can make or break your business’s success.

If you do bookkeeping, you could save on taxes, earn more from your rentals, and keep your expenses in check. On the other hand, if you don’t do bookkeeping, you might end up overpaying taxes, missing income, or wondering where all your money went.

Don’t Let Business Numbers Hold You Back 🚀

Most business owners know they should get a grip on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

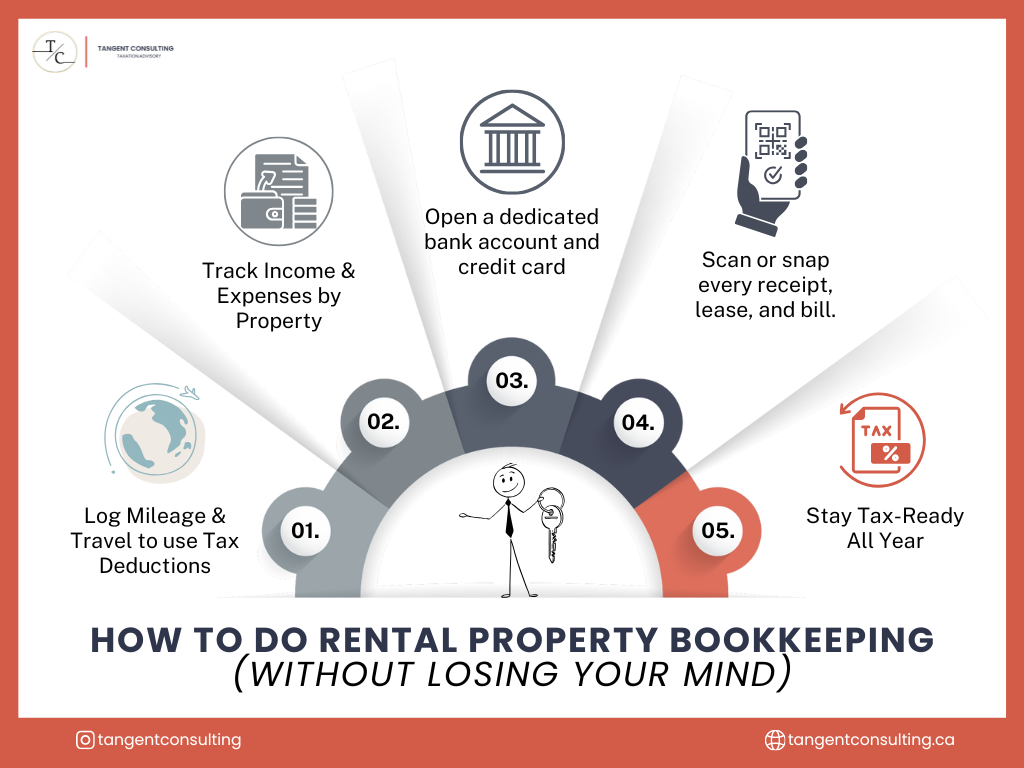

Here’s how you can do proper bookkeeping for your rental properties:

1. Start by Opening a Separate Bank Account

When you turn your property into a rental, you’re no longer just an owner; you’re running a business. And just like any business, your rental property needs its own financial space. That means setting up a dedicated bank account, even if the property used to be your primary residence.

Keeping your rental income and expenses separate from your personal finances makes everything cleaner. It’s way easier to track what’s coming in and going out, and it’ll save you a ton of business headaches at tax time.

In addition, if you buy more properties or inherit one, you’ll want a new account for each one. Trust us; this simple step helps keep your books organized and avoids messy mix-ups.

If you haven’t set up a business account, Ramp offers corporate cards with built-in expense management, bill pay, and invoice tracking features. It’s a great way to keep your bookkeeping system organized and cloud-based. Plus, there’s a bonus waiting for you if you sign up using our link.

2. Get Your Books in Order from Day One

Before the rental money comes in, take a moment to figure out how you’ll track everything, such as income and expenses.

You’ve got two options: build a simple spreadsheet or use accounting software. Either works. The key is picking something you are comfortable with.

If you know about accounting software like QuickBooks, Xero, or Zoho, you can stick with them. Most of these tools let you connect to your bank account so your transactions appear automatically. This means you have to do less manual work and aren’t missing something important.

You can set up a time each week or month to update your records, especially if you’re handling the property yourself.

3. Stay on Top of Your Expenses

If you’re a landlord, tracking your rental expenses regularly should be your top priority. It doesn’t matter if you do it weekly, monthly, or even quarterly; the key is consistency. The more often you stay on top of your records, the easier your bookkeeping will be.

If you are wondering why this such a big deal is, here’s the answer:

For starters, come tax season, you’ll save yourself a ton of stress. Instead of scrambling to piece things together, you can get a report and send it to your accountant.

In addition, tracking everything helps you identify financial trends. You can adjust your budget, improve cash flow, and boost your bottom line.

Speaking of budget, when you’re putting together a budget for your rental, make sure to factor in:

- Maintenance and repairs

- Capital improvements (like new roofing or kitchen upgrades)

- Vacancy periods

- Professional help, like a property manager, lawyer, or accountant

- Travel costs if you visit the property

- Insurance and mortgage interest

- HOA and bank fees

- Utilities or services you cover

- Property taxes

A good rule of thumb is to set aside 1–4% of your property’s value for maintenance each year, just in case things go sideways.

Not all expenses are treated equally at tax time. Regular repairs and capital improvements fall into different buckets, so keep those categories clear in your records.

4. Keep Your Records Organized

Keeping yourself organized is a powerful habit, and when you want to do rental property bookkeeping, you need to keep track of your documents and know where they are when you need them. A solid system, no matter how simple, can save you a lot of time and stress.

Let’s say you want to refinance your rental property or list it for sale. One of the first things a lender or buyer might ask for is a rent roll—a document showing your rental income over time.

If your records are clean and updated, you can send them over in minutes. But if they aren’t, be ready to dig through old bank statements, emails, and notes.

In short, keep your paperwork in order from the start. Your future self will thank you.

5. Hire an Accountant

One of the biggest reasons to stay organized with your records is to make the most of your investment and the tax breaks that come with being a landlord. The truth is, there are a lot of deductions and smart strategies out there that can seriously lower your tax bill. But to take full advantage, you need to know what you’re doing.

That’s where a good accountant comes in. They can help you file everything properly, stay compliant, and uncover savings you might not even know exist.

Now, if you’re more of a DIY type, that’s fine, but be ready to do a lot of homework. Taxes on rental properties can get complicated, and there’s no one-size-fits-all advice since how you’re taxed depends on things like how you own the property, where it’s located, and others. So, if you’re doing it solo, make sure you dig into the details and stay informed.

Final Thoughts

Getting your rental property bookkeeping in order is a solid first step, but it doesn’t stop there. You’ll need to update it regularly and check in on your finances throughout the year.

Once you’ve built a system that works, you can start thinking about growth. And when that time comes, you’ll likely need more than one accountant. You want a team or someone who gets real estate inside and out.

Not every accountant specializes in rentals, and having someone who understands the ins and outs of real estate investing can make a big difference in the value they bring to the table.

Fortunately, you don’t have to open another tab to find a rental property accountant. For over a decade, we’ve been helping rental property owners like you ditch the overwhelmed and take control of your finances. We become your full accounting department, so you don’t have to hire people individually.

Let’s get your accounting system working for you!

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

1. What is the best accounting method for rental property?

The cash basis method is usually best for rental property owners because of its simplicity. Income is recorded when received, and expenses are paid.

2. What is the best bookkeeping software for rental properties?

QuickBooks, Stessa, and Buildium are some of the best software choices for rental property owners.

3. What is the journal entry for a rental property?

| When rent is received: | |

|---|---|

| Debit | Cash |

| Credit | Rental Income |

| For expenses (e.g., repairs): | |

|---|---|

| Debit | Cash |

| Repair Expense | Cash or Accounts Payable |