Why Accounting for Plumbers Isn’t Optional (If You Want to Save Your Business)

We are not technicians, but we don’t think someone can fix leaky faucets with duct tape. It might work for a day or two, but not permanently (Please let us know if it can be done).

If you are running a plumbing business and aren’t sure about accounting, it’s like using duct tape for a leaky faucet. At first, you may not focus much on it, but eventually, things slip, and you can’t seem to track your finances.

So, in this guide, we’ll break down why accounting for plumbers is a necessity you can’t ignore.

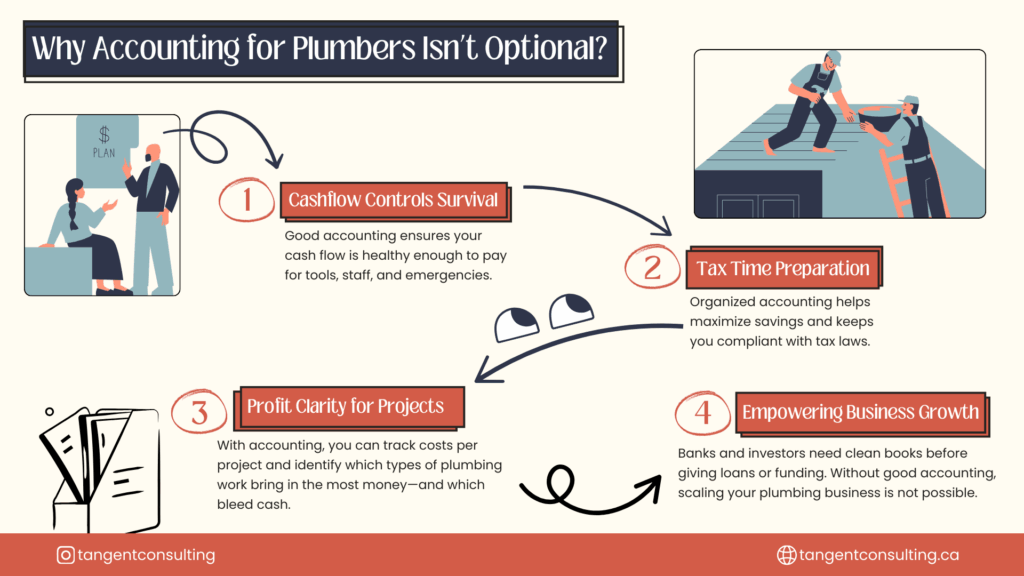

Why Accounting Matters for Your Plumbing Business?

We know accounting for any business can be the least fun part of running a business, but it’s a factor you can’t ignore. It’s the essence of a healthy financial plan and can help you make bigger decisions about your business’s future. Here’s why accounting matters for a plumbing business:

Track Every Dollar

Good accounting helps you keep track of your income and expenses. That means you’ll know how much money is coming in, what’s going out, and where it’s all going. With this information, it’s easier to identify where you might be overspending or where there’s room to grow your revenue.

Tax Laws Compliance

Nobody wants trouble with the IRS or CRA. Accurate accounting ensures your business stays compliant with tax laws and avoids penalties.

Plan for Growth

When you have clear financial data, you can prepare a comprehensive growth plan. Accounting helps you identify trends, create budgets, and forecast. You can prepare for slow seasons or take advantage of growth opportunities.

Keep Your Cash Flow Healthy

Cash flow can make or break a small plumbing business. Accounting helps you keep an eye on your available cash so you can pay your team, cover expenses, and invest in new tools or marketing.

Build a Business That Lasts

Solid accounting is about building a stronger, more resilient business. When you have a clear picture of your finances, you make informed decisions and build a sustainable business.

Don’t Let Business Numbers Hold You Back 🚀

Most business owners know they should get a grip on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

Step-by-Step Guide to Accounting for Plumbers

Did you know that 70% of small business owners don’t use an accountant? Most of them wish they would when the tax season comes. However, taxes are one of the reasons for hiring an accountant. So, here’s a step-by-step guide to accounting for plumbers:

1. Cash vs. Accrual: Pick Your Accounting Style

Before analyzing the numbers, plumbers must choose between two accounting methods: cash-based or accrual-based. Each gives a different view of the business’s performance.

The cash basis is straightforward. You record income when you get paid and expenses when you spend money.

On the other hand, the accrual basis goes a step further. You record income when you do the job, not when you get paid. The same goes for expenses; you record them when they happen, not when you pay the bill.

Still With Us?

If you’ve scrolled this far, chances are you’re serious about getting your business on track.

Book a free 15-minute strategy call — tailored to your industry — and let’s figure out what’s holding you back.

Book My Strategy Call ×While cash accounting is simple and great for managing day-to-day cash, accrual accounting gives you a clear picture of what your business earns and owes. It’s especially helpful if you deal with invoicing and payment delays or want to understand profitability.

2. Do a Break-Even Analysis

If you want to know how much work you need to do to cover your costs, then you have to do a break-even analysis. This analysis helps you figure out the minimum number of jobs or sales you need to break even. It looks at:

- Fixed costs – stuff like rent, insurance, or salaries

- Variable costs – things like materials or fuel that change per job

- Your pricing – how much you’re charging per job or service

Once you know your break-even point, you can set better prices, manage costs, and set realistic sales goals. It also helps you plan for what will happen if prices increase or you need to cut costs.

3. Budgeting and Forecasting

To keep your plumbing business on track, you need a solid plan that starts with budgeting and forecasting.

Budgeting helps you set financial goals, plan out your spending, and track how you use business money.

Forecasting looks at past numbers and current trends so you can make educated guesses about your future income and expenses.

Download Our Startup Financial Forecasting Template

Used by 7-figure clients to plan for growth, raise smarter, and stop guessing cash flow. Get the exact spreadsheet to help startups scale confidently.

Get the Free Template4. Understanding COGS (Cost of Goods Sold)

To grow your plumbing business, you’ve got to know what it costs to do the work. That’s where the Cost of Goods Sold (COGS) comes in. It’s about tracking the direct costs tied to the jobs you do.

Here are the two big ones:

Repair parts: You’re likely buying parts for most jobs. Record what you bought, how much it cost, and where it came from. This helps you bill clients correctly and gives you the paperwork needed for tax deductions.

Keep an eye on prices from different suppliers, so you’re not caught off guard when costs go up.

Labor costs: If it’s just you, this part’s easy; you’re tracking your hours. But if you have a team, it’s crucial to track everyone’s time accurately. Timecards or job logs help you see who’s working efficiently and help calculate wages, overtime, and other payments properly.

5. Managing Cash Flow

Cash flow is the heartbeat of your plumbing business. You have to keep a close eye on what’s coming in and what’s going out. This means tracking client payments, watching your spending on materials, tools, fuel, and wages, and making sure you always have enough on hand to cover the essentials.

A healthy cash flow helps you avoid financial trouble and gives you the freedom to reinvest in your business when the time is right.

6. Forecasting Your Cash Flow

It’s one thing to track where your cash is; it’s another to know where it’s going. By looking at past trends and current jobs in the pipeline, you can predict how much money you’ll have in the weeks or months ahead.

Forecasting also helps you plan for big expenses, like new tools or hiring staff, and keeps you ready for slower periods when income might dip. It also helps ensure you can always pay your team, restock supplies, and cover debts.

7. Tax Ready

Taxes might not be fun, but staying compliant is non-negotiable, especially for plumbing businesses.

Tax compliance means understanding and keeping up with your obligations, whether income tax, sales tax, or payroll tax. Hence, accounting can keep you tax-compliant and help avoid being on the IRS or CRA’s naughty list.

8. Don’t Mess Around with Payroll

If you have a crew, you should pay special attention to payroll. It involves calculating wages, handling payroll taxes, and ensuring everything follows labor laws. If you get it wrong, you could face penalties.

9. When (and How) to Count Your Revenue

Revenue recognition is about knowing when to record the money your business earns. For plumbers, income usually comes from services like repairs, installations, or maintenance.

But here’s the key: you should recognize revenue when the job is done, not when the money lands in your account. If you’re working on a longer project, that might mean spreading the revenue out over time.

10. Bring in Help or Go to the Software Route

Accounting isn’t everyone’s thing. And that’s okay.

If you’re not comfortable doing it yourself, hiring an accountant or financial consultant can be a game-changer. Look for someone who knows the plumbing industry and understands your daily challenges. Yes, it costs money, but the peace of mind and time saved is worth it.

Accounting software is another great option. Tools like QuickBooks or Xero can automate most processes, such as tracking income and expenses, sending invoices, and even running payroll. It’s a more affordable way to stay organized and save time, especially if you’re running a small team.

Final Thoughts

So, now you know why accounting isn’t something you can ignore for the plumbing business. It helps you stay financially organized and keep track of every single dollar.

Running a plumbing business means you have to wear a lot of hats. You’re managing client jobs, making sure the work is perfect, and trying to stay ahead of industry trends. If we add accounting, taxes, and financial planning to the mix, it can feel overwhelming.

Fortunately, you don’t have to feel this way. For over a decade, we’ve been helping plumbing businesses like you ditch the overwhelmed and take control of your finances. We become your full accounting department, so you don’t have to hire people individually.

Let’s get your accounting system working for you!

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

What are plumbing service businesses’ expenses?

The typical expenses include tools and equipment, vehicle costs, parts and materials, insurance, licensing fees, labor, advertising, and software.

How do plumbers estimate the cost of a job?

Plumbers estimate using material costs, labor hours, overhead, and a markup for profit. You can do that through the job costing software or flat-rate pricing models.

What is a good profit margin for a plumbing business?

A healthy profit margin ranges from 20% to 35%, depending on service type, efficiency, and local competition.