Outsource Accounts Receivable Services for Construction Firms: A No-Nonsense Approach

We were talking to an old friend the other day, and he told us about his experiences at a rock-climbing gym.

“I signed up for a free trial just for fun and thought it couldn’t be that hard.” He spoke.

“After one session, my arms were shaking, and I couldn’t walk properly. My trainer said, it wasn’t the strength, it’s the technique that matters.”

We don’t want to bore you with our friend’s adventure, but it reminded us that many construction businesses treat accounts receivable like our friend’s rock climbing. They don’t have a clear idea of what they are doing and often find themselves trapped between the job and the paycheck.

So, in this guide, we’ll break down why outsource accounts receivable services for construction firms makes more sense.

What is Accounts Receivable in Construction?

In construction, accounts receivable (AR) refers to the money your clients owe you after the completion of the work.

Let’s say you finish framing a house for a builder and send them an invoice for $50,000, giving them 30 days to settle the payment. Until they pay that bill, that $50,000 sits on your books as accounts receivable.

For construction companies, keeping track of unpaid invoices is critical because delayed payments can disrupt cash flow, stall jobs, or even put the business at risk.

Don’t Let Business Numbers Hold You Back 🚀

Most business owners know they should get a grip on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

Why Accounts Receivable Matters in Construction?

Let’s see why AR matters in the construction business.

Keeping Cash Flow Steady

In construction, cash is king, and accounts receivable play a huge role in keeping it flowing. Getting paid on time means you can pay your crew, cover material costs, and keep projects moving without cash shortages. The faster you collect from clients, the easier it is to manage day-to-day expenses and maintain a healthy business.

It Affects Your Working Capital

Accounts receivable directly affect your working capital. That’s the cash you have left after covering your current bills. A strong AR system helps ensure you’ve got enough cushion to handle short-term obligations and have room to take on new jobs without requiring additional funds.

No Payments, No Progress

If you’re waiting too long to collect what you’re owed, it can cause major slowdowns. For instance, subcontractors go unpaid, materials are held up, and project timelines can be delayed. Staying on top of accounts receivable (AR) helps avoid these unnecessary disruptions.

Your Profits Depend on It

When you manage accounts receivable (AR) well, it shows up in your bottom line. If you’re collecting quickly, you’re in a stronger position to reinvest in equipment, hire additional staff, or bid on larger projects. But if accounts receivable start piling up, it locks up your cash, slows down growth, and can even eat into profits.

Is Your Accounts Receivable Helping or Hurting Cash Flow?

Answer these 5 quick questions and get your AR Health Score.

Why Bother Outsourcing Accounts Receivable in Construction?

Running a construction business isn't easy. You must manage long timelines and tight budgets while keeping a close eye on every invoice. Besides this, if you have to chase payments, it can cause undeniable business headaches.

Your accounts receivable process is your cash flow lifeline. However, most construction businesses are unaware of it.

That's where outsourcing AR services makes a difference. When you bring in experts who understand the ins and outs of construction accounting, you get a team that improves how fast you get paid, reduces errors, keeps your clients on schedule, and frees up your internal team.

If you are wondering, "Oh Tangent, my construction business doesn't need an expert."

Perhaps it is true, but most small to mid-sized construction companies don't have the budget or time to build a full-scale finance team in-house. Outsourcing fills that gap with less stress, more structure, and better results. So, it might be time to call in the pros.

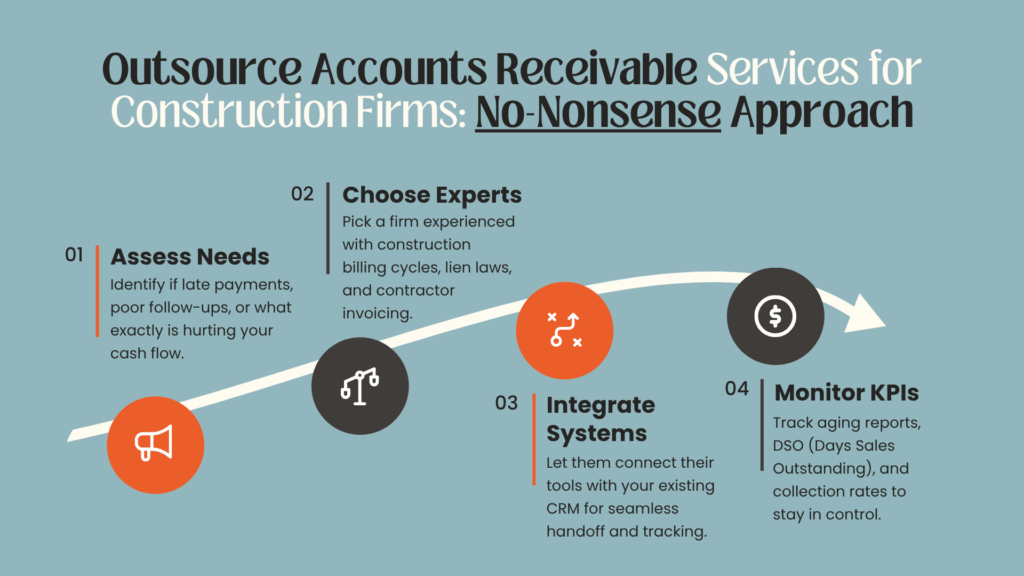

How to Outsource Accounts Receivable Services for Your Construction Business?

Step 1: Set Clear Credit Terms Before You Start the Job

Firstly, you need to decide if you're going to offer credit. In other words, will your clients be allowed to pay after the work is done?

If the answer is yes, then be crystal clear about your payment terms. How long do they have to pay? What happens if they're late? Get all that in writing and ensure your clients understand the deal upfront.

Here's why this matters: Contractors who offer credit with clear terms often get paid faster, on average, about 15 days sooner. That can make a real difference to your cash flow, especially on big jobs with tight margins.

Still With Us?

If you’ve scrolled this far, chances are you’re serious about getting your business on track.

Book a free 15-minute strategy call — tailored to your industry — and let’s figure out what’s holding you back.

Book My Strategy Call ×Step 2: Send Out Professional, Trackable Invoices

Once the work is done (or as each phase wraps up), it's time to invoice. Each invoice should clearly outline what was done, the associated costs, and the payment due date. So, no confusion remains.

Pro Tip: Every invoice should have a unique number. That way, you (or your AR team) can easily track payments, match them with the right job, and follow up if needed.

If you're still sending paper invoices, now's a great time to switch. Electronic invoicing speeds up the process, especially on larger jobs where approvals are required to go through multiple people.

Going digital also makes it easier for outsourced AR services to manage without chasing papers.

Step 3: Keep a Close Eye on What You're Owed

After you send out invoices, the job's not done; you've got to keep track of who's paid and who still owes you. This process is especially important when you have multiple clients or are working on larger projects.

Take a look at our CCA accounts receivable process flow chart. It outlines the entire process in a clear, easy-to-follow manner.

Step 4: Record Everything in Your Books

Tracking AR is one thing; you also need to make sure it's all showing up correctly in your financial records.

This part includes:

- Setting payment due dates for each project

- Recording journal entries to reflect money owed and payments received

- Making notes for early payment discounts or writing off bad debts when needed

- Using reports like the AR Aging Report to see who's falling behind

When you're working with an outsourced AR team, they'll usually take care of all this behind the scenes. So, you can focus on building, not bookkeeping.

Pros And Cons of Outsourcing Accounts Receivable Services for Construction Firms

Final Thoughts

We hope this post helped shine a light on why outsource accounts receivable services can be a smart move for construction businesses.

When you have a proper AR system in place, your projects continue to run smoothly, your team gets paid on time, and your business grows.

And if your current setup is holding you back, partnering with a specialized AR firm can make all the difference.

Fortunately, you don't have to open another tab to find an accounts receivable services partner. For over a decade, we've been helping businesses like yours ditch the overwhelmed and take control of their finances.

Our accounts receivable services structure your invoicing, track payments effectively, and handle reporting. That means fewer delays, fewer headaches, and more predictable cash flow.

Let's get your accounts receivable system working for you!

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

How much does it cost to outsource accounts receivable?

Costs can vary but typically range from 1% to 5% of the total invoice value, depending on volume and complexity.

What are the 4 types of accounts receivable?

The four types include trade receivables, notes receivables, installment receivables, and accrued receivables.

What accounting methods are commonly used in the construction industry?

Construction firms often use cash basis, accrual basis, percentage-of-completion, or completed contract methods, depending on project size and timeline.