How Are Digital Tax Solutions a Quick Fix for Any Small Business?

How Are Digital Tax Solutions a Quick Fix for Any Small Business?

In 2017, Airbnb faced tax challenges as it expanded globally. Operating in different countries, Airbnb had to manage tax data for thousands of hosts and bookings. If the company tried to do all of this manually, we and you would be laughing.

But they didn’t.

Airbnb applied digital tax solutions to save time and comply with local tax laws.

The real reason for giving you this example is if a giant like Airbnb can benefit from digital tax solutions, so can your small business. So, in this guide, we’ll break down what digital tax solutions are and how they can benefit you.

What Are Digital Tax Solutions?

Small business owners often multitask, but taxes can take the best out of us. According to SCORE, 40% of business owners say taxes and bookkeeping are the worst parts of owning a business.

We have seen many tax owners flip out during the tax season, and they want a better approach. That’s when digital tax solutions come into play.

By solutions, we mean tax software and tools that can automate and simplify the tax filing process and stay compliant with tax laws. Instead of manually entering data into spreadsheets, tax software simplifies the entire tax process.

Imagine it’s the tax season, and you own a coffee shop. You know all about aromas, textures, and flavors. But when it comes to taxes, it’s not your cup of tea.

You spend many hours figuring out whether your espresso machine is a deductible expense or how to categorize coffee beans you import from Brazil. You switch to a digital tax tool and upload your receipts, and voila! All taxes are done in an instant.

How Digital Tax Solutions Can Help Your Small Business?

Taxes can feel like fingertip pushups, but digital tax solutions make the whole process simpler, faster, and stress-free. Let’s find out how digital tax solutions can help you.

1. Saves Time

We know time is money, and we saw in Airbnb’s example that doing taxes manually isn’t the right way to save time. When you apply digital tax tools, you can automate tax filing.

These tools save you time when knowing terms like adjusted gross income, tax credits, tax exemptions, and others, as they automate the whole process.

As a growing startup, Warby Parker, an eyewear company, used digital accounting and tax tools to automate tedious tasks and focus on expansion. This allowed them to scale quickly and manage their taxes efficiently.

2. Adds Accuracy

As humans, we make errors, which are inevitable in our lives. But some errors like taxes are costly. Filing mistakes can lead to audits, fines, and more paperwork. A report called “The Impact of the Digital Tax Administration System on Compliance Among SMEs” showed how digital tax systems play an important role in small and medium businesses.

When you adopt digital solutions, tax errors get reduced. These tools categorize your expenses so you don’t get a knock on the door from the IRS and CRA.

3. Get More

Generally, digital tax solutions are thought to be expensive for small business owners. While we understand you should get a tax prep service instead of a tool, it’s an investment that can pay off in the long run.

Many tools come with built-in features that automatically scan for potential deductions and reductions in potential fines so you can get the most out of your tax returns.

4. Keeping up With Compliance

Tax laws can change like TikTok trends, and you can’t keep up with all of them. Digital tax solutions automatically update the latest tax rules, so you don’t need to track them manually.

When the gig economy boomed, new tax laws came into the picture. Lyft was able to stay compliant across all US states without manually tracking changes.

5. Easy Access

Many of the solutions are cloud-based. It means you can access and manage your data from anywhere. All your tax information is with you all the time.

Many small business owners use Shopify to manage their businesses. Shopify integrates with cloud-based tax tools, so business owners can manage their businesses anywhere.

5 Digitial Tax Tools for Small Business Owners

In a Small Business Majority report, research finds that two-thirds of businesses use some form of accounting software and 8 out of 10 are satisfied with the platform.

So, let’s break down 5 digital tax solution tools that can satisfy your business needs.

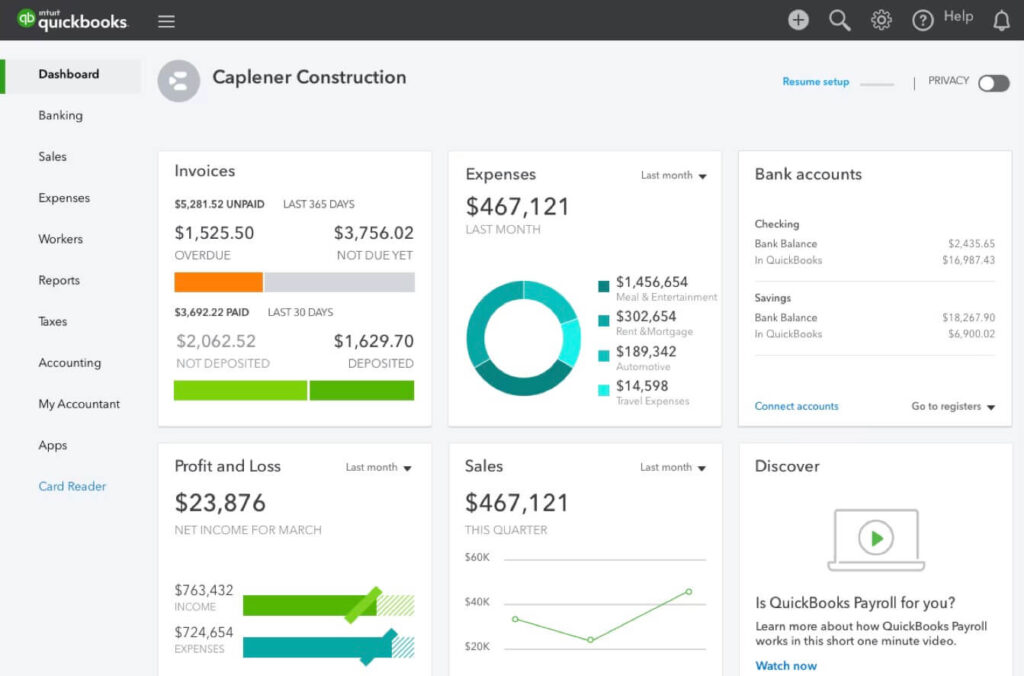

1. QuickBooks

QuickBooks is more than a tool. It’s a Swiss Army knife of accounting and taxation. It can generate tax reports, automate tax expense categories, keep your books organized, track overall income and expenses, and much more.

Fun fact: QuickBooks has a cool feature of receipt uploading, where it can automatically scan those receipts.

You would be happy to know that Tangent Consulting partnered with QuickBooks to offer 80% off the first 6 months of an annual subscription. This offer also includes a 30-day free trial. So, grab a deal now before it’s too late.

2. TurboTax

TurboTax is perfect for owners who prefer a DIY tax approach. You’ll find TurboTax helpful if you are a tax genie like Tangent. It guides you through the whole tax filing process so you don’t miss out on any deductions. For instance, if you are wondering, are property taxes deductible? TurboTax will have the answer in seconds.

The tool also comes with a built-in tax calculator, so you know your tax liabilities.

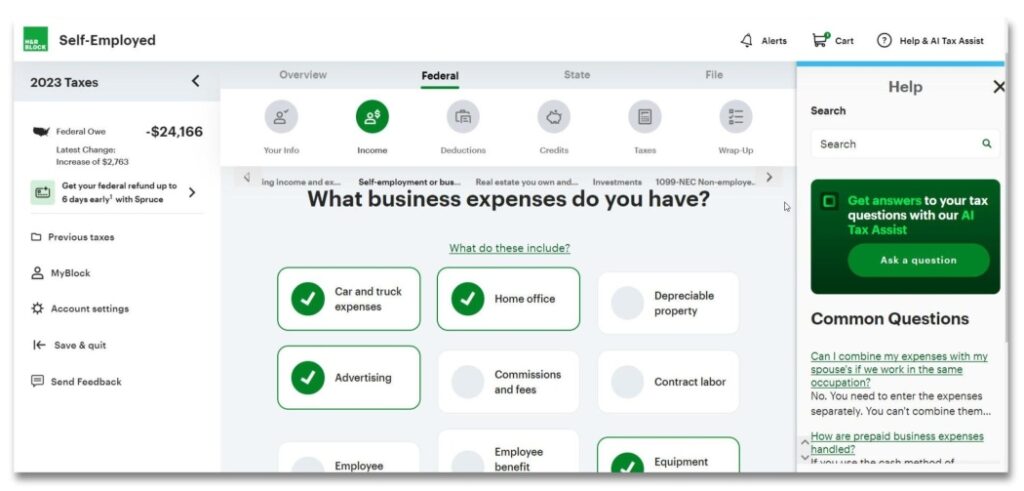

3. H&R Block

If you are looking for multiple tax preparation options, H&R Block could be your go-to tool. It offers many DIY and automated features bringing flexibility. If you sign up, H&R also has an AI-tax assist that can guide you better by asking a series of tax-related questions.

It’s a Batman of digital tax tools. You can DIY or have someone (Robin) do it for you.

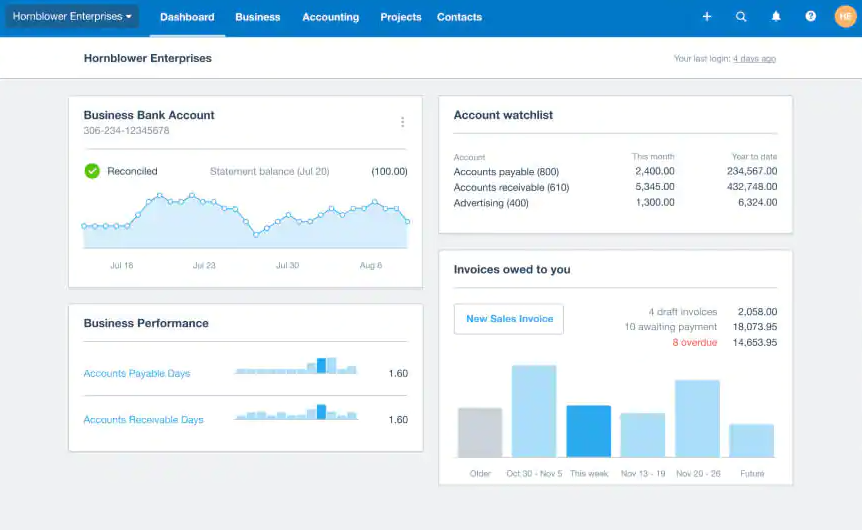

4. Xero

Xero is a powerful yet simple cloud-based accounting tool. It is known for its intuitive interface and tax tools suitable for all small business owners. You can set up tax assignment rules and create reports.

With Xero’s integration, you can easily manage small business tax prep checklists, which include tracking deductions and filing forms.

5. TaxJar

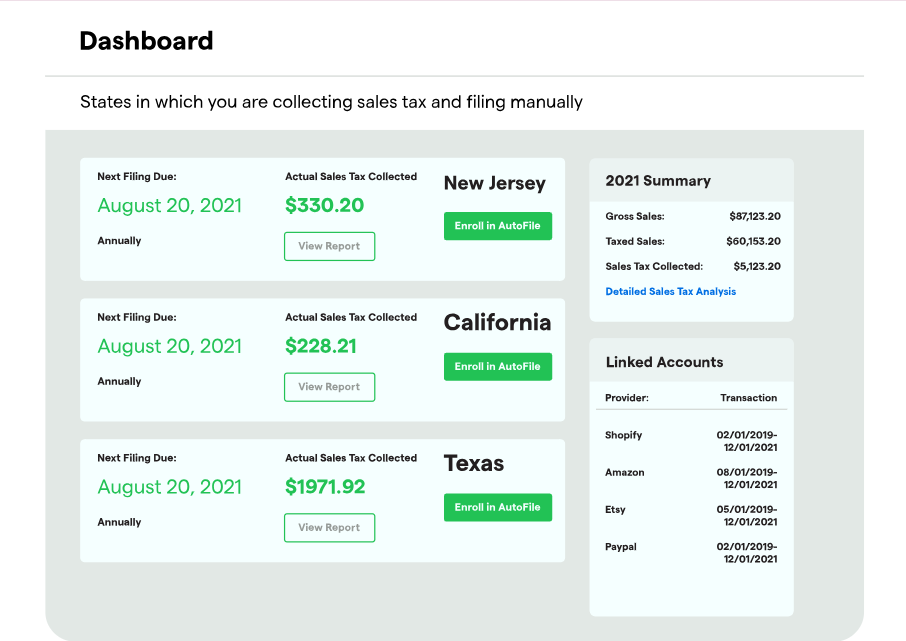

If you are running an e-commerce business, TaxJar should be on your tools list. The tool simplifies tax calculations and filings if you sell on platforms like Shopify, Amazon, or eBay. TaxJar automates the tax life cycle across all your sale channels and creates tax reports.

One of the cool features of the tool is the Nexus Insights Dashboard, which makes it easy to see which US states require sales tax collections based on your economic activity.

At Tangent, we have seen how adopting digital solutions has helped our clients in tax prep, reduce errors, and stay compliant. We work closely with small businesses to ensure they use the right accounting and tax tools.

However, tools can be complicated and can cost you a lot of money. Here, the solution is to hire a virtual tax prep service. These services, like tax software, provide a hybrid solution. They can prepare your taxes online and can contribute to other financial areas like budgeting, strategic planning, forecasting, financial reporting, and others.

If you are wondering, where can you get these services from?

Fortunately, you don’t need to go to Tahiti to look for such services, as we provide a complete package. We handle everything from corporate tax filings to tax resolutions. But that’s not all. We offer a range of services and become your finance department, saving you time and resources.

Final Thoughts

Businesses like Airbnb, Lyft, and Warby Parker have proven that if you adopt digital tax solutions, you can gain benefits in the long run. And if big players can benefit, imagine what these solutions can do for your small business.

At Tangent Consulting, we’ve helped countless small businesses transition from old-school tax methods. With our right tax solutions, you save time, money, and, most importantly, your sanity.

FAQs

What happens if you don’t file taxes?

In the US, if you don’t file your taxes, you will be subject to a failure-to-file penalty, which is 5% of the tax owed for each month your return is overdue, up to 25% of the bill.

In Canada, the CRA will charge interest on the amount owed from the day after the deadline.

How to file previous years taxes for free?

You can file previous years’ taxes for free using the IRS Free File program if you qualify. Some tax tools like TurboTax and H&R Block offer free options for simple filings from previous years if you are eligible.

Where do I get tax forms?

You can get tax forms from the IRS and CRA websites. You can also get them from the local offices, post offices, and other authorized locations.