Starting an E-commerce Business? You Should Know About Fractional CFO for Startups

Starting an E-commerce Business? You Should Know About Fractional CFO for Startups

We were going through an article yesterday mentioning Micheal Dubin, founder of Dollar Shave Club, so we thought we should share it with you.

Micheal saw an opportunity in the men’s grooming industry and started offering razors on a monthly subscription of $1. The company gained substantial brand awareness and attracted a lot of customers, and Unilever acquired it for $1 billion.

The reason to tell the story is to highlight the power of strong, targeted, and effective branding for an e-commerce startup. The story also illustrates how quickly e-commerce businesses can scale.

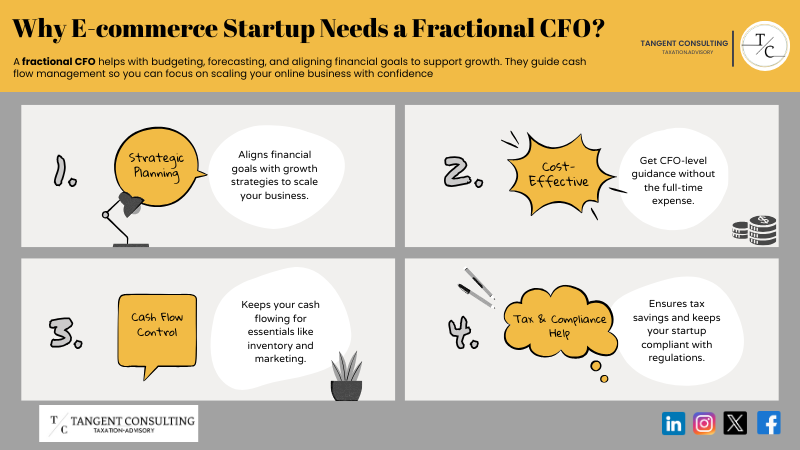

However, it isn’t just about branding or marketing. You have to take care of financial aspects too. This is where a fractional CFO for startups comes in.

You don’t need to panic if you haven’t heard about a fractional CFO, as today we’ll talk about them in detail and how they are essential for an e-commerce startup.

Who is a fractional CFO?

A fractional CFO does full-time work for a fraction of the cost. In other words, they provide services on a part-time or project basis.

A fractional CFO looks at the business’s overall financial performance. These include focusing on financial analysis and planning, risk management, reporting, and data gathering. They go beyond traditional accounting services and dig deeper into financial data to provide a complete picture.

If you want to get a complete picture of what CFO services are, you can check our detailed guide here.

How to Hire a Fractional CFO for Startups?

The demand for fractional CFOs is increasing as startups seek flexibility without paying too much. In 2023, fractional CFO demand was up by 103%.

With the rising trend, finding the needle in the haystack is important. Here’s how you can hire a fractional CFO.

1. Define Your Needs

Before you start interviewing candidates, it’s important to know what you want from a fractional CFO. Are you looking for help managing cash flow, preparing financial statements, or doing strategic planning?

Knowing what you want means finding a person with the right experience. For example, if you are challenged by accounts receivable or want to integrate your accounting software better, find a candidate with a previous record of excellence in these areas.

2. Look for Industry Experience

An experienced fractional CFO who has worked with e-commerce startups can bring information that will be more specific and specialized. They can understand nuances of inventory, sales tax, and how credit card payment flows work in an online business.

You can request referrals or look for portfolios to determine if they have represented an e-commerce startup before. A CFO with a good matchup can bring unique insights that can solve short-term and long-term needs.

3. Ask About Availability

Unlike a full-time accountant, a fractional CFO can give you more flexibility. You can ask if their availability matches your business cycle and if they can commit the time needed to make an impact.

You can also ask how they manage other clients and projects to ensure they are available when you need them.

4. Evaluate Their Approach

A good fractional CFO should not just manage the daily routine but look at the bigger picture. In interviews, you should ask how they build financial strategies. Do they help craft plans for scale? How do they prioritize financial data accuracy and make recommendations that are aligned with business growth?

A great Fractional CFO should be able to explain technical ideas simply and collaborate with you to put in place easy-to-understand systems for reporting financial information.

5. Ask About Cost

It’s important to be clear about your budget and ask fractional CFO service provider about their pricing model. Most fractional CFOs price by the hour, month, or on a project basis. The monthly rates range between $1,500 – $10,000, depending on services.

6. Check Reviews

Check reviews online and ask other businesses if they have worked with the service provider. The references can provide a good insight into the work style, reliability, and ability to deliver tangible results.

Mrs. Sanders has a great boutique downtown, and when her finances became messy, her friend recommended us for CFO services.

How can a CFO help an E-commerce Startup?

In 2024 global retail e-commerce sales are estimated to reach $4.1 trillion. If you have to navigate your way through this massive industry, you need someone who can do more than basic accounting.

A fractional CFO for startups can change the way you do business; here’s how:

1. Cash Flow Management

Did you know that 82% of small businesses fail because of cash flow problems? Many businesses think they have enough cash flow. However, when things go south, they don’t have enough cash.

A Fractional CFO works through cash flow problems by giving you clarity by balancing inventory costs, sales income, and expenses.

Hiring a CFO can reduce this dreadful outcome by giving you strategies to maximize cash and keep operations running smoothly.

2. Financial Strategy and Budgeting

As a business owner, growth could be always on your mind, but rapid growth without a financial strategy and budgeting is like building a house on sand.

A fractional CFO builds a solid foundation and helps grow your business sustainably so that your financial infrastructure keeps pace with the overall expansion.

When you expand, you need proper budgeting. A fractional CFO estimates costs, calculates profits, and even helps determine realistic sales goals based on financial information.

So, you are not guessing but making data-backed decisions for scaling your business.

3. Cost Control

E-commerce startups often find it difficult to control costs, especially when scaling. A fractional CFO can help you identify areas you are overspending on, such as warehousing or marketing costs, and advise you on improving profitability.

A good example of cutting unnecessary costs is Airbnb. When the pandemic hit, they cut $1 billion in marketing to keep the business going.

4. Inventory Management

If you have an idle inventory, it can cause cash flow problems. It’s because your cash locks up unsold products, and you need to pay other costs, such as payroll and bills. This creates a cash flow crunch.

One reason Toys “R” Us’s business suffered was too much inventory. They bought too much physical inventory while consumers were shopping online, resulting in a major cash crunch.

A fractional CFO can improve inventory turnover and ensure continuous flow. This creates a financial safety net, so you can keep up with demand without locking up all your capital in stock.

5. Tax Efficiency

The last thing you want as a small business owner is to be on the naughty list of IRS or CRA. For instance, if you cannot pay your taxes according to deadlines set by the CRA, CRA charges compound daily interest on unpaid balances. There are plenty of penalties you need to look out for.

A fractional CFO ensures you comply with all the tax laws and financial regulations and don’t end up giving more than what is due.

6. Building Investor Confidence

If you want to get funded or attract investors, a fractional CFO can prepare your business for getting funds or building investors’ confidence. They make sure financial reports highlight your business’s strength so you can get the best deal.

Final Thoughts

A fractional CFO for startups is an essential part of any e-commerce business. As a new owner, you don’t want to get stuck in complex financial jargon and terminology, so you would want someone to manage it.

But where to find that someone?

Fortunately, you don’t need to dig up to Tahiti to locate it, as we provide fractional CFO services to make sure your business runs smoothly.

FAQs

What is the average rate for a fractional CFO?

The average rate of fractional CFO depends on services. However, the cost can be between $200 to $1000 per hour.

How many hours does a fractional CFO work?

A fractional CFO can work as little as 5 hours per month and as much as 100 hours per month. It all depends on the required services.

Is a fractional CFO worth it?

A fractional CFO can take a deep dive into your financials and offer helpful insights to help cut costs, generate cash flow, have tax deductions, and more.