The Ideal Accounting Department Structure for 7-Figure Businesses

Let’s say you brought home a Great Dane puppy. Cute, right?

However, you live in a tiny condo, and a few days later, you have chewed furniture and torn cushions, and you’re wondering if it was worth it.

The moral of the story is that managing something big without a plan doesn’t end well.

We don’t do nighttime story-reading, but if you’re running a 7-figure business without a clear accounting department structure, you can end up miserable, like the owner of a Great Dane puppy in a tiny condo.

We don’t want you to be miserable, so we’ll walk you through what a well-structured accounting department looks like and why it’s beneficial for your business.

What is an Accounting Department Structure?

An accounting department structure is how an accounting team works together. It highlights who does what, who reports to whom, and how tasks get passed. Thus helping everyone stay in their lane while working toward the same goal.

For example, in a growing construction company, the structure might look like this: a bookkeeper handles day-to-day transactions, a controller oversees monthly reports and compliance, and a CFO makes strategic decisions, such as budgeting and forecasting.

Still With Us?

If you’ve scrolled this far, chances are you’re serious about getting your business on track.

Book a free 15-minute strategy call — tailored to your industry — and let’s figure out what’s holding you back.

Book My Strategy Call ×Don’t Let Business Numbers Hold You Back 🚀

Most business owners know they should get a grip on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

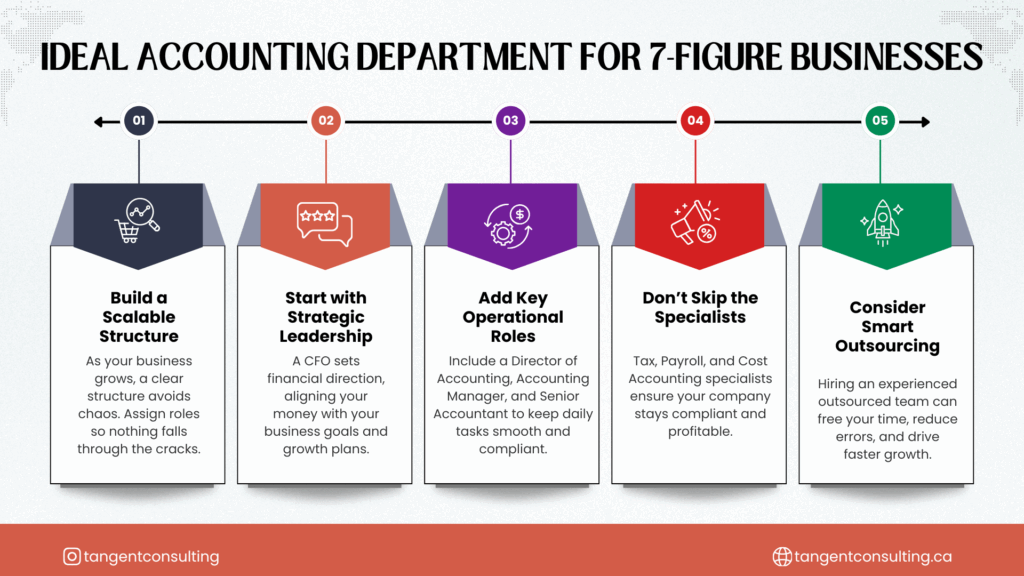

Accounting Department Structure for 7-Figure Businesses

As your business crosses the 7-figure mark, you have to manage a lot of things. Perhaps you are missing your invoices, payroll is becoming a headache, or you don’t know how to forecast cash flow.

It’s not that your team isn’t working hard; it’s just that without a clear structure, things slip through the cracks.

That’s where a well-organized accounting department comes in. Here’s how an accounting department is structured for a 7-figure business:

CFO

The CFO is the top-level financial strategist. They set the vision, align accounting goals with business strategy, and keep an eye on the company’s overall financial health.

Director of Accounting

Reporting to the CFO, this person oversees the entire accounting operation, ensuring everything is accurate, timely, and compliant with financial regulations.

Accounting Manager

Accounting managers are the day-to-day quarterbacks. They manage the team, assign work, and keep the department running on schedule.

Senior Accountant

A key player on the team, they maintain ledgers, prepare financial statements, and ensure everything is accurate before it reaches upper management.

Accountant

They’re in the trenches, entering transactions, reconciling accounts, and supporting senior accountants in maintaining accurate and up-to-date records.

Tax Specialist

Tax specialists focus on staying compliant with tax regulations and ensuring that returns are filed on time. They may report to either the Accounting Manager or Senior Accountant.

Cost Accountant

They dive into costs, track inventory expenses, and help figure out how much it costs to run your business and deliver services.

Financial Analyst

They are responsible for turning raw data into insights. They handle forecasting, budgeting, and financial modeling, helping leadership make informed decisions.

Accounts Payable Specialist

They make sure your vendors get paid on time and that your expenses are tracked properly.

Accounts Receivable Specialist

They track what clients owe, follow up on payments, and help keep cash flow steady.

Payroll Specialist

A payroll specialist handles employee paychecks and tax withholdings, ensuring that everyone receives their payment correctly and on time.

Audit Specialist

They double-check everything through internal reviews or work with external auditors to ensure transparency and compliance.

Budget Analyst

They build and monitor budgets to keep spending in check and aligned with the company’s financial goals.

Clerical Staff

The clerical staff provides support through data entry, record organization, and maintaining the department’s backend operations smoothly.

Build Your Ideal Accounting Department

Here’s Your Ideal Accounting Department Setup

Based on your responses, you might benefit from outsourcing bookkeeping and hiring a part-time CFO. Automation of AR processes could also speed up your month-end close.

Schedule a Free Strategy CallShould You Outsource Your Accounting Department?

If you’re running a 7-figure business, outsourcing your accounting might just be one of the smartest moves you can make.

But it only works well if you bring in experienced professionals from the start. If you hire junior folks just to save a buck, you’ll still be stuck reviewing everything they do. That’s not real delegation; it’s micromanaging with extra steps.

On the other hand, hiring a seasoned team allows you to step back fully. They know what they’re doing, they don’t need constant handholding, and they keep things running smoothly without your daily input.

Now, we’re not going to pretend it’s an easy or cheap decision. Hiring experienced accountants or a fully outsourced finance team might feel like a hit to your margins at first.

But it’s worth it.

Here’s what happened when one of our construction clients made the leap.

We cannot mention their name due to confidentiality, but we can report that within two months, the owner saved enough time to secure two new contracts, which were worth more than the entire annual accounting budget.

Final Thoughts

Knowing how your accounting department should be structured is a game-changer for any 7-figure business. When every team member understands their role and how it fits into the bigger picture, your finances run more smoothly, decisions are made faster, and growth feels more manageable.

If you are thinking about building or reshaping your accounting team, fortunately, you don’t have to open another tab. For over a decade, we’ve helped businesses like yours set up accounting systems that work without any guessing.

Let’s get your accounting system working for you!

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 🙂

FAQs

What is the structure of accounting?

It’s the way an accounting team is organized, including who is responsible for what, who reports to whom, and how financial tasks are managed across different roles.

How can I improve the accounting department?

You can start by clearly defining roles, using the right tools, and bringing in experienced people who can work independently and accurately.

What is the accounting life cycle?

It’s a step-by-step process of recording, processing, and closing financial transactions, accompanied by reporting and analysis.