The Basics of Accounting in Property Management: What Every Landlord Needs to Know?

The Basics of Accounting in Property Management: What Every Landlord Needs to Know?

When you bake a sourdough loaf for the first time, you feel like you can pull this off (that’s what we thought). You need to mix flour, salt, and water, and you are good to go.

However, your dough doesn’t rise as you have no idea about proofing. The whole thing came out looking like a flat tire.

There is an interesting analogy between sourdough bread and managing rental properties. From the outside, it might look straightforward—collect rent, fix a few things, and call it a day. But behind the scenes, there’s a whole layer of financial stuff that needs to be done right, or things can get messy.

That’s where property management accounting comes in. You need to understand how money flows in and out of your business.

So, let’s break down what accounting in property management means and how you can get started.

Accounting in Property Management Explained

Managing rental properties isn’t just about collecting rent; it’s also about maintaining a property’s value. It also means keeping a close eye on your finances. That’s where property management accounting comes in.

It’s a specialised type of accounting tailored to the needs of landlords and property managers, and it extends beyond the standard income-and-expense tracking typically found in most businesses.

Instead of looking at your books as one big lump, property management accounting breaks things down for each property and for each tenant. That level of detail helps keep everything organized and helps you stay on top of your cash flow.

Here’s a quick look at what this kind of accounting covers:

Rent Collection and Tracking

It’s all about making sure rent comes in on time, keeping records straight, and quickly dealing with late payments.

Expense Management

Expense management entails repairs, maintenance, utilities, insurance, property taxes, and the list goes on. You’ll need to track everything carefully for each property.

Financial Reporting

Reports like income statements, balance sheets, and cash flow statements help you see how each property is doing financially. It’s about getting a clear picture, not just looking at numbers.

Budgeting and Forecasting

You have to set budgets for every property, predict future income and costs, and plan to stay profitable.

Tax Compliance

Staying on the good side of the IRS or CRA means accurate records and timely filing. Property management accounting helps you do that.

Accounts Payable and Receivable

That’s the money coming in (like rent) and going out (like bills). Keeping it all in check ensures your books stay balanced and your business runs smoothly.

Don’t Let Your Books Hold You Back 🚀

Most business owners know they *should* get a handle on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

How to Set Up a Property Management Accounting System?

If you manage multiple properties, a solid accounting system is a must-have. It helps you track the profitability of each property, makes tax time a breeze, and ensures you’re not leaving any deductions on the table.

Here’s how to get things set up the right way:

1. Start with the Right Bank Accounts

One of the first and most critical steps is to set up separate bank accounts. Why? Because mixing all your funds into one account isn’t just messy; it’s often illegal, depending on where you’re operating.

Here’s a breakdown for the US and Canada:

For US Property Managers

Most states require you to separate your funds, especially if you’re handling other people’s money, like rent or security deposits. Here’s a typical setup:

Property Management Trust Account

Used to hold client funds like rent before it’s transferred to owners.

Security Deposit Account

Law often requires that deposits be kept in a separate escrow account so you can return them when tenants move out.

Operating Account

This is your main account for business expenses—maintenance, utilities, management fees, etc.

Reserve Account (optional)

A backup fund for unexpected costs or vacancies.

Some states allow combining certain accounts if you manage a few properties but always check your state laws to stay compliant.

For Canadian Property Managers

In Canada, things are a little different, but the same logic applies: keep funds separate and well-documented.

Trust Account

This holds rent collected on behalf of landlords or condo corporations. Many provinces, like British Columbia and Alberta, legally require these to be separate and regulated.

Security Deposit Account

In provinces like Alberta or Nova Scotia, damage deposits must be held in a separate interest-bearing account and returned to the tenant with interest (unless there are deductions). Check with your provincial tenancy board for the rules.

Operating Account

Used for paying vendors, handling management fees, and general operating costs.

Contingency or Reserve Fund

While not always mandatory, having one is smart, especially for unexpected repairs or vacancies.

If you haven’t set up a business account, Ramp offers corporate cards with built-in expense management, bill pay, and invoice tracking features. It’s a great way to keep your bookkeeping system organized and cloud-based. Plus, there’s a bonus waiting for you if you sign up through our link.

2. Pick an Accounting Method That Works for You

Once your bank accounts are set up, the next step is deciding how you’ll track your money. There are two common approaches in property management: cash basis and accrual accounting.

Accrual Accounting

With accrual, you record income and expenses when they happen, not when the money hits (or leaves) your bank. So, if a tenant pays you upfront, you don’t record the whole payment immediately. Instead, you spread it out over the months it covers.

Let’s say someone rents your property and pays $10,000 for four months in advance. Even though the full amount is in your account, you’d only show $2,500 monthly as income on your books.

Accrual gives a clearer picture of your business’s monthly performance, especially if you deal with long-term leases or advance payments.

Cash Basis Accounting

This one’s simpler. You only record money when it’s received or spent. Using the above example, if your tenant pays $10,000 up front, you record the full $10,000 as income the day it lands in your account.

So, which one should you go with?

If you’re just starting or managing a few properties, the cash method is usually easier and more common. But if you’re growing and want more accurate financial reporting, accrual might be the better fit.

3. Set Up a Chart of Accounts

The chart of accounts is your financial roadmap. It’s a list of categories you’ll use to sort every transaction in your property management business, whether money is coming in or going out. Every time you enter something into your books, you’ll reference this chart to know exactly where it belongs.

Each account falls into one of a few major categories:

- Income – Money you earn (like rent or late fees)

- Expenses – Money you spend (like maintenance or utilities)

- Assets – What your business owns (like bank balances or security deposits)

- Liabilities – What you owe (like loans or refundable deposits)

- Equity – Your business’s net worth

The more specific your chart, the better insights you’ll gain into your cash flow and property performance. But there’s a balance; too many categories can make your books harder to manage.

You can create your chart of accounts in a spreadsheet or even a Word doc, but most accounting software will have this section built in and ready to customize.

Here’s an example of a simple chart of accounts for a property management business:

| Category | Account Name Examples |

|---|---|

| Income | Rental Income, Late Fees, Application Fees, Laundry/Vending Income |

| Expenses | Repairs & Maintenance, Utilities, Property Taxes, Insurance |

| Assets | Bank Account, Rent Receivable, Security Deposits Held, Equipment |

| Liabilities | Accounts Payable, Mortgage Payable, Security Deposits Payable |

| Equity | Owner’s Capital, Retained Earnings, Owner’s Draw |

4. Set Up Your Journal

Once you’ve prepared your chart of accounts, the next step is to set up your journal, the place where every financial move is recorded first.

This is called a general journal, basically your master log. Each time money comes in or goes out, you jot it down here with the date, the amount, the accounts involved, and a short note about what the transaction was for.

After you’ve recorded something in the journal, the info gets transferred to the general ledger. This is where transactions are sorted by account, so you can easily see all the activity tied to rent income, repairs, utilities, or any other category. It helps you understand how each area of your business is performing financially.

Now, when it comes to recording your entries, you have two main options:

Single-Entry Bookkeeping

This is the simple version. Each transaction is recorded once, like keeping a checkbook. Some small property management businesses use this method because it’s easy. But there’s a catch: it’s limited, and you’re more likely to make mistakes or miss key details.

Double-Entry Bookkeeping

This is the gold standard, especially for property managers handling multiple accounts and properties. Here’s how it works: every transaction gets recorded twice, once as a debit and once as a credit.

For example, if rent is paid, you increase your bank account (debit) and rental income (credit). It’s a little more complex but gives you a much more accurate and complete view of your finances.

Most growth-focused or well-organized property management businesses go with the double-entry system. It helps you track where your money is coming from (rent, late fees, deposits) and where it’s going (repairs, taxes, utilities). Plus, it’s often required if you’re using accounting software or working with accountants or auditors.

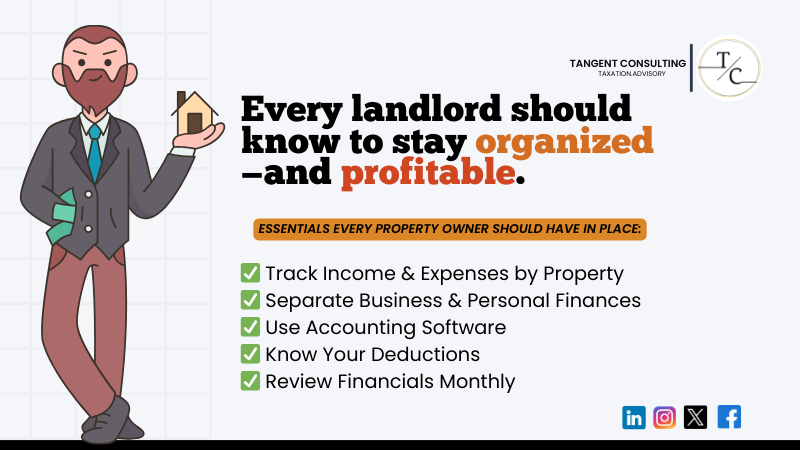

Best Practices for Accounting in Property Management

Now that you’ve got the foundation in place, let’s talk about how to keep your accounting system running smoothly. These simple but effective tips can help turn your bookkeeping into a real advantage for your property management business.

1. Reconcile Your Accounts Every Month

Think of reconciliation as double-checking your math. You compare your records against your bank statements to make sure everything lines up.

Doing this at the end of each month helps you catch mistakes early, whether they’re typos, duplicate entries, or unexpected bank fees. It also makes year-end reports and tax filings much less stressful.

By building a monthly habit of reconciling your accounts, you stay in control of your cash flow.

2. Keep Your Cash Flow in the Green

Cash flow is what’s left over after collecting rent and paying your bills. Sounds simple, but losing track is easy if you’re not paying close attention.

Bad investments like overpriced property or unnecessary business expenses can drain your cash fast. And when that happens, both you and your clients feel the pressure.

On the flip side, strong positive cash flow gives you options. You can upgrade, invest in growth, or tackle debt without sweating it out.

3. Set Up a Rainy-Day Fund

Unexpected costs can occur, such as a sudden vacancy or emergency repair. That’s why having a backup fund is essential.

Work with your property owners to agree on how much to keep in reserves. This helps you handle surprises without scrambling or dipping into personal funds.

Make sure the money is easily accessible (aka liquid), so you’re not hit with withdrawal penalties when needed. A good rule of thumb is to have enough to cover three to six months of expenses.

4. Look for Deductible Expenses

If you’re not tracking deductible expenses, you’re probably leaving money on the table come tax time. These are costs you can write off to lower your taxable income—and they add up fast.

In property management, common deductible expenses include repairs, routine maintenance, management fees, and even marketing your rentals.

The trick is to stay on top of it all year long. Record these expenses as they happen, not months later when you scramble through receipts. This habit makes tax season smoother and helps you keep more of your income.

5. Automate Where You Can

Managing your books manually isn’t wrong, but it leaves more room for errors and eats up a lot of your time. Even if you’re flawless with your numbers, there’s one big reason to automate your accounting: it saves you hours every week.

You’ve got two solid options to make automation work for you:

1. Use Accounting Software

Tools like property management accounting software can handle a lot of heavy lifting. From automatically collecting rent to syncing with your bank account and generating reports, they make your job easier and reduce the risk of mistakes. In addition, they keep everything consistent and organized without you having to think twice.

2. Hire a Remote Accounting Service

If software still feels like too much to manage, outsourcing is a great alternative. A remote accounting service gives you access to experts who handle everything from bookkeeping to tax prep without needing someone in-house. It’s efficient, cost-effective, and frees you up to focus on growing your business.

Final Thoughts

Accounting in property management is the engine that keeps your rental business running smoothly. When done right, it helps you track every dollar, spot issues before they snowball, and make smarter decisions that grow your bottom line.

Speaking of growing your bottom line, Tangent Consulting helps landlords like you outsource the entire accounting department. For over a decade, we’ve been helping hardworking pros, contractors, handypeople, and small business owners ditch the overwhelm and take control of their finances.

Let’s get your accounting system working for you!

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

What is the best accounting software for property management?

Some popular choices include Buildium, AppFolio, and QuickBooks. The best one depends on your portfolio size and specific needs, such as rent tracking or maintenance management.

What is the role of a property accountant?

A property accountant handles rent collection, expense tracking, budgeting, and financial reporting for rental properties to ensure accuracy and compliance.

What is the difference between general accounting and real estate accounting?

General accounting tracks overall business finances, while real estate accounting focuses on property-specific details like tenant accounts, escrow funds, and lease-related expenses.