Top 10 Accounting Tips for Service-Based Businesses

It’s Saturday night, and the football match is about to begin. You sit down with snacks, ready to support your team. All of a sudden, the doorbell rings. A relative has paid a surprise visit.

Your game night is ruined, and you have to cater to the guests. What a terrible thing, right?

Now, imagine you are running a service-based business, and you are ignoring your accounting. It’s gonna play with your mental peace and business.

That’s why we’ve compiled these 10 accounting tips specifically for service-based businesses. So, make sure to stick with us for the next 10 minutes or so.

What Service-Based Businesses Need to Know About Accounting?

If you run a service-based business like a law firm, consulting agency, or marketing studio, your accounting needs are a bit different from those selling physical products.

Instead of tracking inventory, you have to deal with billable hours, expertise, and client relationships, which can create certain challenges.

For instance, one of these hurdles is figuring out when to recognize revenue. Say you’re a law firm working on a case that could take over a year. At what point do you count that income? Or maybe you’re a consultant, adjusting your deliverables as the client’s needs evolve; how do you track that?

These situations aren’t always black and white. You need a clear strategy for recognizing revenue, managing expenses, and reporting income correctly. And things get even trickier when contracts include results-based payments or performance bonuses. That kind of unpredictability makes it even more important to have pro accounting tips at your disposal.

Don’t Let Business Numbers Hold You Back 🚀

Most business owners know they should get a grip on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

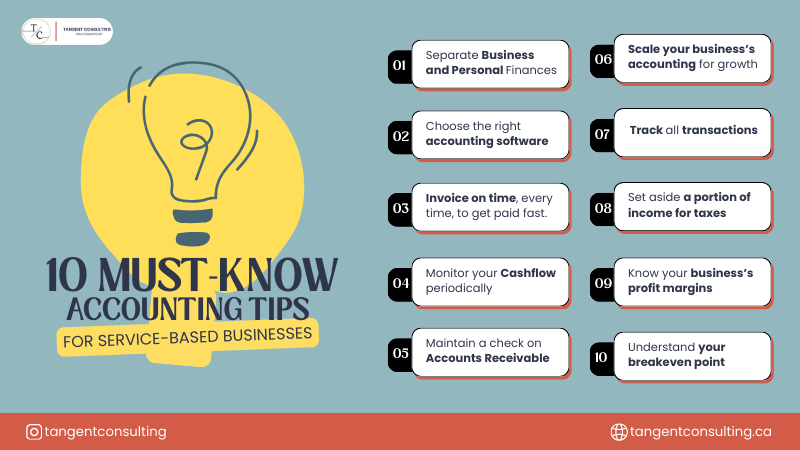

Top 10 Accounting Tips

We are going to be honest here; accounting probably isn’t the reason you started your business. But the irony is it’s something you’ll need to stay on top of. There are regular tasks, some weekly, some monthly, some yearly, that help keep your finances in check and your business healthy.

Here are some must-know accounting tips to make service-based businesses less stressful:

1. Keep Track of Every Transaction

Whether it’s a sale or an expense, you should record each transaction. Ideally, do this weekly, though if you have a lot of activity, daily or bi-weekly might make more sense. In case you are wondering, a transaction includes everything from selling products to buying supplies.

You can use a spreadsheet or write things down, but small business accounting software like QuickBooks saves you time and connects with your bank account automatically.

2. Save and Organize Your Receipts

Once you’ve logged your transactions, remember to store the proof. Although keeping receipts and invoices might seem old-school, they’ll save you during tax season or an audit.

But how do you store them?

If you throw everything into a shoebox, it’s a recipe for chaos and confusion. A much better approach is to set up digital folders or use software that lets you save receipts.

3. Set Up a Chart of Accounts

Your chart of accounts is the backbone of your financial reporting. It’s a map that illustrates where money is coming from and where it is going. It helps you organize your income, expenses, assets, and liabilities.

Make sure your control accounts (like accounts receivable or payroll liabilities) and transit accounts (like undeposited funds) are reviewed and reconciled regularly. Otherwise, you might develop a financial blind spot.

Let’s say you receive client payments but forget to move the amount from your undeposited funds account to your actual bank income. On paper, it looks like you have more money than you do. Come year-end, that error could throw off your entire profit calculation and delay your filing.

4. Use Budgeting and Forecasting

Good budgeting is about planning with purpose. You can create a realistic budget based on your business goals, then check in regularly to see how you’re tracking. If things are off, you can adjust.

Forecasting is a sneak peek into the future. It helps you predict cash flow and identify red flags. When done right, budgeting and forecasting help you make smarter decisions, allocate resources wisely, and stay financially grounded.

5. Keep an Eye on Your Cash Flow

Cash flow is the heartbeat of your business. You have to know how much cash you have now, what’s coming in soon, and what bills are due.

If you don’t plan, you could find yourself short when it’s time to pay employees, suppliers, or rent.

You don’t need fancy software to start. You can use a simple spreadsheet showing your current bank balance, expected income (like upcoming client payments), and outgoing expenses (like payroll or bills due next week).

Let’s say your current bank balance is $15,000. You expect to receive $10,000 from a client next week, but you also have $18,000 in bills due over the next 10 days. Without this forecast, it’s easy to assume you have cash left. However, in reality, you could be $3,000 short.

6. Stay on Top of Accounts Receivable

You know paying bills is important, but getting paid is super important. If your customers aren’t paying you on time, your cash flow suffers, and so does your ability to grow.

You should check your AR every month. Look at the outstanding balance and the overdue balance. A good rule of thumb is to keep overdue invoices under 10–15% of your total receivables.

If clients start slipping, follow up weekly. One way to encourage prompt payment is to charge late fees. For example, if you apply a 2% monthly interest on a $10,000 unpaid invoice, that’s an extra $200 added each month. However, be sure to outline this clearly in your contracts or payment terms upfront.

7. Send Invoices On Time

Sending invoices can be boring. We remember Chalie Munger’s quote, “I hated sending other people invoices.” However, if you are a service-based business, sending invoices on time should be your top priority.

If invoices are late, payments can get delayed and that messes with your cash flow.

You can make invoicing easier by sticking to a few simple habits:

- Be specific. Clearly list what was delivered, when, and at what cost.

- Don’t delay. Send invoices right after the job is done, or the product is delivered.

- Follow up. Use friendly email or text reminders if a payment hasn’t come through.

Oh, and tracking your invoices also helps you spot trends like which clients always pay late (so you can tighten your terms) and which ones are early birds (maybe offer them a small discount to keep it going).

8. Make Tax Planning a Year-Round Habit

Nobody likes dealing with taxes, but they’re part of running a business. Waiting until the last minute usually means stress and possibly overpaying.

To counter such a situation, you can set aside money for taxes throughout the year. You can either handle it yourself or bring in a pro, but either way, understanding the basics puts you in control. Learn how tax brackets work, try out a few tax calculators, and get familiar with how to file a return.

Even if you outsource your taxes, knowing the lingo helps you ask the right questions and reduces the likelihood of being overcharged or making a costly mistake.

If you’re scanning receipts, name the files with the date and vendor name. It’ll save you time come tax season.

9. Don’t Let Debt Get Out of Hand

Here’s a classic piece of advice that still holds up: don’t take on more debt than you can handle. It sounds obvious, but it’s one of the most common reasons businesses get into trouble.

In fact, according to Statista, 16% of small and midsize businesses have outstanding debt between $100,000 and $250,000.

That doesn’t mean all debt is bad. A well-structured loan can help you grow. However, taking on too much debt without a proper plan can lead to cash flow issues and missed opportunities.

10. Know When to Call in the Pros

Most business owners wear a lot of hats, but accounting doesn’t have to be one of them. Sure, you can handle the books yourself, but outsourcing to professionals can save you time, reduce costly errors, and give you peace of mind.

Here’s how the pros can help:

- Bookkeepers stay on top of day-to-day transactions and make sure everything is recorded and categorized correctly.

- Fractional CFOs take a big-picture view. They help with budgeting, forecasting, and building a strategy to keep your finances strong as your business grows.

- Tax preparers keep you compliant and can help you plan smartly to reduce your tax bill.

Final Thoughts

Running a service-based business isn’t all smooth sailing; it takes real commitment and constant monitoring, especially when it comes to finances.

That’s why we compiled these top 10 accounting tips to help you keep your books organized, your cash flow healthy, and your stress levels low.

Speaking of stress levels, for over a decade, we’ve been helping small business owners like you ditch the overwhelmed and take control of your finances. We become your full accounting department, so you don’t have to hire people individually.

Let’s get your accounting system working for you!

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

What is the best accounting method for a small business?

It depends on your business type, but most service-based businesses benefit from the accrual method since it gives a clearer picture of income and expenses.

What is WIP in accounting for a service industry?

WIP (Work-in-Progress) tracks ongoing projects that have yet to be completed or billed. It helps match revenue to the work being done.

Which is better, cash or accrual?

Accrual is better for understanding your business’s full financial health, but cash is simpler and great for tracking cash flow.