7 Questions to Ask Before Hiring the Best Virtual CFO for Your Business

Have you ever bought something late at night?

With our half-eyes closed, we did some online shopping last week. We never cared to look back at what we ordered.

Two days later, it arrived, and we instantly regretted it. “What the hell did I order?”. It was a disaster and a wasteful way to spend money.

We aren’t bringing up our shopping experiences but rather trying to draw an analogy here.

If you hire the wrong CFO for your business, you’ll instantly regret it like we did. It may look good, and you think you have hired the best virtual CFO, but when it shows up, you realize you should have asked a few questions.

In this guide, we are breaking down some important questions you need to ask before hiring the best virtual CFO for your business. Let’s jump right in!

What does a virtual CFO do?

A virtual CFO is a part-time financial expert who brings high-level strategy and insight without a full-time salary. They do pretty much everything a traditional CFO would do, but on a flexible basis. Instead of being tied to just one company, virtual CFOs often work with several businesses, offering their expertise.

Here’s a quick look at what virtual CFO services usually cover:

- Financial planning and analysis

- Budgeting and forecasting

- Cash flow management

- Risk management

- Financial reporting and M&A support

- Accounting and bookkeeping

You hire a virtual CFO if you’re looking for expert financial advice but don’t have the budget (or need) for a full-time CFO.

For example, let’s say your business is growing fast, and you’re not sure if you can afford to hire more staff or invest in new equipment. A virtual CFO would analyze your numbers, forecast the impact, and help you make a confident decision.

We’re keeping things short and sweet here, but if you want a full breakdown of everything a virtual CFO can do for your business, check out our detailed guide here.

Don’t Let Business Numbers Hold You Back 🚀

Most business owners know they should get a grip on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

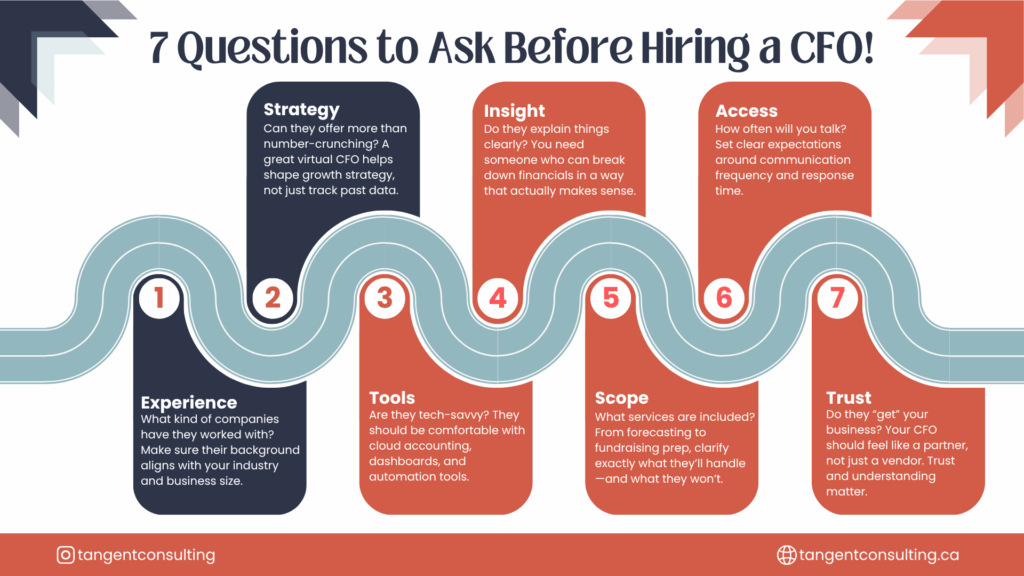

Hire the Best Virtual CFO by Asking These Questions

Hiring virtual CFO services is about making the right choice for your business. A virtual CFO can help you grow, plan, and make better financial decisions. But how do you know who’s the right fit?

Here are the key questions you should be asking:

1. What Are My Business Goals, and Can This CFO Help Me Reach Them?

Start by getting clear on what you want. Are you trying to increase revenue? Expand into a new market? Cut unnecessary costs? Think short-term (the next few quarters) and long-term (where do you want your business to be in 5 or 10 years from now?).

Knowing your goals will make it easier to find a virtual CFO who can build the right financial strategy for you.

2. Does This Virtual CFO Have the Right Experience and Industry Know-How?

Not all CFOs are created equally. You need to hire someone who understands your industry and has experience helping businesses like yours.

You need to ask about their background, the types of clients they’ve worked with, and how they’ve improved financial outcomes in the past.

3. Do They Have the Right Technical Skills and Tools?

The best virtual CFO should be familiar with their numbers. It means being best at financial analysis, accounting, and reporting.

But it doesn’t stop there. They also need to be comfortable using advanced financial software. Tools like QuickBooks, Xero, or Sage can help with daily tasks like budgeting and tracking expenses.

You need to ensure that the person you’re hiring knows how to work with these tools and can effectively turn complex data into clear strategies.

4. Can They Communicate Clearly?

We know technical skills are important, but don’t overlook the human side. A virtual CFO needs to explain financial analysis in a way that makes sense to the rest of your team. That means clear communication is a must.

They also need to be good at solving problems and making fast decisions, especially when things don’t go as planned.

Ask yourself: Can this person remain calm under pressure and help us move forward when the numbers become challenging? If yes, you’re probably on the right track.

5. Will They Be Available When You Need Them?

Since a virtual CFO works remotely, it’s essential to inquire about their availability and responsiveness. What are their typical working hours? Will those hours work with your schedule, especially if you’re in different time zones?

You want someone who’s not just available for scheduled meetings but also responsive during peak hours. When something urgent arises, you need a CFO who is readily available with solid answers.

6. Can They Help Manage Investor Relationships?

The best virtual CFO can also help manage relationships with investors. It means keeping investors in the loop, building trust, and presenting reports at the right time.

In addition, they can help mentor your internal finance team and encourage growth.

7. How Do They Handle Security and Confidentiality?

When you hire a virtual CFO, you’re trusting them with your most sensitive financial info, so security is a must-have.

Ask what steps they take to keep your data safe. Do they use secure systems? Are they up to date with financial regulations?

Make sure they’re serious about protecting your information. It’s also a good idea to obtain a confidentiality agreement to ensure expectations are crystal clear.

🎯 Compare the Best Virtual CFOs

Use our interactive Virtual CFO Comparison Scorecard to rank and rate providers based on what actually matters to your business.

- 🧠 Evaluate expertise by category

- 📊 Score performance side-by-side

- 🏆 Find your top CFO match with ease

Perfect for founders, COOs, and finance leads who want more than a gut check.

When Is the Right Time to Hire a Virtual CFO?

Now you know how to hire the best virtual CFO, but is your business ready for it? Here are some signs that bringing a virtual CFO on board could make sense:

1. You’re Struggling With Cash Flow

If you’re constantly wondering where your money’s going—or if you’ll have enough to cover payroll next month, you’re not alone. A virtual CFO can step in to build better cash flow models, monitor spending, and create a budget that works for your business.

For instance, a fast-growing e-commerce business realized it was turning a profit but running low on cash. Their virtual CFO identified the issue of overstocked inventory and helped them rebalance their spending.

2. You’re Scaling

Growth is exciting, but it also brings chaos. If your revenue is rising but you have no idea what your margins look like or which products are most profitable, you need expert guidance to help you understand these key metrics.

For example, a software startup was landing new clients every week but had no clear idea of its customer acquisition costs. A virtual CFO helped them track unit economics and optimize pricing.

3. You’re Preparing for Fundraising or an M&A

Raising capital or selling your business? You’ll need clean books, solid projections, and answers to investor questions. A virtual CFO knows how to get you deal-ready.

A virtual CFO can draft professional financial reports, forecast growth, and handle all investor due diligence.

Still With Us?

If you’ve scrolled this far, chances are you’re serious about getting your business on track.

Book a free 15-minute strategy call — tailored to your industry — and let’s figure out what’s holding you back.

Book My Strategy Call ×4. Your Board or Investors Want Better Financial Reporting

If you’re being pressured to provide more detailed, timely, or strategic reports and are wondering how to draft them, it’s time to seek help.

5. You’re Entering New Markets or Launching a New Product

Expansion can be risky without solid financial planning. A virtual CFO helps you model different scenarios, set realistic targets, and plan for unexpected costs.

Final Thoughts

There you have it. Now you know how to hire the best virtual CFO. Truth be told, at some point, every growing business hits a financial wall. Perhaps they have cash flow problems, lack clean records, or are operating a business without a proper financial structure.

That’s where a virtual CFO can help. When you hire a virtual CFO, you need to hire someone who acts as a partner and understands your business requirements. So you can have a better idea.

Speaking of a partner, at Tangent, we work as an extension of your team. For over a decade, we’ve been helping businesses like yours ditch the overwhelmed and take control of your finances. Our virtual CFO services give you a clear view of your numbers, your goals, and how to reach them.

Let’s get your accounting system working for you!

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

How much does a virtual CFO cost?

Virtual CFOs typically charge between $2,000 and $10,000 per month, depending on your business size and the level of support you need.

What are the four faces of the CFO?

The four faces are Strategist, Operator, Steward, and Catalyst. Each of these focuses on growth, efficiency, compliance, and driving change.

Is the CFO worth it?

Yes, if your business needs better financial insight, planning, or investor readiness, a CFO can be one of your smartest investments.