When do you need an accountant for your small business?

When do you need an accountant for your small business?

Does one ALWAYS need an accountant by their side when starting a business?

Certainly not!

Only make sure that you are not aiming to become one of the leaders in your industry within a small timeframe (6 months to one year). Generally, you can start doing your own bookkeeping on a piece of paper and its fine.

Upgrade to spreadsheets when the business becomes more consistent. This will also help the machines keep a digital copy for future use. In the starting cycle of small business, it is good to invest only in absolutely necessary expenses.

After one or two years of continuous business, it’s however a different ballgame altogether. Your business should be growing by this point.

Either the profit margin should be increasing by diversification of your offered services or products. Or you should be launching more exclusive, profitable products and services to ensure you are making money. Making money is important, right?

So that is when you need an accountant, full-time, to streamline your money matters.

And what would happen if you hired one?

An accountant will take over everything financially speaking, in your business. Or they should take over everything financial, to be honest. Remember, you hired them to solve your problems, not to be another headache to deal with.

So, the first thing to check is, are there services comprehensive enough to cater to your business’s financial needs? Think of the future and ask yourself, would this guy (the accountant for your small business) be able to add value to my business’s growth?

- You might need an automated way to do repetitive critical tasks (payroll, customer collections, payables reconciliation) to save time. Can he automate them?

- Would you expand into new product lines or open new branches of your office? If yes, does this person have the ability to incorporate new businesses?

- Does he basically guarantee that you won’t have to go through the (laborious) task of finding an accountant again?

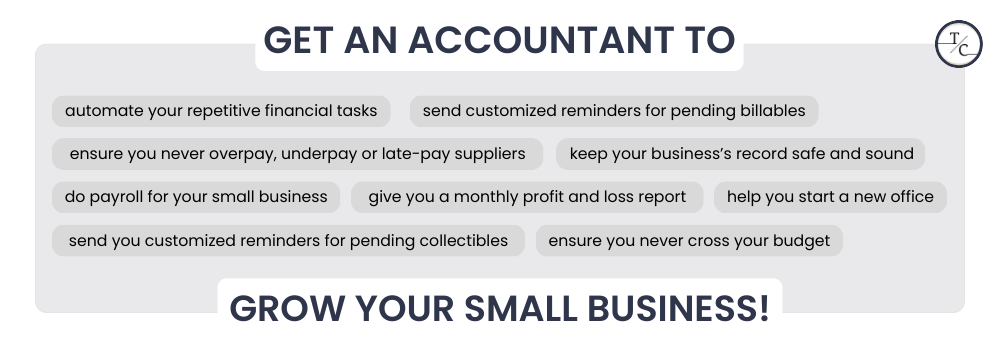

Once you have chosen the right accountant working for your business, these are some of the ways that he or she should be helping your business:

- Streamlining all your business operations to ensure financial efficiency in every one of them.

- Data gathering, processing and storage to ensure you are ready for an audit from any regulatory body, anytime.

- Repeated (nice-looking) presentation of the summary from the gathered data to help you make informed decisions.

- Connections with the right people in regulatory bodies to ensure external factors don’t become a bottleneck to your business’s continuous growth.

30mins of free consultation to see if you need an accountant?

Instead of guessing your financial standings, let a CPA have a look, for free!

If you want to see a practical example of the above phenomenon at work, continue reading!

One of our recent clients, let’s call him Mike, is in the construction business. Finances were all awry when we took over in the sense that:

- His customers simply did not pay for the invoices they owed, and no proper follow-up system was implemented either.

- People working for him would be wasting their time (and fuel) on non-issues therefore straining his cashflow and increasing the maintenance cost of his fixed assets (tools, vehicles etc.)

- Supplier invoices were not being reconciled. If a supplier overstated the amount-to-pay, he would simply pay it, because of the lack of data on his end to verify the accuracy of that amount-to-pay.

- No one vetted his payables. This often caused the company to cross its credit limit with suppliers. As a result, the company incurred monetary fines and the suppliers blocked the company account. This, in turn, prevented his employees from buying anything necessary for their jobs.

We, as the accountants for his small business, first focused on gathering data. We set up an email account (you can use Gmail, Outlook or any account suited to your preference) to get all invoices from his suppliers and payment receipts from his clients in one place.

He was working with QuickBooks online (QBO) and a field service app called Jobber.

Unpaid shoutout: Jobber helps a ton of businesses from 50 different field service industries improve business flow.

If you plan to sign up, give us a nudge to get a one-use discount code when you sign up!

Then we requested our CPAs who already had experience with Jobber, to help our inhouse developers make automations to save time in doing the otherwise laborious repetitive but equally important tasks.

Soon, every invoice on the mail account was automatically getting to the right place, at the right time, that enabled his employees to bill new jobs with an accurate rate and thus, reduce the number of losses.

Around 5/6 of further new processes along with this one introduced in the same theme enabled us to bring down his collectables to 25% of what they originally were, when we took over. His sales boomed following the quarter when data-driven advice was being communicated.

The instances of his company crossing the credit limit went to zero and we halved his payroll-processing time while doubling the checks in it, to ensure everyone was actually working, for the time they are paid. Whoosh!

Seems like a lot of work, eh? And some of the words used above may seem a bit technical too but that’s the beauty of having an accountant in your camp; you get to enjoy your evenings away from the boring technical stuff while an accountant ensures that your business’s finances are running smoothly.

Do you want to improve your finances with the most affordable accountants for small businesses in the US or Canada?

Our developers assigned to Mike’s business are making further process enhancements to help him increase his profitability, as you read these lines. We can do the same improvements for your business as well!

30 minutes, Your Business Finances, Our CPAs.

Let’s help you make sense of your cash, and decide for yourself if you need a CPA to fuel your business’s growth.