A Survival Guide to Bookkeeping for Independent Contractors

A Survival Guide to Bookkeeping for Independent Contractors

We had a conversation with our new client this week and thought we should tell you his story.

Matt (can’t tell the full name) is an independent interior designer. His business grew overnight when one of the celebs became his client. Matt was excited, but he neglected the accounting part.

He didn’t realize it, but during last year’s tax season, he ended up missing thousands of dollars in tax deductions. Knowing his financials aren’t looking good, and he can’t survive another tax season, he approached us.

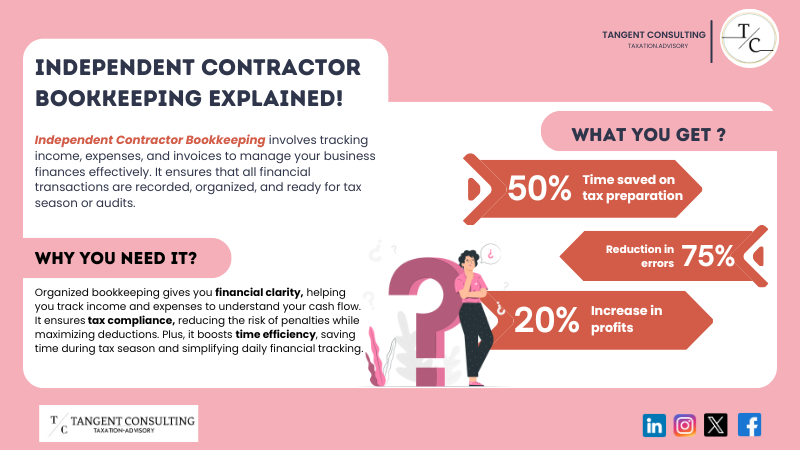

We can’t discuss everything here, but bookkeeping for independent contractors can provide a solution to Matt’s problems. In this guide, we’ll discuss how to avoid his mistakes and what you can do about them.

Independent Contractor Explained in Less Than 100 Words

Some of you may say, “Oh, Tangent, first tell us a little about independent contractors.”

An independent contractor owns their own business rather than being a full-time employee. Independent contractors fix their own hours, track their own expenses, manage their own payments, and do their own taxes.

In the US, 45% of the workforce is classified as independent contractors.

So, independent contractors are different from traditional employees, who have to do everything themselves.

Why is Bookkeeping Important for Independent Contractors?

Did you know that 21% of small and medium businesses know nothing about bookkeeping? It’s a shocking statistic, given that bookkeeping can help you grow.

As an independent contractor, here’s why you should consider bookkeeping:

Taxes Done Properly

We admit bookkeeping isn’t glamorous or s***y, and it can be frustrating to see the numbers all the time. However, it is a shield between you and the tax audit.

IRS and CRA can come hard at you if they see any irregularities in your taxes. In fact, 40% of small businesses incur IRS penalties for incorrect filings.

There can be audits without proper filings, or you can miss out on tax deductions like Matt.

Manage Cash Flow

As we mentioned earlier, you need to do everything as an independent contractor. However, managing cash is difficult; tracking every dollar in and out can be tiresome.

Suppose you finished a project and forgot to invoice your client. Late payments are one of the many cash flow problems. You can check out our detailed guide here to learn more about some cash flow problems.

Future Planning

Bookkeeping isn’t just about numbers; it also gives you a clear picture of a business’s finances. You can compare the current results with older ones and see the areas of improvement. It helps you analyze expenses, profits, cash flow, and budgeting.

You can check our guide here to learn more about how bookkeeping can be a game-changer for any business.

How to Set Up Bookkeeping for Independent Contractors?

Setting up bookkeeping can be hard for an independent contractor. However, you can do some things to limit the risks of financial chaos, and then a professional bookkeeper can take over.

Keeping Personal and Professional Separate

We all know we need to keep personal and professional lives separate. It goes the same for bank accounts. One of the easiest things you can do is open a dedicated business account.

Mixing personal and business payments can feel like adding sugar if the pasta is salty. You can’t track your business expenses properly, and your finances aren’t organized when the tax season comes.

Pro Tip: Most banks offer a special account for independent contractors and freelancers. It comes with benefits like low fees and easy tax payments.

If you are looking to expand your business, we would suggest Ramp. Their corporate card gives you control over your spending and an average savings of 5%. Plus, you can get a free $500 sign-up bonus.

Keep Track of Your Expenses

Every dollar you spend is tax-deductible; if you don’t track it, you are just giving away your money. You can also reduce unnecessary expenditures like travel, office supplies, meals, and many others. This helps you manage expenses and devise cost-effective solutions.

Fun fact: You can deduct half of self-employment tax from net income when calculating income tax. For instance, if your self-employment tax is $5000, $2500 would be deductible.

So, you see why tracking expenses is so important!

Keeping up with Tax payments

While a portion of the salary of regular employees is automatically deducted towards taxes, no taxes are deducted from the income of independent contractors. Thus, you have to set aside money for taxes every month.

You can use reminders on your accounting software (more on that in a while) to avoid any tax payment panics.

Independent Contractor Taxes You Need to Know

Speaking of taxes, there are key types of taxes you need to know as an independent contractor.

- Self-employment Tax

- Federal Income Tax

- State Income Tax

- Employment Tax

- Sales Tax

Best Bookkeeping Software for Independent Contractors

Thankfully, days of spreadsheets and shoebox receipts are over, and you can use cloud-based accounting software like QuickBooks, Xero, and ZohoBooks to automate most of the bookkeeping tasks.

Even if Math was not your favorite subject in school, these tools allow you to track expenses, manage cash flow, and generate financial reports.

But if we had to select one, we would go with QuickBooks. QuickBooks dominates the US market, and over 80% of small businesses use the tool. Besides the US, the accounting software company has over 7 million global users.

You would be happy to know that Tangent Consulting partnered with QuickBooks to offer 80% off the first six months of an annual subscription. This offer also includes a 30-day free trial. So, grab a deal now before it’s too late.

Best Bookkeeping Tips for Independent Contractors

To sum it up, if you are struggling with bookkeeping as an independent contractor, here are a few tips you can apply:

- Schedule weekly time for income tracking, reviewing cash flow, and updating expenses.

- Check your monthly financial reports to get a clear picture of your business.

- Set aside income each month for tax payments.

- Invest in good accounting software like QuickBooks.

- Consider outsourcing bookkeeping and let the pros handle it.

Final Thoughts

We know bookkeeping is boring, but it’s an important part of being an independent contractor. Using bookkeeping, you can get tax deductions, manage cash flow, and get an overall picture of your business.

DIY bookkeeping sounds cool until you realize you have missed some important details. Don’t be that business.

You can hire Tangent professional bookkeeping services that not only take the guesswork out but also keep you from having sleepless nights. Hey, we care about you 😊

FAQs

Can a company be an independent contractor?

As an independent contractor, you can set up a sole proprietorship, LLC (limited liability company), or PLC (private limited company).

Why is the self-employment tax so high?

Self-employment taxes ensure individuals make the same contribution and receive the same benefits as a full-time employee.

How do you report freelance income?

You can report freelance income in the US on Form 1040 Schedule C. On the other hand, you can report on the T1 General Form as a sole proprietor in Canada.