The Ultimate Guide to Bookkeeping for Realtors

The Ultimate Guide to Bookkeeping for Realtors

Our imaginary friend Ben once undertook the noble task of assembling a bookshelf. Ben proceeded with nothing but a vague instruction manual and the confidence of a man who once built a LEGO castle in 1996.

2 hours later, the bookshelf stood, leaning like Pisa Tower. Ben, naturally, was quite pleased.

Now, managing your real estate business without proper bookkeeping is remarkably similar. You might think you have got this, but when the tax season comes, you are all over the place and don’t get enough time for your business.

That, dear reader, is why we’ve assembled the ultimate guide to bookkeeping for realtors.

So, whether you are just starting or already deep in property deals, we will show you how to keep your books balanced. This is different from Ben’s messy bookshelf.

What is Bookkeeping for Realtors?

Bookkeeping for real estate agents involves tracking money—what’s coming in, what’s going out, and how much you owe in taxes. It covers everything from rental income and commissions to tax deductions specific to realtors.

At its core, bookkeeping means recording your income and expenses so you can see how each property is performing. This keeps you on top of tax payments and prepares you in case you ever face an audit.

Why Bookkeeping Matters for Realtors?

It doesn’t matter if you sell a few homes each year or big commercial deals. Good bookkeeping is essential. Without it, it’s nearly impossible to see how your business is doing or make smart decisions about your money.

If you’re running your show, it’s worth taking the time to understand the basics of your finances. Here’s why:

- You get a clear view of your personal and business finances

- You can track how your business is doing over time

- You’ll be better equipped to manage cash flow and catch any red flags

- Filing taxes becomes way less stressful

- You’ll stay on top of bills and avoid late fees

- You can take full advantage of real estate tax deductions

Should real estate agents do their own bookkeeping?

Running a real estate business comes with a lot of moving parts. You have to keep track of income from commissions, marketing expenses, ongoing fees, and others. Even if you’re a solo agent, tracking everything correctly can get overwhelming.

You can do your own bookkeeping with the help of software like QuickBooks. But here’s the thing: it’s easy to miss important deductions or make small mistakes. These errors could lead to an audit or cost you penalties.

If your real estate business is growing and you’re bringing in a steady income, it’s probably time to get some help. A professional bookkeeper can keep everything organized and make sure you’re not leaving money on the table.

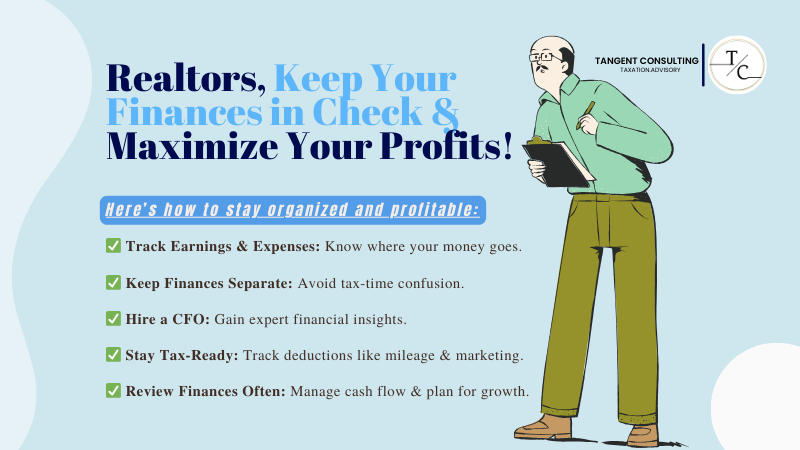

5 Best Practices for Real Estate Bookkeeping

Here are five habits that can make your bookkeeping easier and keep your finances in good shape:

1. Open a Business Bank Account

From day one, set up a separate account for your real estate business. Use it for all your income and business expenses—like paying off your business credit card.

Don’t use it for personal stuff. Instead, transfer money from your business account to your personal account when you pay yourself.

Speaking of business bank accounts, if you haven’t got one, Ramp provides corporate cards. Through them, you can pay bills, manage business expenses, send invoices, and so much more.

Plus, thanks to our partnership with them, you get a $500 sign-up bonus. So, make sure to check out the link here.

2. Do a Monthly Financial Check-In

Even if your accounting software handles a lot of the work, don’t go on autopilot. Set time aside each month to review your income and spending. If something looks off, you can catch it early—before it becomes a bigger headache.

3. Track Your Income and Expenses

Make sure you’re recording every dollar coming in and going out. You can use spreadsheets or software, depending on what works for you. Here are some common items to track:

- Commission income

- Membership fees for realtor associations

- Continuing education costs

- Office supplies and software

- Website and marketing expenses

- Social media ads

- Flyers, business cards, and other promotional materials

- Travel for business

4. Learn the Key Reports

Even if someone else handles your books, you should know what these reports mean:

- Balance Sheet: A snapshot of what you own, what you owe, and your business’s net worth.

- Income Statement (P&L): Shows your earnings and expenses over time so you know if you’re making a profit.

- Cash Flow Statement: Tells you how much cash is moving in and out of your business.

5. Itemize Everything

When tax season comes, itemized records will save you hours of digging. The more organized you are, the easier it is to file your return and grab all your deductions.

The IRS uses Schedule E for real estate income and expenses. Make sure you know the categories that apply to you.

Bookkeeping Options for Real Estate Agents

You’ve got a few ways to tackle your bookkeeping:

Hire a Bookkeeper

This is the most hands-on (and most expensive) option. A pro will know the ins and outs of real estate accounting and can tailor everything to your business.

Use Accounting Software

This works well for maintaining control while having structure. Many tools also make it easier to share your books with a tax pro.

Outsource Your Bookkeeping

Want to offload some of the work but avoid high costs? Services like the one we offer at Tangent give you professional support at a more affordable rate.

Final Thoughts

Letting bookkeeping slide is easy when you’re busy showing homes or closing deals. But trust us, waiting until tax season to sort through receipts is not the way to go.

As a realtor, your finances are more complicated than the average solo business owner. The sooner you get help with your bookkeeping, the easier it will be to stay organized. This will help you make smart money choices and claim all the tax breaks you deserve.

If you are looking for a bookkeeper, you have come to the right place. Tangent Consulting is your go-to source for outsourcing your accounting department. We can help you prevent cash flow leaks by understanding your business. So, you don’t sleep worrying about your business accounting.

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

What is the best accounting software for realtors?

QuickBooks Online is a top pick for most realtors, but others like Xero, FreshBooks, and Wave are also worth considering.

What are the three types of bookkeeping?

The three main types are single-entry, double-entry, and virtual bookkeeping. Each of them has different levels of detail and complexity.

Should I use QuickBooks as a real estate agent?

Yes, QuickBooks is a great option. It helps you track income, expenses, and deductions all in one place.