Burn Rate Explained in 100 Words

Burn Rate Explained in 100 Words

Burn rate is the speed at which a company, especially an early-stage startup, burns through its cash reserves while trying to reach profitability. Think of it as a countdown timer; the faster your company spends money without generating enough revenue, the sooner the timer runs out.

Investors and founders track burn rate to gauge financial sustainability, typically measuring it in terms of monthly cash outflows. If a startup has a burn rate of $1 million, it’s spending $1 million monthly to keep the lights on.

This number isn’t just an abstract metric—it directly determines the runway or how much time a business has before raising more funding or starting a profit. A high burn rate with no clear revenue stream? That’s a warning sign. A manageable burn rate with a solid growth plan? That’s strategic scaling.

FAQs

How do you calculate the burn rate?

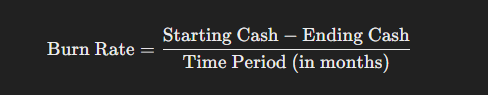

Burn rate is calculated by determining how much cash a company spends over a specific period, typically per month.

What is the rate of burn?

The rate of burn is another way of referring to burn rate. It’s the cash a company spends each month to cover its expenses. The higher the burn rate, the faster the company consumes its cash reserves.

What is the difference between burn rate and run rate?

- Burn Rate measures how fast a company uses its cash reserves, usually in a negative cash flow scenario (e.g., startups before profitability).

- Run Rate is a projection of a company’s future revenue or expenses based on current figures. It helps forecast performance, assuming no major changes occur.

Is the burn rate positive or negative?

Burn rate is typically a negative cash flow measure, representing cash going out rather than coming in. However, it isn’t always bad. Startups expect a negative burn rate while scaling, but it must be controlled to avoid running out of cash too soon.

What is the difference between burn and loss?

- Burn Rate focuses on cash flow—how much a company spends monthly.

- Loss refers to net income, which factors in revenues, expenses, and accounting adjustments (such as depreciation).

What is a good burn rate?

A “good” burn rate depends on the business model and funding strategy. However, a general rule of thumb is:

- A startup should aim for at least 12-18 months of runway before running out of cash.

- Investors often expect burn rates that allow for steady growth without excessive risk.

- If the burn rate is too high relative to funding, the company risks running out of money before hitting key milestones.

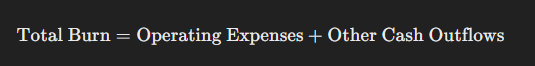

What is the total burn formula?

Total burn refers to gross cash outflows (total expenses).

If a startup spends $150,000 on salaries, $50,000 on rent, and $30,000 on marketing per month, the total burn is $150,000 + 50,000 + 30,000 = 230,000.