CPA Vs Bookkeeper: What’s Suitable for Your Business?

CPA Vs Bookkeeper: What’s Suitable for Your Business?

Last Friday, we had to go through an ordeal: choosing a movie. One person wanted a thriller, another voted for a rom-com, and one guy pushed for a documentary (oh gosh).

The debate went on, and we couldn’t reach a decision.

The topic of CPA Vs Bookkeeper for business is kind of like that. Both options have their strengths and seem important, yet you’re stuck wondering which suits your business.

We may not be good at deciding the movie, but CPA Vs Bookkeeper debate comes inside our circle of competence.

So, let’s break down which of these two services is suitable for your business and when you should bring each in.

What Can a Bookkeeper Do for My Business?

A bookkeeper helps you stay on top of your finances by tracking what comes in and goes out (credits and debits). As the name suggests, they keep your books in order.

Thanks to bookkeepers, business owners can make sense of the numbers. They help you build a budget, spot patterns, and plan.

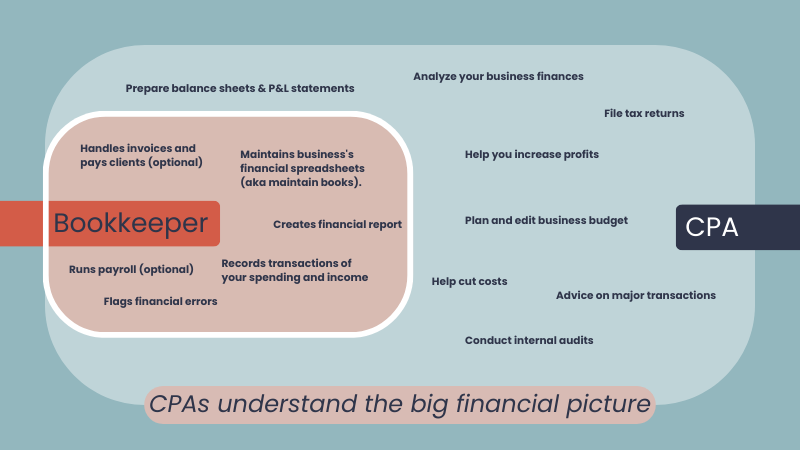

Here’s a quick breakdown of what bookkeepers typically handle:

- Entering and organizing transaction details for both incoming and outgoing payments.

- Keeping your records updated using bookkeeping software, spreadsheets, or databases.

- Creating financial reports like income statements and balance sheets.

- Double-check financial records to make sure everything adds up.

- Spotting and flagging any errors or mismatches in the numbers.

- Handling invoices, whether it’s paying bills or billing clients.

- Running payroll for your team.

Not every business needs the full list of services. What your bookkeeper does depends on how your business runs; every business is different. So, your bookkeeping setup should reflect that.

What Does a CPA Do for a Business?

82% of businesses fail due to poor cash flow management, and that’s exactly what a CPA can help you avoid. Think of a CPA as your go-to financial expert. Someone who can either fix a specific problem in your business or help it grow stronger overall.

CPAs (Certified Public Accountants) often focus on different areas of accounting, depending on their expertise. They don’t just crunch numbers in the background; they work closely with you, understand your business, and build the trust key to long-term success.

Here’s what a CPA typically does:

- They dig into your financial records to get a clear picture of where your business stands and find ways to improve it.

- They help cut costs, increase profits, and guide you toward smarter financial decisions using the right tools.

- They handle bank reconciliations and make sure your checkbooks balance out.

- They prepare important reports like balance sheets and profit and loss statements.

- They make sure every business transaction is properly logged in the books so nothing slips through the cracks.

- They conduct audits to ensure your financial statements are accurate, timely, and compliant with laws and regulations.

- They advise on major transactions, such as new leases, major purchases, and contract reviews.

- They review employee expense reports to make sure no personal spending gets mixed into business costs.

- They assess your internal accounting processes and recommend improvements when needed, like better ways to track costs.

- They file tax returns (including corporate and payroll taxes) and handle sales tax reports for different states.

- They help you plan your budget based on where the business is headed and adjust it as things change.

- Most importantly, they work with you to set financial goals and create a plan to achieve them. CPAs understand the big financial picture and use that knowledge to guide their clients.

Don’t Let Your Books Hold You Back 🚀

Most business owners know they *should* get a handle on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

CPA Vs Bookkeeper: Who Should You Hire?

Both CPAs and bookkeepers bring value to the table, but in different ways.

A CPA is your best bet if you need financial advice, help with investor reporting, or someone to review a complex transaction for tax or compliance purposes. They’re especially helpful when applying for a loan or preparing for an audit.

On the flip side, bookkeepers are more budget-friendly and can handle most of your day-to-day financial tasks. They’ll take care of transaction tracking, bank reconciliations, and monthly reports—freeing you up to focus on building your business instead of stressing over spreadsheets.

CPAs typically charge 2x to 3x more than bookkeepers but bring in more strategic value as your financial needs grow.

At the end of the day, it depends on what stage your startup is at and what you can afford. Early on, you’re better off putting your money into product development and proving your value to investors.

Hiring a full-time accountant at this point might be overkill. But as your startup grows and you start thinking about raising more funds, bringing in a CPA becomes a smart move.

Most startups start with a bookkeeper and level up as they grow. Over time, your financial needs will become more complex, and having a CPA or even a full finance team can make a big difference.

Final Thoughts

There is no single answer when it comes to managing your business finances. The CPA vs. Bookkeeper decision really depends on where your business is in its journey.

If you’re just starting and need help staying organized, a bookkeeper can keep your day-to-day finances in check without breaking the bank. However, as your business grows and your financial decisions get more complex, a CPA can offer the deeper insight, strategy, and compliance support you’ll need to scale.

Speaking of CPA and bookkeeping, fortunately, you don’t need to open another tab to look for these services. Tangent Consulting offers CPA and bookkeeping services, so you can select one.

We help you structure your business correctly and grow with confidence. Whether you need help setting up your books, managing cash flow, or want to stop stressing about tax time, we’ve got you.

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

What is the difference between accounting and bookkeeping in business?

Bookkeeping tracks daily financial transactions, while accounting interprets data for big-picture planning, taxes, and decision-making.

Do small businesses need bookkeeping?

Yes, bookkeeping helps you stay organized, track cash flow, and prepare for tax season without stress.

How much does a CPA cost for a small business?

CPA services typically cost between $150 and $400+ per hour, depending on the complexity of your needs and location.