15 Creative Tax Deductions for Small Business Owners You Probably Missed

Last week, we were cleaning kitchen cabinets and found an unpacked box of chocolates. Can you believe that? A chocolate box hiding from our wrath.

Perhaps we didn’t remember where it was hiding, else it wouldn’t have been missing.

Speaking of missing things, did you know there are a few creative tax deductions for small business owners you probably missed this year?

If you think you haven’t, kudos to you! If you think you have, go down to our list and check what you have missed.

We don’t want you to miss any write-offs when the next tax season arrives. So, here are the 15 creative tax deductions you don’t want to miss.

What Is a Small Business Tax Deduction?

A small business tax deduction, aka a tax write-off, is a way to lower your taxable income by subtracting eligible business expenses from your total earnings.

In simple terms, the less profit you show after deductions, the less tax you pay.

In the U.S. and Canada, the concept is built around the idea of ordinary and necessary expenses. That means if you spent money on something common in your line of work and needed to run your business, you might be able to deduct it.

The puzzling thing is neither the IRS nor the CRA gives a clear-cut list of every single deductible expense. Instead, they use the broad definition—ordinary and necessary —which can be confusing for many small business owners.

While both tax agencies have guidelines and examples in their publications, there are still plenty of gray areas. That’s why many small businesses miss out on tax savings, as they’re unaware of what they can legally write off.

Let’s say you own a construction company. You buy a new laptop for work, subscribe to construction software, pay for a co-working space, and grab a coffee while meeting clients.

All of these could qualify as deductible expenses if they’re tied to running your business. But if you don’t know about these deductions, you can leave money on the table.

Don’t Let Business Numbers Hold You Back 🚀

Most business owners know they should get a grip on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

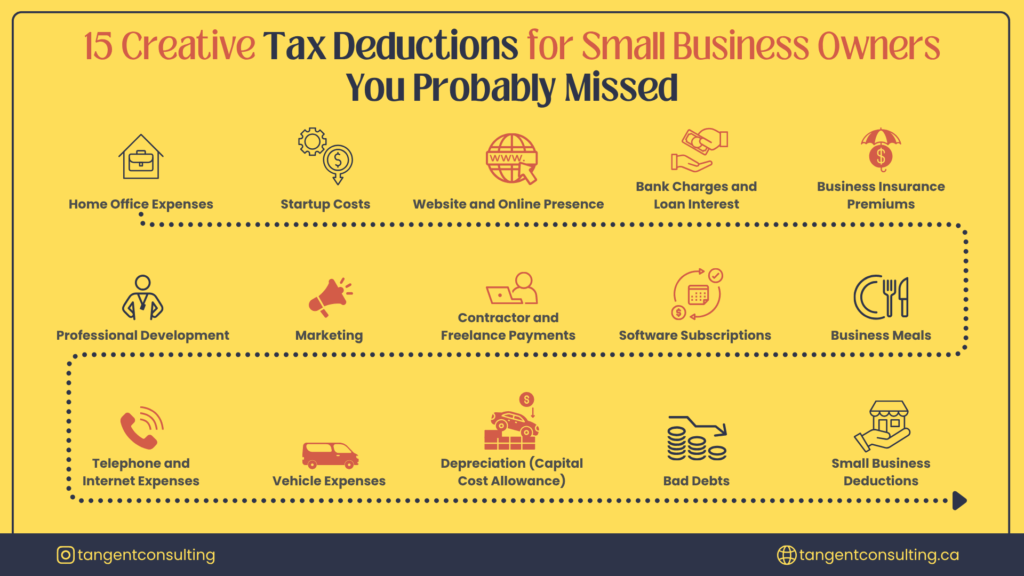

15 Creative Tax Deductions for Small Business Owners

In the above section, we talked about not knowing about tax deductions. However, we don’t want to spook you. So, let’s come to the main part of this guide.

Here are 15 creative tax deductions for small business owners:

1. Home Office Utilities

If you are running your business from home, you might be sitting on a hidden tax break. If you have a space in your house that you use only for business, such as a dedicated home office, you can claim a portion of your utilities as a tax deduction.

In the U.S. and Canada, the tax authorities let you deduct part of your home expenses based on how much space your office takes up. In the U.S., the IRS offers a simplified option—$5 per square foot, up to 300 square feet (so, a maximum of $1,500).

In Canada, the CRA allows you to deduct a percentage of your home expenses (like electricity, heat, and internet) based on the square footage of your workspace compared to your entire home.

We’re feeling a bit cheerful this morning, so let’s share some good news with you. If you rent your place, you can still claim these deductions.

The key is to keep good records and make sure that the room isn’t being used as a guest bedroom one day and a business hub the next. The space must be clearly and consistently used for business purposes.

2. Advertising

Most marketing and advertising costs can be written off as long as they’re tied to promoting your business and are considered reasonable. This includes running social media ads, printing flyers, creating a website, or even distributing branded merchandise such as pens or mugs.

The key is that the expense must be ordinary and necessary for your business. While big, flashy promotions like celebrity endorsements or skywriting might raise eyebrows at tax time, everyday marketing tools usually qualify without issue.

3. Software

Software is a core part of running a modern business if you’re managing projects, doing your accounting, editing content, or staying organized. Tools like QuickBooks, Adobe Creative Suite, and Microsoft 365 are often essential, not optional.

If you’re using software for your business, you can deduct the cost. In the U.S., this may fall under Section 179 for certain business equipment, while in Canada, it’s part of your business expenses.

Note that if you use it for both work and personal tasks, you’ll need to calculate the percentage used for business purposes and deduct only that portion.

4. Business Phone

If you have a phone that’s used strictly for business calls, emails, and apps, you can usually deduct the full cost. But let’s be realistic: most people use the same phone for both personal and work purposes. That’s where things get a bit more nuanced.

In that case, you can still claim a portion of your phone bill. The IRS and CRA allow you to deduct the business-use percentage.

So, if about 30% of your phone usage is work-related, you can claim 30% of your monthly bill as a business expense.

Still With Us?

If you’ve scrolled this far, chances are you’re serious about getting your business on track.

Book a free 15-minute strategy call — tailored to your industry — and let’s figure out what’s holding you back.

Book My Strategy Call ×5. Internet

If your business depends on the internet, such as running an online store, handling client bookings, or managing cloud-based systems, you can claim your internet costs as a utility expense.

Even if the internet isn’t critical to running your business, it still supports your operations, such as checking industry updates, sending client emails, or using apps like Slack; it may still qualify as an office expense.

Just like with your phone, if you’re using it for both business and personal reasons, only the business-use portion is deductible.

6. Insurance

Running a business comes with risks, and that’s where insurance comes in. Luckily, most business-related insurance premiums are tax-deductible. This includes general liability, property insurance, professional liability (such as errors and omissions), and cyber liability if you handle sensitive data.

If you offer health insurance to employees, those costs are also deductible. For sole proprietors, there’s an added perk. You may be able to deduct your health insurance premiums on your tax return as long as you’re not eligible for coverage through another plan.

Some business owners also choose to hire their spouses and provide health insurance as part of their compensation. It can be a smart, legal way to manage expenses while staying compliant with tax rules in both countries.

💸 Take the Write-Off Finder Quiz

Are you leaving money on the table? In just 2 minutes, uncover hidden tax deductions you might be missing based on your business setup.

- 🧾 Personalized deduction suggestions

- 📩 Results sent straight to your inbox

- ⏱ Only takes 2 minutes

Perfect for self-employed pros, solopreneurs, and small business owners who love keeping more of what they earn.

7. Loans

If you’ve borrowed money to fund your business, you might be able to deduct the interest paid on that loan. This applies to loans from banks and other recognized lenders, not your cousin or a handshake deal with a friend.

To qualify, the loan must be for business purposes, both parties must agree that it’s a real debt, and you must be legally responsible for repaying it. In the U.S. and Canada, only the interest, not the principal of the loan, is deductible.

And it doesn’t stop at traditional loans. If you’re using a business credit card, the interest on purchases made for business use can also be claimed as a deduction. Be sure to keep those expenses separate from personal charges to stay on the safe side.

If you haven’t set up a business account yet, Ramp offers corporate cards that come with built-in expense management, bill pay, and invoice tracking features. It’s a great way to keep your bookkeeping system organized and cloud-based from the start. Plus, there’s a bonus waiting for you if you sign up using our link.

8. Business Meals

Some meal costs can be tax-deductible. In the U.S. and Canada, meals provided for the benefit of your employees, like dinner during a late night at the office or food at company events, can usually be written off at 100%.

Other business meals, like taking a client out for lunch, are partially deductible at around 50% if the meal is directly related to your business and not just an event.

Keep detailed records of who you met, where you went, and what was discussed. Writing a quick note on the back of the receipt works well and keeps you organized if you ever get audited.

9. Business Vehicle

If you use your car for business purposes, you may be able to write off some of the related expenses. When the vehicle is used only for business, you can deduct the full cost of operating it. If it’s used for both work and personal trips, you’ll need to track mileage and claim only the business portion.

There are two ways to calculate your deduction:

Standard mileage rate: In the U.S., the rate for 2024 is $0.67 per mile. Canada also allows a per-kilometer rate, which varies by province.

Actual expense method: This involves tracking all vehicle-related costs—such as fuel, maintenance, insurance, and lease payments—and then multiplying that total by the percentage of business use.

A key point to note is that once you opt for the actual expense method for a specific vehicle, you typically can’t switch back to the standard mileage rate later.

10. Business Travel

If you or your employees travel for business, those travel-related expenses may be tax-deductible. To qualify, the travel must take you away from your regular place of business for longer than a standard workday, and the trip should be necessary.

Covered expenses may include flights, hotel stays, transportation, and meals while travelling. Temporary work assignments (up to one year) can also fall under this rule.

11. Education

Education that helps you stay sharp in your field can be a smart tax write-off. If the class, course, book, or training directly improves your current skills or adds value to your business, it usually qualifies.

- Some deductible education costs may include:

- Courses that build on your existing knowledge

- Industry-specific books, webinars, or online training

- Trade publication subscriptions

- Workshops or professional development events

- Travel expenses to attend seminars or courses

12. Home Office Equipment and Supplies

If you’ve purchased items for your home office, such as a desk, chair, computer, printer, or storage unit, you may be able to write them off as business expenses. These must be used for work purposes only, not for personal use, and should be considered essential for your day-to-day operations.

13. Gym Memberships

Generally, gym memberships aren’t considered a business expense. However, there are a few exceptions.

In the U.S., if a doctor prescribes physical activity as part of a treatment plan for a diagnosed medical condition, and you join a new gym (not one you were already a member of), you may be able to deduct the membership as a medical expense. This applies when it’s part of an official plan recommended by your physician.

For business owners with incorporated businesses, gym reimbursements might also be possible under a corporate wellness or accountable plan, provided it’s set up properly and applies to employees equally.

In Canada, the rules are even tighter, and gym memberships are rarely deductible. However, if they’re part of an employee benefit program or included in a broader wellness initiative for your team, there may be some room, depending on how the plan is structured.

14. Pets

You can’t claim your pet as a dependent, but in rare cases, your furry coworker might qualify as a legitimate business expense.

If your animal plays a role in your business, such as guarding a warehouse, greeting clients at your storefront, or even appearing in your marketing materials, you can deduct work-related costs, including food, training, and grooming.

That said, these claims are pretty unusual and may raise flags with the IRS or CRA. To stay on the safe side, make sure the pet’s role is tied to your business, and keep detailed records of any related expenses.

15. Free Beer

Believe it or not, beer can be a tax-deductible expense, but only in the right context. If you’re giving a bottle of wine, craft beer, or a similar gift to a client or business contact, it may qualify as a gift expense.

In the U.S. and Canada, small gifts to clients are tax-deductible as business expenses, typically up to $25 per person per year.

Final Thoughts

As you can see, there are plenty of creative tax deductions for small business owners to lower their tax bill. Staying informed and keeping detailed records can make all the difference, especially if the CRA or IRS ever decides to take a closer look.

Speaking of a closer look, if you’re looking for a professional to review your taxes, we can help.

For over a decade, we’ve been helping businesses like yours ditch the overwhelmed and take control of their finances. Our tax services can help you identify overlooked deductions, organize your year-end filings, and make tax prep straightforward and stress-free.

Let’s get your business taxes working for you!

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

What items are 100% deductible?

Business expenses like employee meals, office supplies, software subscriptions, and business insurance are often 100% deductible.

What deduction can I claim without receipts?

You may claim mileage, home office use, or meal per diems if you have a record.

What is the most overlooked tax break?

Home office expenses are often missed, especially by solopreneurs who work from home.