10 Hidden Dentist Tax Deductions You Should Not Miss This Year

10 Hidden Dentist Tax Deductions You Should Not Miss This Year

Have you seen the TV show Extreme Makeover?

Don’t worry if you haven’t, as we didn’t either.

The main point is that dentist and entrepreneur Dr Bill Dorfman appeared on that show and gained popularity for his dental health advocacy. He quickly became “America’s Dentist”, and many Hollywood celebs (no names, please) became his clients.

However, despite his celebrity status, Dr. Dorfman knows that running a dental clinic isn’t cheap or tax-free. But what if we tell you there are some hidden dentist tax deductions you can benefit from?

Let’s see what hidden tax deductions there are so you can reduce tax liabilities like Dr. Dorfman.

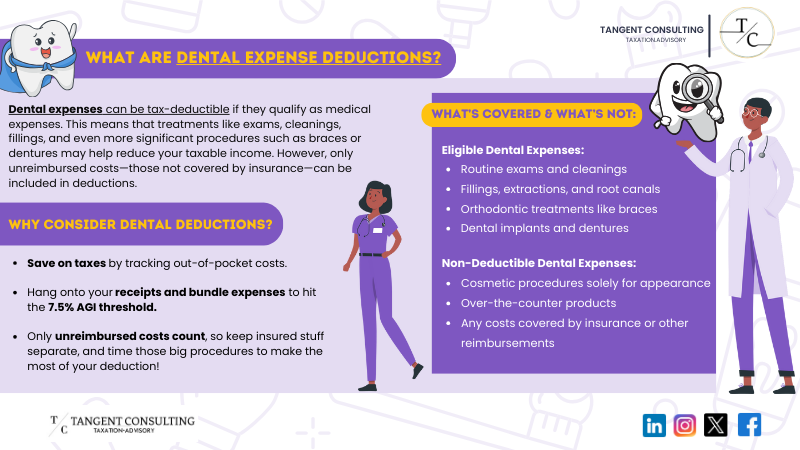

Are Dental Expenses Tax Deductible?

IRS’s Topic No. 502 discusses medical and dental expenses in detail. The good news is that many costs associated with dental clinics can be tax-deductible in the US and Canada.

In the US, the IRS allows dentists to deduct various expenses. These can include medical supplies, equipment maintenance, or office rent. We’ll discuss them in detail later.

The important thing to add is that in the US if you provide dental benefits to your employees, the costs associated with insurance premiums can also be deducted. This includes contributions to health savings accounts on behalf of your employees.

Let’s go North. In Canada, dentists can benefit from several tax deductions. The CRA allows deductions of business-related expenses like dental services. Similar to the US, costs associated with insurance premium tax are deductible.

You can also have deductions on medical expenses. This implies that you provide dental and medical insurance to your employees.

Some of you may be thinking, “Tangent, what can I do with these tax deductions”?

Putting on our nerdy glasses, and knowing how to maximize tax deductions can keep your gross income lower, allow you to reinvest in your business, and build a positive cash flow.

Did you know that in 2017, the US and Canadian governments introduced new tax laws for doctors? Although criticized in Canada, the US law proved suitable.

10 Hidden Dentist Tax Deductions

You probably have heard the saying, “A penny saved is a penny earned.” The IRS and CRA allow you to save thousands of dollars in tax deductions. Let’s see what hidden tax deductions are there:

1. Dental Equipment and Supplies

Let’s be honest: Dental equipment and supplies are super expensive, and starting a small dental practice can cost around $500k. If you are just starting out, overall costs can quickly drain your budget.

Thankfully, equipment and dental supplies are deductible in the US and Canada. These deductions can limit some of the costs and help you run a successful dental clinic.

It’s important to note that although these expenses can be considered business expenses, in the US, they must be used by the business 50% of the time to qualify.

2. Membership Dues

Memberships aren’t just for fancy things; they are deductible, too. Gaining or renewing memberships from the American Dental Association or the Canadian Dental Association comes with a hefty annual fee. But you can write them off as a business expense.

3. Marketing Costs

In 2022, Amazon spent over $22 billion on advertising, and as a dentist, you need to spread the word, too. Whether you advertise on social media, mail flyers, or use billboards, all these methods are tax deductible.

One thing to keep in mind is that the IRS and CRA require a receipt or a paid invoice for every marketing expense. The more information you have, the better.

4. Business Meals

There are in-office expenses, and then there are outside expenses. If you qualify for their requirements, the IRS allows 50% deductions on business meals.

The requirement includes:

- As a business owner, you should be present at every meal.

- The meal must be with the patient or an employee.

- Social meals aren’t tax deductible.

You can follow the chart below for more.

5. Office Space and Utilities

It’s not a big secret that office expenses are the biggest expense for any dental clinic. However, rent and utilities can be deducted. You can even deduct in the US if you have set up a home dental practice.

6. Tools and Software

As a dentist, you would want tools to help you grow. For instance, you need billing software to organize receipts and invoices. However, these tools don’t come cheap and cost you hundreds of dollars monthly. But tech expenses are tax deductible.

Speaking of tools, you would be happy to know that Tangent Consulting partnered with QuickBooks to offer 80% off the first six months of an annual subscription. This offer also includes a 30-day free trial. So, grab a deal now before it’s too late.

7. Loans

As we mentioned earlier, starting dental practice in the US costs around half a million dollars. So, you need financing. Fortunately, interest on these loans is tax deductible. For instance, if you have a $100k loan with 5% interest, you can write off $5000.

8. PPEs

Dental uniforms, PPEs, gloves, and others can be written off as necessary business expenses. You can also deduct the costs of specialized clothing if your employees use them or buy them themselves.

9. Unpaid Bills

No one likes unpaid bills, but the IRS and CRA allow tax deductions. If the patient has unpaid bills, you can write it off as a bad debt. This deduction can be helpful for outstanding balances on expensive payments.

If you want to curb dental expenses, Ramp’s corporate card gives you control over your spending and an average savings of 5%. Plus, you can get a free $500 sign-up bonus.

10. Education

Learning is an important part of any business. But the cool thing is that as a dental clinic owner, you can deduct education costs, such as training courses and even attending educational seminars.

Final Thoughts

This year’s tax season doesn’t have to be a nightmare. Those mentioned above hidden and often overlooked deductions can save you money. You can reinvest the savings into your practice, hire new employees, and provide better dental treatment for your patients.

Just as you’d recommend a good flossing regimen to a patient, isn’t it better to leave tax planning to the pros?

We provide a comprehensive approach to tax planning for dentists and apply smart tax strategies that can keep you smiling.

FAQs

Can I claim dental implants on my taxes?

According to the IRS, “false teeth” payments are deductible if they exceed 7.5% of your AGI.

How much tax do dentists pay in Canada?

The average Canadian dentist can pay 43% to 50% in taxes.

Can you use HSA for dental?

HSA (Health Savings Account) is one of the best ways to cover dental expenses in the US.