Your Family Management Company Needs a CFO (Before It’s Too Late)

Your Family Management Company Needs a CFO (Before It’s Too Late)

In 1962, a discount store opened in Rogers, Arkansas. The owner believed in offering lower prices and great customer service. 62 years later, the store has revolutionized the way Americans shop. The store is called Walmart and was opened by Sam Walton.

The Waltons are famous for their business success and for managing their wealth through a family management company.

Most of us aren’t making billions like Walmart; the reason for giving an example is if you are running or planning to run a family management business, you need a CFO.

There are compelling reasons to have a financial expert on board before your finances become a mess.

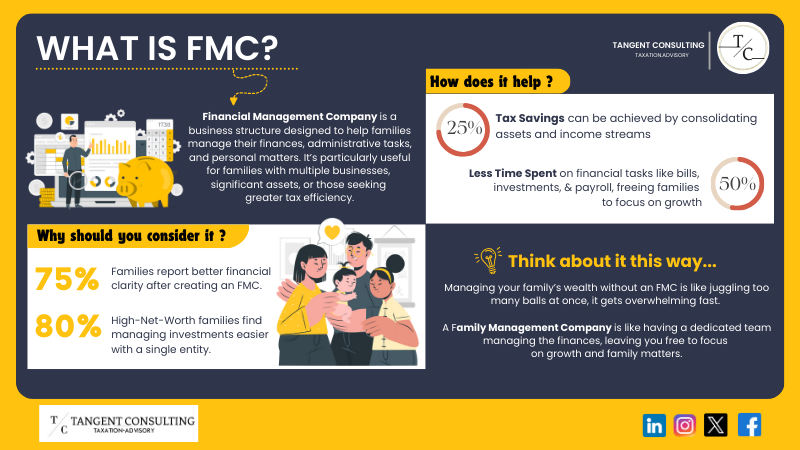

What Is a Family Management Company?

Let’s start with the basics. A family management company is formed to manage the family’s financial, administrative, and personal needs. This can include managing bills, handling investments, and paying kids.

For families that own many businesses or assets or don’t have time, forming a family company is tax-efficient and more beneficial than owning a single-member company. For example, Pritzkers, a well-known Chicago family and owner of Hyatt Hotels, created a family management company to manage their real estate investments.

Did you know family businesses contribute up to 57% of the US’s GDP and employ 63% of the workforce?

One thing to keep in mind is even a small business can form a family management company. It’s not a term only for billionaires. For instance, a small floral shop owner can set up a family business to take advantage of taxes. And this is exactly when you need a CFO, as they can simplify the hassles of taxation for you.

How to Set Up a Family Management Company in the US and Canada?

The average age of a family business is 24 years. But to reach that age, you need to start somewhere. So, if you are looking to set up a family business, here’s how you can do that in the US and Canada:

Choose Business Structure

In the US, you have sole proprietorship, LLC, or S-Corp formation structures. The type of entity you choose depends on the assets and services your family business will provide. On the other hand, in Canada, you can set up a Sole Proprietorship or a Corporation.

The Walton family uses a series of LLCs to manage its business ventures and assets and oversee its charitable foundations.

Tax Registration

In both the US and Canada, you need to register your family management company for tax purposes. Tax registration ensures you can pay for your kids, get tax-free income allowances, and file family taxes under the company.

The biggest advantage is the tax benefit on hiring your kids under 18. You can avoid FICA taxes in the US on your income and can benefit from the standard deductions. This saves you from payroll and income taxes. Similarly, in Canada, you can reduce the collective family’s taxable income by paying family members.

This seems cool, right?

What’s cooler is that a pro CFO service like Tangent Consulting can find these nuggets of information and tell you all the deductions you can take.

Stay Compliant

When you run any company, staying compliant with tax and employment laws is numero uno. The last thing you want as a small business owner is to be on the naughty list of IRS or CRA.

For instance, if you are unable to pay your taxes according to deadlines set by the CRA, CRA charges compound daily interest on unpaid balances. There are plenty of penalties you need to look out for.

Hire Professionals

At some point, you need to hire a professional to manage various aspects of your family management company. You want to bring in professionals who can manage accounting, taxes, and payrolls to simplify the process.

If you have a growing business, the pros like accountants, tax advisors, and eventually a CFO to manage the overall business operation.

Set Responsibilities

A family business can only grow if everyone is on board. There have to be clear roles for family members. For instance, kids can manage small tasks, and senior family members can manage investments.

When you set these roles, everyone knows what they have to do, and it keeps them organized.

5 Reasons Your Family Management Company Needs a CFO

In the previous section, we touched on how hiring a professional is a must-have for any family business. If you are saying, “Oh Tangent, I don’t need a CFO, I can manage everything on my own.”

We know you are a genie, but here are five reasons for those who don’t want to manage everything themselves.

Preparing Tax Strategies

If you go to IRS or CRA websites and read the tax laws, your head may start spinning. Without expert guidance, managing taxes can feel like walking in maize.

A CFO can help you prepare tax strategies that may not be visible to you so you can take full advantage of tax deductions and credits and avoid overpaying payroll taxes. They can help you file taxes, structure your payments, and cut down the costs.

The Koch family is one of the wealthiest families in the US. They are known for finding tax loopholes to minimize their income taxes, which is no wonder they have a net worth of $116 billion.

Managing Payroll

If you are thinking of paying your kids, firstly, it’s a smart move as it’s tax-free up to a certain limit in the US and Canada. Under the age of 18, kids don’t need to pay FICA taxes when employed by their parents.

However, it’s difficult to calculate FICA taxes according to different types of compensation. A CFO simplifies this process by calculating the FICA tax and ensuring you are following all the rules, even if you are paying them just to keep them busy. We know the drill 🙁

Managing Investments

Families often have various investments like stocks, real estate, or other businesses. Without expert guidance, these investments can be hard to manage. A family CFO oversees all your assets, making sure all the investments align with the long-term financial goals.

The Mars family, owners of Mars Inc., is a great example of managing assets through a family management company. They employ top financial experts, including CFOs, to manage their $117 billion empire.

Financial Reporting

If you don’t do financial reporting, you aren’t going to get a clear picture of your business. When we talk about financial reporting, we mean income statements, cash flow statements, and balance sheets. Knowing the key information from these statements can provide the family members with a clear idea of where the business is heading.

A CFO provides regular reports on income, expenses, and future projections so you can stay transparent and prepare for tax season.

Future Planning

Family-owned businesses are not just about today; they are about planning for the future. If you are thinking about passing the family business to the next generation or want to make sure all the business assets are protected, a CFO can play an important role.

CFOs can create a succession plan that minimizes taxes and ensures a smooth transition of wealth. For example, Walt Disney’s careful planning allowed the next generation to control the media empire.

Final Thoughts

Managing family businesses can seem simple, but as the business and assets grow, it becomes difficult to manage everything. A CFO brings structure, accountability, and long-term planning that protects wealth and avoids tax penalties.

A CFO ensures your family finances remain transparent so you can avoid uncomfortable dinner conversations. And what better way to remain transparent is by hiring an expert CFO services provider, Tangent Consulting?

You can have access to expert CFO services with strategic support that can optimize all your financial operations.

To find out, check out our CFO services page and learn how we can help you out.

FAQs

How much can you pay your kids tax-free?

Currently, you can pay up to $14,600 tax-free in the US.

At what age can I put my child on the payroll in Canada?

The child must be seven or older. Once they reach 18, they are no longer exempt, and you need to deduct taxes like usual employer.

Can I pay my wife a salary in Canada?

You can pay your spouse in Canada. However, you must follow the same rules that apply to paying your kids.