How Financial Statement Preparation Services Save You Money and Headache?

How Financial Statement Preparation Services Save You Money and Headache?

Let’s create a situation:

James is a small business owner in New York. He just landed a major contract, and the business seems booming. One day, his bank called, asking for financial statements to approve his loan.

James was so focused on running a business that he forgot to prepare financial reports.

What options does James have here? He can hire professional financial statement preparation services or do it himself. However, DIY can make matters worse, as he doesn’t know how to prepare a financial statement.

If you are a small business owner and find it stressful to prepare financial statements, stick around. In this, we’ll delve deeper into how financial statement prep services can save you time and headaches.

What are Financial Statements?

Financial statements reflect the financial performance of your business. These statements are audited by Government agencies such as IRS or CRA or accountants for tax, financing, and auditing.

These reports aren’t all about agencies or accountants. As we’ll see in the next few minutes, these reports can help you grow your business.

How do they work?

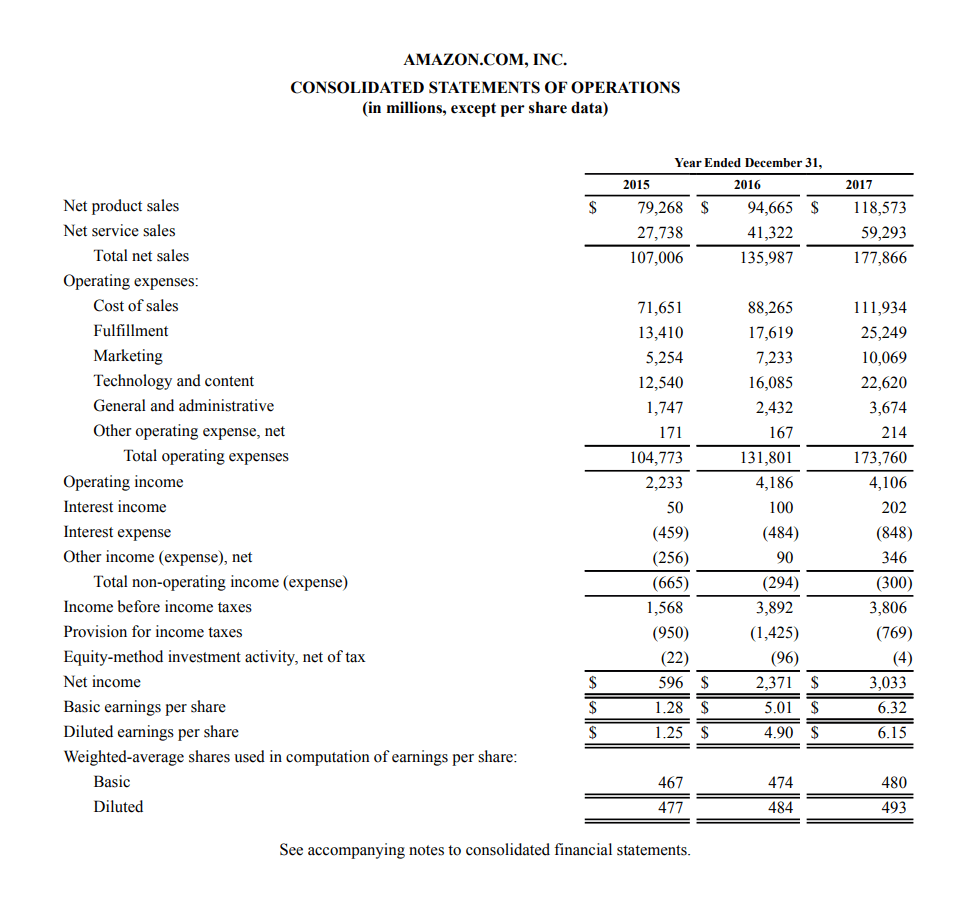

Financial statements show the overall health of the business. Internal and external parties analyze the data to understand where the business is going. For instance, here’s an income statement from Amazon Inc. You can see every expense and income mentioned here.

You would be thinking we are talking about financial statements. Where does the income statement come from?

An income statement is a type of financial statement. But there are many other types of financial statements, too. Let’s discuss them in detail.

4 Types of Financial Statements

We are going technical here, so bear with us for less than a minute. According to GAAP (Generally Accepted Accounting Principles), there are three types of financial statements: Income statement, balance sheet, and cash flow statement.

However, when you have a corporation or company listed on a stock exchange, there’s another type of financial statement called the statement of retained earnings.

With that out of the way, let’s discuss types of financial statements in detail.

1. Income Statement

We saw Amazon Inc.’s income statement mention income and expenses. So, the income statement is basically a profit and loss statement. It answers basic questions like, “Are we making money?” The statement summarizes revenue from all sources, operational expenses, and other costs.

For example, if you run a bakery, your income statement will highlight how much you earned from sales of donuts, cakes, and pastries and how much you spent on ingredients, rent, or wages if you have employees.

So, why is it important? When you analyze the income statement, you can identify seasonal dips, rises, or rising costs. Looking at these figures, you can adjust your business strategy.

Here’s an interesting fact: Businesses with updated income statements can avoid cash flow problems.

2. Balance Sheet

Simply put, the balance sheet provides a comprehensive look at a business’s assets, equity, and liabilities. Assets are what you own, and liabilities are what you owe. Equity is your invested business capital.

Say you run an auto-repair business. Your balance sheet will include the equipment you use (assets), business loans (liabilities), and the capital you invest (equity).

Balance sheets are super important when it comes to financing. It shows if your business is financially stable to meet its obligations.

In the Journal of Banking and Finance, the balance sheet strength and bank lending, businesses with strong balance sheets secured more funding from the banks during the 2007-2008 financial crises.

3. Cash Flow Statement

The cash flow statement illustrates how you earn and spend cash. Simply, it tracks where the money is coming from and where it is going. For example, a construction company income statement would show cash inflow from the latest projects and outflows from material, labor, and equipment.

Maintaining a healthy cash flow is super important for any business. Most small businesses fail because of poor cash flow. You can check out our guide for healthy cash flow tips.

4. Statement of Retained Earnings

As we mentioned earlier, the statement of retained earnings is a type of financial statement required when you are listed on the stock exchange or a corporation. It is also known as an equity statement, statement of shareholders’ equity, and statement of owner’s equity.

The statement shows how much profit is reinvested in the business or distributed to shareholders in dividends. For example, an AI startup may reinvest all its profits in research and development rather than pay dividends.

Pro Tip: Reinvesting can be a major difference between stagnation and growth. So, small businesses need to reinvest wisely.

Why Financial Statement Preparation Services Matter?

Quick question: Have you ever prepared financial statements?

If you have, you should know it’s not just about filling in numbers. It’s about making sure that every figure is accurate and compliant with the GAAP. This is where professional financial statement preparation services come in.

Let’s see how these services can help you:

Save You Money

First and foremost, when relying on a financial statement prep service provider, you can save tons of money. Now, we know what you would be thinking: “How can paying a service provider save me money?” You see, when your financial statements are prepared properly, you don’t get caught up in tax liabilities.

Often, businesses see a reduction in their tax liabilities when they outsource financial statement preparation. In addition, accurate financial statements help you make data-driven decisions that can reduce useless expenses.

Also, you may not know answers to questions like managing assets and liabilities. Or why the income statement is prepared first?

These questions can be answered with professionally prepared financial statements, saving money, and headaches.

And if you think it won’t save you money, you can hire a fractional CFO. We have a detailed guide, so you can check it out afterward.

Preventing mistakes

With a financial statement preparation services provider like Tangent Consulting, not only do you not need to do DIY, but you can also prevent costly mistakes.

For instance, if you are preparing compiled financial statements, the service provider can ensure everything is according to AR-C 70. They know GAAP and can ensure that every detail is mentioned accurately.

Transforming Financial Data into Strategy

When you prepare financial statements, you see data everywhere, like you are doing a Matrix Movie. Looking at revenue figures, expenses, cash flow statements, and others can be confusing. Raw data can only take you so far, even if you understand all of it.

When you hire financial statement preparation services, they transform your data into an actionable insight that drives business growth. They dig deeper into analyzing the numbers, identifying trends, opportunities, and potential risks.

For instance, your income statement can show consistent revenue growth, but you may not see rising operational costs. A pro with their hawk eyes can see such discrepancies, helping your business’s profitability.

In addition, service providers can advise according to various industries. For example, for a retail business, seasonal sales patterns can matter. On the other hand, insights into customer retention can be helpful for a SaaS company.

So, service providers ensure that the insights you receive from financial statements are not generic but targeted.

Preparation vs Compilation: Which one do you need?

If you have made up your mind about using financial statement preparation services, you have a choice between preparation and compilation.

Preparation involves creating financial statements from the data your management provides. On the other hand, in compilation, you’ll prepare the financial statements, and a CPA or a CFO will just look at them and make sure they are correct.

So, choose according to your business needs.

Final Thoughts

We all have heard time in money. By using financial statement preparation services, you save money and time. You also avoid the common mistakes that come with DIY financial statement preparation.

Talking about preparation, Tangent Consulting is here to make sure your finances are in order, and you aren’t caught up in paperwork. We don’t just provide financial statement preparation; we become your finance department, handling everything from tax preparation to other CFO services.

So, the next time you are buried in paperwork or spreadsheets, remember you don’t have to do this alone. With Tangent Consulting, your finances are in expert hands.

FAQs

Is financial statement preparation a non-attest service?

Financial statements, tax preparation, bookkeeping, or other accounting practices are part of non-attest services.

Which financial statement summarizes the financial position of a company?

A company’s balance sheet provides information on its financial position. It is broken down into assets, liabilities, and equity.

Who is in charge of preparing financial statements?

Usually, a CPA prepares financial statements. However, an accountant or a bookkeeper can also prepare financial statements.