How to Master Construction Job Costing Without the Noise?

Let’s create a scene.

It’s raining outside, and you decide to wash the car.

We asked, “What are you doing?”

You said, “I am washing the car, can’t you see?”

We asked, “We know, but why?”

You said, “Needed to do something productive”.

We know the scene made you look crazy, but we had to draw an analogy as this is how many contractors approach construction job costing.

They are working hard and tracking numbers, but they are doing things in the wrong way for the wrong reasons.

If you have ever felt you are managing finances but still don’t know about a project’s profitability, this guide is for you.

Let’s break down how to master construction job costing without the noise.

What is Job Costing in Construction?

Job costing is your project’s budget tracker. In construction, it means keeping track of every dollar you spend on a specific job, such as labor, materials, equipment, overhead, and others.

Instead of seeing a lump sum at the end, you get a detailed view of where your money goes throughout the project.

Now, a lot of construction businesses rely on their general ledger to keep track of spending. That works for looking at your finances, but it’s not great when you need to focus on one job.

That’s where job costing comes in. It lets you isolate costs tied to a single project. You can see how much you’ve spent, your expenses, and whether you stay on budget. If something starts to go over, you’ll catch it early and have a chance to fix it.

Don’t get us wrong, job costing is not a replacement for the general ledger. It just adds another layer of detail. The transactions still go into your books, but your project managers can track profit and loss on each job without digging through company-wide reports. In short, it makes managing construction projects a whole lot easier.

Don’t Let Business Numbers Hold You Back 🚀

Most business owners know they should get a grip on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

Job Costing vs. Process Costing

Contractors often confuse job costing with process costing. However, they are used in different situations.

Job costing is used when each project is different and needs its budget, such as construction jobs, custom furniture builds, or any one-off service.

With job costing, you’re tracking everything: how many hours your crew worked, how many nails you used, and even how much the overhead costs were for that job.

On the other hand, process costing is used in industries where everything is made the same way, over and over again. It’s common in manufacturing, like when a company makes thousands of single products.

In that case, you don’t need to track every unit individually; you just calculate the average cost of producing one unit based on the total materials, labor, and overhead and apply that across the board.

How to Break Down Construction Job Costing?

When starting job costing on a construction project, the first step is to create a detailed cost breakdown. This is usually done by the estimator, who breaks down the entire work into activities or categories that make up the project.

It’s important to note that every job is different, but the process of breaking down costs usually follows the same steps.

1. Start by Identifying Your Costs

The foundation of job costing is knowing what you’re spending money on. For construction projects, those costs usually fall into two categories:

- Direct costs—These are tied to the work being done, such as materials, labor, and equipment. If it’s physically used on the job site, it’s probably a direct cost.

- Indirect costs—These are expenses that are not related to one specific task but are necessary to keep the project moving. They include site security, power bills, permits, and admin support.

2. Allocate Costs

After identifying all your costs, the next step is to assign them to the right project. This part ensures every expense (direct, indirect, or overhead) ends up where it belongs. Each type of cost needs a slightly different approach.

Direct Costs

These are the easiest to deal with. Since direct costs are tied to a specific project, you can allocate them with no guesswork. Materials purchased for a job, hours worked by your crew on-site, or equipment rented for that project all go into that job’s cost sheet.

Indirect Costs

These are a bit trickier. They aren’t tied to a single task but still support the job. These get split between projects based on how much they were used. For example, if two projects share a delivery truck, you might divide the transport cost based on how many materials each received.

Overhead Costs

Now comes the tough part: the overhead. Your business’s day-to-day operating costs include office rent, insurance, leadership salaries, marketing, etc. They’re not tied to any one job, but they need to be calculated.

Companies usually apply a formula to handle overhead that spreads the cost across all active projects. One common way is to use a percentage based on labor hours, total direct costs, or machine use.

Let’s say Project A makes up 10% of your monthly direct labor costs. You’d assign 10% of your overhead costs to that project. That way, every job contributes its fair share to the business’s running expenses, giving you a much clearer view of how profitable the project is.

3. Monitor Job Cost Reports

Job costing isn’t something you do once and forget about. It’s a process you need to monitor from start to finish.

Things change fast on a construction site. Material prices go up, labor costs shift, or unexpected issues pop up. That’s why regular job cost reports matter. They give project managers a clear view of what’s happening financially as it happens.

By checking in often, you can catch problems early, adjust, and keep everything moving in the right direction.

How to Calculate Construction Job Costing?

Calculating job costing in construction is a simple process, but each category needs to be broken down carefully. Here’s how you can calculate:

Labor Cost

Labor is usually one of the biggest costs in any construction job, so it’s important to get it right. It includes what you pay your crew and what it costs you as an employer.

You need to start by figuring out how much you pay for on-site labor’s regular hours, overtime, and any bonuses. Then, employer payroll taxes and benefits like health insurance or retirement contributions should be added. That gives you the full picture of what labor is costing you.

Don’t forget about indirect labor. Project managers, account managers, or purchasing staff might not be swinging hammers, but their time still impacts the job.

Since these folks are often salaried, you must calculate their hourly or daily rate, factoring in extras like insurance and taxes. So, you can allocate a fair portion of their time to each job.

Still With Us?

If you’ve scrolled this far, chances are you’re serious about getting your business on track.

Book a free 15-minute strategy call — tailored to your industry — and let’s figure out what’s holding you back.

Book My Strategy Call ×Subcontractor Cost

If you’re bringing in subcontractors, make sure to include their fees in your job cost. Double-check that what they’re billing you doesn’t go over the amount you originally agreed to in the contract.

Materials Cost

Most construction jobs require materials like piping, wood, steel, or concrete. You’ll need to calculate your total spending and account for the quantities used, any leftover stock, and even materials you’ve ordered but haven’t received an invoice for yet. That means adding in committed costs from purchase orders, even if you haven’t paid them yet.

Equipment Cost

Every job requires tools and machinery. If you’re renting equipment, it’s easy, you just need to include the rental fee. But when you’re using your own equipment, you’ll need to assign a cost for their use on each job. This could be a daily or hourly rate that reflects maintenance and storage.

Overhead Cost

Most companies handle overhead costs by applying an overhead rate to each project. It is a percentage of labor or total direct costs. For example, if your monthly overhead is $50,000 and you have five active projects, you might assign 20% (or $10,000) of that overhead to each job.

Let’s break down all the costs into an example:

Say you’re working on a residential renovation project.

- Labor cost: $25,000 (including wages, taxes, and benefits)

- Subcontractor: $8,000

- Materials: $15,000 (plus $2,000 in outstanding POs)

- Equipment: $3,000 (including rental and allocated use of owned gear)

- Overhead: 15% of direct costs = 15% of $51,000 = $7,650

Total job cost = $60,650

This breakdown gives you a full, transparent view of the project’s cost. Thus, you can price your jobs smarter and protect your margins.

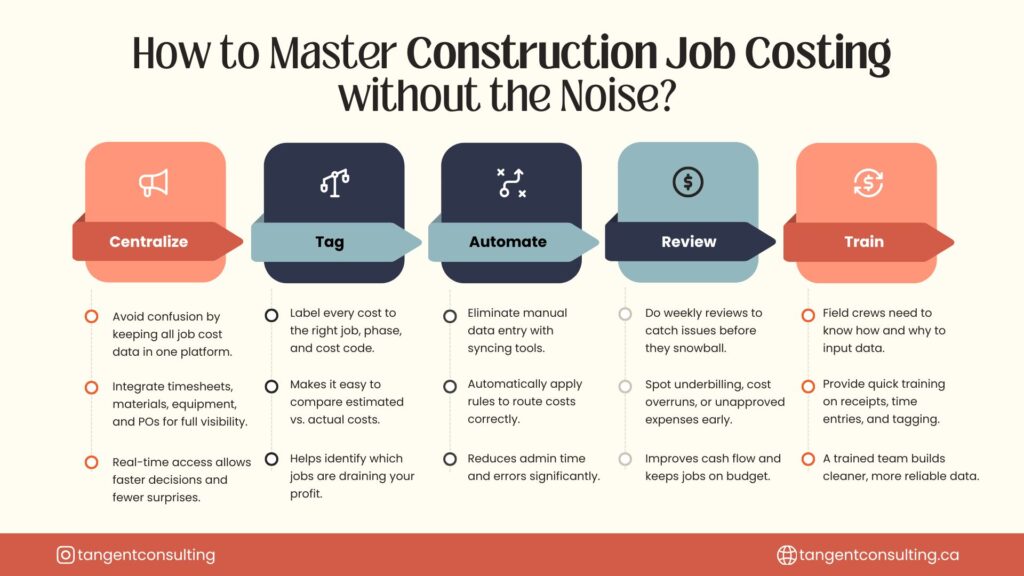

Best Practices for Construction Job Costing

According to a KPMG Global Construction Survey, only 31% of construction projects stayed within 10% of their budget. That’s a pretty illustrating stat, and it shows how tricky job costs can be, even when you think you’ve got everything under control.

So, how do you get closer to accurate, reliable numbers on your projects? Here are a few practices that can help:

Break Down Your Estimates and Use Cost Codes

You can start by breaking your estimates into clear, detailed parts. This doesn’t help you build better bids; it also shows you which parts of a job are under or over budget.

Cost codes can make your life easier here. They let you group related expenses together so you can see, for example, if framing is eating up more money than expected or if material costs are denting your budget.

Don’t Skip the Labor Burden

When estimating labor, make sure you’re including everything, not just wages. Your labor burden includes payroll taxes, insurance, benefits, and other costs tied to having employees on staff. If you leave these out, you’ll always underestimate your true labor cost.

Chart of Accounts for Construction Businesses

Construction businesses that don’t track labor, materials, and equipment leave money on the table. Don’t let that be you. Download a chart of accounts built just for you.

Get My Free Chart of AccountsTrack Costs While the Job’s Still Running

A big mistake contractors make is waiting until the job’s done to see if they made money. By then, it’s too late to correct the course. Instead, use job costing software. So, you can monitor your costs as the project progresses.

Stay on Top of Client Billings

If you’re working with reimbursable costs like materials or change orders, make sure you’re billing them. Sometimes, costs slip through the cracks because they’re not properly tracked or assigned. That means you’re eating those costs instead of passing them on.

Final Thoughts

Construction job costing is about getting an accurate picture of each project’s costs. It takes careful planning and ongoing tracking to get it right. However, when done properly, it can give you the insights you need to protect your profits and make smarter business decisions.

Sure, you can manage job costs on your own, but let’s be honest: It’s time-consuming and can quickly become overwhelming. That’s where we come in.

Our accounting solutions are built to help you stay on top of every dollar so you know how each job is performing, where you’re spending too much, and how to keep future projects on track. We become your full accounting department, so you don’t have to hire people individually.

Let’s get your accounting system working for you!

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind.

FAQs

1. What is the cost method of construction?

It’s a way to track and assign all project-related expenses, like labor, materials, and overhead, to calculate the cost of a job.

2. How to estimate construction cost?

To get an estimate, you can break the project into tasks and estimate the cost of materials, labor, equipment, and overhead for each part.

3. What are the 4 methods of costing?

The four main costing methods are job costing, process costing, activity-based costing, and standard costing.