How to Manage S Corp Bookkeeping Without Losing Your Mind (or Money)

We are in so many useless group chats, and we wanted to talk to you about them for a second.

We are talking about those where you have 40 unread messages, half of them cringe memes and someone asking what’s going on in the group.

It creates so much confusion, to tell you the truth.

Wait, this isn’t clickbait. The reason for telling you about these group chats is if you don’t do S Corp bookkeeping properly, it can create so much confusion. You’ll have no structure, unclear transactions, and tax nightmares.

So, we want you to take a deep breath and stay with us for the next 10-15 minutes as we explain how you can manage S Corp Bookkeeping to organize your business finances.

Why Is S Corp Bookkeeping Different?

Bookkeeping for S Corps isn’t your average small business bookkeeping. It’s different because of the tax structure. In an S Corp, profits and losses pass through to the owners instead of being taxed at the corporate level. That helps avoid double taxation but adds a few extra layers you won’t see with other business types.

Here’s what makes it stand out:

You’ve got more paperwork to stay compliant. Besides financials, you’ve got to keep proper corporate records like meeting minutes and bylaws.

You file different tax forms. S Corps don’t file a regular business tax return. Instead, you file Form 1120-S and issue each shareholder a Schedule K-1. That form shows how much income each shareholder made from the business, so they can report it on their personal taxes.

Shareholders have more responsibility. Because profits pass through to the individual level, shareholders are responsible for reporting their share of income. That means they must also stay on top of their books and not just rely on the company’s records.

Given all this, it’s smart for the business to offer guidance and keep detailed, up-to-date records. Bookkeeping becomes more than tracking income and expenses; it’s how you protect the business.

Let’s illustrate the points we mentioned with an example. Say you own a Batcave Construction Company that elected S Corp status.

You pay yourself a salary and take additional profits as distributions. Your bookkeeper has to make sure your salary is reasonable (as the IRS expects), track your payroll taxes, and issue the right forms when the tax season arrives.

If anything goes wrong, like underpaying yourself to dodge payroll taxes, it could put your S Corp status at risk. That’s why solid bookkeeping matters.

Don’t Let Business Numbers Hold You Back 🚀

Most business owners know they should get a grip on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

How to Do S Corp Bookkeeping the Right Way?

According to the IRS estimates, there are around 5 million S Corps in the U.S. But here’s the thing: many don’t set up their books properly from the start, leading to headaches during the tax season. If you want to avoid that fate, you need to do the S Corp bookkeeping the right way.

1. Choose the Right Accounting Method

When it comes to S-corp bookkeeping, choosing the right accounting method is the first step. It’s important as it affects how your taxes are calculated and how your business appears on paper.

You have three accounting methods at your disposal:

Cash Basis Accounting

If your S Corp is still in its early stages and your transactions are simple, like getting paid when the job’s done and paying bills as they come, then a cash basis is probably your best friend. It’s easier to manage, especially if you focus on steady cash flow.

Accrual Basis Accounting

If your S Corp is growing and you’re invoicing clients, buying on credit, or dealing with bigger and more complex transactions, you should use the accrual method. It tracks income when earned and expenses when incurred, not when cash moves in or out.

Accrual accounting is also better if you plan to apply for loans or bring in investors. Why? Because it makes your financials look more professional and accurate.

Hybrid Method

Some businesses use a mix. For example, you might track inventory using accruals but manage the rest of your finances on a cash basis. This gives you flexibility while still meeting IRS requirements.

S Corps can choose either method as long as their average annual gross receipts stay under $25 million. However, the IRS has some exceptions, so it’s smart to double-check with a tax advisor before making the call.

2. Revenue and Expense Management

As an S-corp owner, one of your core bookkeeping tasks is monitoring money’s flow. This starts with properly tracking revenue.

S Corps can earn revenue from different sources, like:

- Selling products or services

- Earning interest or investment income

- Selling off business assets

- Charging rental fees

You need to break these income streams into clear categories. That way, you can identify which part of your business brings in the most money and budget accordingly.

However, income is only half the story; you also need to track your expenses. S Corps deal with multiple costs to keep things running, including:

- Paying vendors

- Processing payroll

- Covering taxes

- Paying interest on business loans

If you’re using accounting software like QuickBooks, all of this will show up in your profit and loss (P&L) statement, which gives you an idea of how your business is performing.

We are often asked this question, so it’s best to clear it now. Business owners mix up expenses/revenue and assets/liabilities. You need to track them separately.

For example, when you buy something valuable for the business, such as equipment or a vehicle, don’t treat it like a regular expense. Instead, log it as an asset and record its value when you acquire it.

To calculate the full value, you also need to include any extra costs like shipping or installation fees.

3. Record Transactions

You need a simple and reliable system for recording transactions to keep your S Corp’s books in good shape. That starts with collecting and organizing receipts, invoices, and documents tied to your business spending or income.

Use a consistent method to categorize and track everything, whether it’s sales revenue, interest earned, service fees, or other types of income.

On the flip side, keep track of your business expenses. That includes rent, payroll, utilities, software subscriptions, and office supplies.

4. Managing Financial Records

Managing your S Corp’s financial records starts by setting up internal controls to protect your financial data from errors or misuse.

Keep a well-maintained general ledger that includes assets, liabilities, equity, revenue, and expenses. Also, don’t skip income statements, balance sheets, and cash flow reports.

Besides this, you need to stay on top of accounts payable and receivable so you know exactly what’s owed to you and what you owe others.

The important part of financial records is to reconcile bank statements regularly so you can identify any discrepancies.

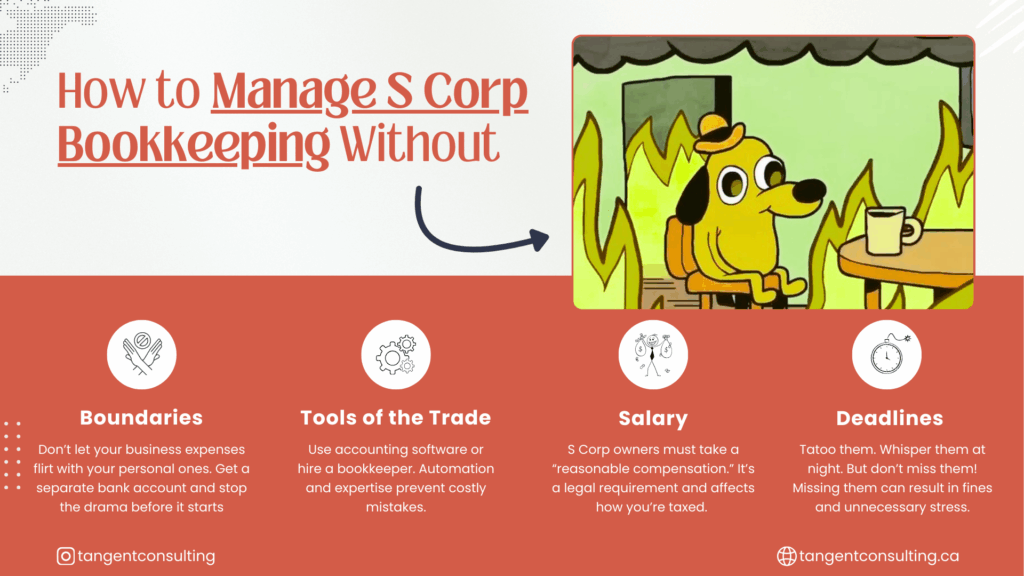

5. Staying Tax Compliant

Tax compliance is a big deal for S Corps, and falling behind can lead to costly penalties. To stay on the safe side, make sure you’re withholding the right amount for payroll taxes and paying them on time.

Estimating your taxes accurately and making quarterly payments as needed is also important.

You must record all tax-related items like deductions, payroll taxes, and filings. And since tax laws can shift, stay informed about any changes that might affect your business. A little effort throughout the year can save you a lot of stress when the tax season arrives.

6. Payroll and Compensation Management

One of the most important parts of S Corp bookkeeping is handling payroll, especially when shareholders are also employees. The IRS expects these shareholder-employees to be paid a reasonable salary before they take any distributions.

This salary can’t be a casual payment; it needs to be processed through a proper payroll system, with the right withholdings for income tax, Social Security, and Medicare.

To stay compliant, it is best to use payroll software like QuickBooks or a trusted provider to manage Form 941 and W-2 filings. Also, make sure to reconcile your payroll records every month so all wages and taxes are correctly recorded.

In addition, don’t try to pass off wages as distributions just to dodge payroll taxes. The IRS will see this as a red flag and may issue audits or penalties.

Still With Us?

If you’ve scrolled this far, chances are you’re serious about getting your business on track.

Book a free 15-minute strategy call — tailored to your industry — and let’s figure out what’s holding you back.

Book My Strategy Call ×Tips for Effective Bookkeeping

Good bookkeeping is essential to keeping your S corporation running smoothly. Every business is different, so your bookkeeping system should reflect your specific needs.

Here are some of the effective S Corp bookkeeping tips:

- First, always collect and store any document tied to a business transaction—receipts, invoices, bank statements. If your business does a high volume of sales, you might not log every transaction, but you should still track them in a way that gives you a reliable record.

- Next, make it a habit to update your corporate ledger regularly. The more business you do, the more often you’ll need to record transactions. The double-entry method, where each transaction affects two accounts, keeps things balanced and reduces errors.

- You’ll also need to prepare financial statements from time to time. An income statement helps summarize your company’s profits and losses, while your balance sheet gives an idea of the business’s financial position by showing assets, liabilities, and shareholder equity.

📘 Stressed About S Corp Bookkeeping?

Grab our free S Corp Bookkeeping Compliance Checklist — includes everything you need to stay on the IRS’s good side:

- ✔ Payroll rules

- ✔ Owner’s compensation

- ✔ What to track monthly

- ✔ What to prep for tax time

Common S Corp Bookkeeping Mistakes to Avoid

Even small bookkeeping hiccups can threaten your S Corp’s tax status or compliance. That’s why it’s important to know what to look out for.

- One of the biggest mistakes is mixing personal and business finances. Always keep them separate. A dedicated business bank account is necessary to protect your S Corp status.

If you haven’t set up a business account yet, Ramp offers corporate cards that come with built-in expense management, bill pay, and invoice tracking features. It’s a great way to keep your bookkeeping system organized and cloud-based. Plus, there’s a bonus waiting for you if you sign up using our link.

- Another common issue is overlooking shareholder loans. Whether money is going to or coming from a shareholder needs to be properly documented. You need to have a promissory note and track any interest owed, just like with any other loan.

- Another red flag is not keeping a proper audit trail. Every transaction should be backed by a receipt, invoice, or written contract. Without this documentation, you’ll struggle to prove expenses or income during an audit.

- And lastly, distributions can’t be handled casually. If a shareholder doesn’t have enough basis (i.e., their investment in the company), issuing distributions could lead to unexpected taxable income and penalties.

Avoiding these mistakes helps you stay compliant, keeps your financials clean, and protects your S Corp from unnecessary trouble.

Final Thoughts

So, there you have it. Bookkeeping for an S Corp is essential to keep your business legit, profitable, and tax compliant. Every detail matters more than you’d think, from choosing the right accounting method to handling shareholder salaries correctly.

And if it ever feels too overwhelming, outsourcing your bookkeeping can be a smart move to save time, reduce errors, and growing your business.

Fortunately, you don’t have to open another tab to do this. For over a decade, we’ve been helping S Corp owners like you ditch the overwhelmed and take control of your finances. We become your full accounting department, so you don’t have to hire people individually.

Let’s get your bookkeeping system working for you!

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

What is the difference between corporate accounting and bookkeeping?

Bookkeeping tracks daily transactions, while accounting interprets that data to create financial reports and guide decisions.

What is an S Corp balance sheet?

It illustrates your S Corp’s assets, liabilities, and shareholder equity for a specific period.

Can an LLC be an S Corp?

An LLC can elect to be taxed as an S Corp by filing IRS Form 2553. This lets the business avoid double taxation while keeping LLC flexibility.