How to Set Realistic Pricing for a Small Business?

Let’s say you paid $15 for a sandwich at the airport because you were starving. We know that’s ridiculous, but what’s more ridiculous is that it wasn’t that good.

But you paid the high price as you were hungry, and that’s when the pricing psychology kicked in. You wouldn’t pay this crazy price if you weren’t hungry. Many businesses use these psychological pricing strategies for their products and services.

But what if you don’t know how to price your product/service?

If you are a small business owner who wants to set realistic pricing for your products/services, stick with us for the next 20 minutes or so.

We’ll break down the different types of pricing strategies and how to set realistic pricing.

What is a Pricing Strategy?

Pricing is all about deciding what to charge for what you sell. Price is one of the key pieces of marketing (you’ve probably heard of the 4 Ps: Product, Price, Place, Promotion), and a pricing strategy is the thinking behind setting those price tags for a product on a shelf or a service you offer.

The thing about pricing is that not every strategy works for every business. Some models perform well with low prices and high volume, while others do better with premium pricing. The right pricing approach can help you:

- Show customers the value of what you’re offering

- Catch their attention

- Build their trust

- Drive more sales

- Increase revenue

- And yes, boost your profit margins

A solid pricing strategy helps you speak directly to the kind of customers you want, position your product the way you want it, and ultimately grow your business with intention.

Imagine you run a construction consultancy. If you charge by the hour, clients might focus too much on the clock instead of the outcome. But with a value-based pricing strategy, you can price your service based on the results you deliver.

Don’t Let Business Numbers Hold You Back 🚀

Most business owners know they should get a grip on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

What are the 5 Ps of Pricing?

Before we get into how to set realistic pricing, let’s talk about the 5 Ps of pricing. These are the core elements that guide how you should price your services or products. So, let’s break down the five Ps:

1. Cost

This is the starting point. You can’t set smart prices until you know what it costs to deliver your product or service. That includes direct costs (like materials or labor) and indirect ones (like rent, tools, or admin time).

Each service or product can have a very different margin. Overlooking this leads to underpricing or overpricing certain items.

That said, just because something costs a certain amount doesn’t mean that’s the only factor you should consider. Customers usually have no idea what your costs are, and they don’t care. What they do care about is value.

Here’s a simple way to think about it:

Potential sales = Units sold × Customer’s perceived value

Cost of sales = All direct and indirect costs

Gross margin = What’s left to cover other expenses and make a profit

2. Customers

Your customer decides if your price makes sense, so you need to understand how they view the value of what you’re offering.

Ask yourself:

What price range do they expect?

What’s the maximum/minimum they’d pay?

A helpful move is to ask the customers directly. You can mention something like, “If this were priced higher or lower, would you still buy it?”

Their answers can help you find your sweet spot.

Still With Us?

If you’ve scrolled this far, chances are you’re serious about getting your business on track.

Book a free 15-minute strategy call — tailored to your industry — and let’s figure out what’s holding you back.

Book My Strategy Call ×3. Channels of Distribution

If you’re not selling directly to your customers, you need to think about cuts of middle people like distributors or resellers. They need enough margin to stay motivated to sell your product or service.

But it’s not just about what they earn; you also need to consider the costs they add. Are they improving the customer experience? Are they helping you reach markets you couldn’t on your own? If not, it’s time to reevaluate whether they’re worth the expense.

4. Competition

Here’s where a lot of small businesses make a mistake. Even if you think your offering is one-of-a-kind, your customers may see it differently.

So, look at it from their perspective: What are they comparing you to? What else could they choose instead of you? If you’re unsure, talk to your customers. A quick conversation can give you surprising insights into how they weigh their options and how you can set prices.

5. Compatibility

Your pricing doesn’t exist in a vacuum. It has to be aligned with your bigger goals, like branding and marketing strategy.

For example, if a burger joint started offering $10 steaks, it would feel totally off-brand. The same goes for you. If your pricing sends the wrong message, it can confuse customers or work against your sales goals.

10 Common Pricing Strategies to Explore

Every business runs differently, so your pricing should reflect that. There’s no one-size-fits-all approach to pricing, but here are ten strategies to help you find a pricing model that fits your service or product.

1. Cost-Plus Pricing

Cost-plus, aka Markup pricing, is probably the simplest strategy. You start by calculating all your costs (materials, labor, overhead, etc.), then add a set percentage as your profit margin.

Let’s say you’re a plumbing business owner. Your time, tools, and resources cost you $500. If you apply a 40% markup, your final price would be $700. That covers your costs and gives you a $200 profit.

2. Competitive Pricing

This strategy involves knowing what your competitors charge and adjusting your prices accordingly. If you’re in a niche where many businesses offer similar services or products, price often becomes the deciding factor for buyers.

For example, let’s say you run a home cleaning service. If most competitors in your area charge around $150, you might set your price at $145 to grab attention.

But be careful: competing on price alone can turn into a race to the bottom. It’s always good to combine this approach with strong service, clear value, or an add-on that makes you stand out.

3. Value-Based Pricing

Value-based pricing focuses on what customers think your service or product is worth. This works great when your product/services are high-quality, solve a real problem, offer a standout experience, or fill a unique gap in the market.

Let’s say you’re a business consultant. If your service helps a client increase profits by $20,000, charging $5,000 for that transformation feels like a fair trade.

4. Price Skimming

Price skimming is about charging top dollar when your service or product first hits the market and then lowering the price over time as competition grows or demand levels out.

This strategy helps you maximize profits early on, especially if you’re offering something new, innovative, or in high demand with limited alternatives.

Imagine you’ve launched a premium service for business owners. At launch, you price it at $999, targeting early adopters who see the value and want early access. A few months later, you drop the price to $699 to bring in more price-sensitive buyers once the buzz starts to settle.

5. Discount Pricing

Everyone loves a deal, and that’s why discount pricing is such a popular strategy. There are different types of discounts such as seasonal sales, a clearance event, or a limited time offer.

Discounts can increase foot traffic, move older inventory, and attract shoppers who are always on the hunt for a bargain. That’s why we offer such huge discounts on Christmas.

6. Penetration Pricing

This strategy is about making a strong entrance. If you’re launching a new business or entering a competitive space, penetration pricing means offering your service or product at a lower price than the competition to quickly attract customers and grab attention.

Once you’ve built a customer base and earned trust, you gradually raise your prices to match the value you provide.

7. Dynamic Pricing

Dynamic pricing is flexible and constantly shifting based on factors like demand, availability, competitor pricing, or even the weather. It’s commonly powered by software or algorithms that update prices automatically.

Think about booking a hotel room. Prices often change based on seasonality, local events, or how many rooms are left. A hotel might charge $120 on a Tuesday, but that same room could jump to $250 during a festival weekend.

8. Psychological Pricing

Psychological pricing taps into how people feel about numbers, not how they think. One of the most common tricks is ending prices with “.99” instead of rounding up. A product priced at $9.99 feels cheaper than $10, even though the difference is just a penny. That’s why subscription services always end with .99.

This subtle shift can nudge customers toward a purchase by making the price look like a better deal.

9. Premium Pricing

Premium pricing sends a message that your products/services are more valuable. You set your price higher than competitors, not because of cost but because of value, brand perception, or exclusivity. This is the strategy many luxury brands use.

Of course, this doesn’t work everywhere. If your audience is extremely price-sensitive, premium pricing might turn them away, so know your market first.

10. Economy Pricing

This is the low-price, high-volume model. You keep your prices as low as possible by minimizing costs, and you make your money by selling a lot of units over time.

It works best when your products or services are simple, easy to deliver, and not heavily reliant on branding.

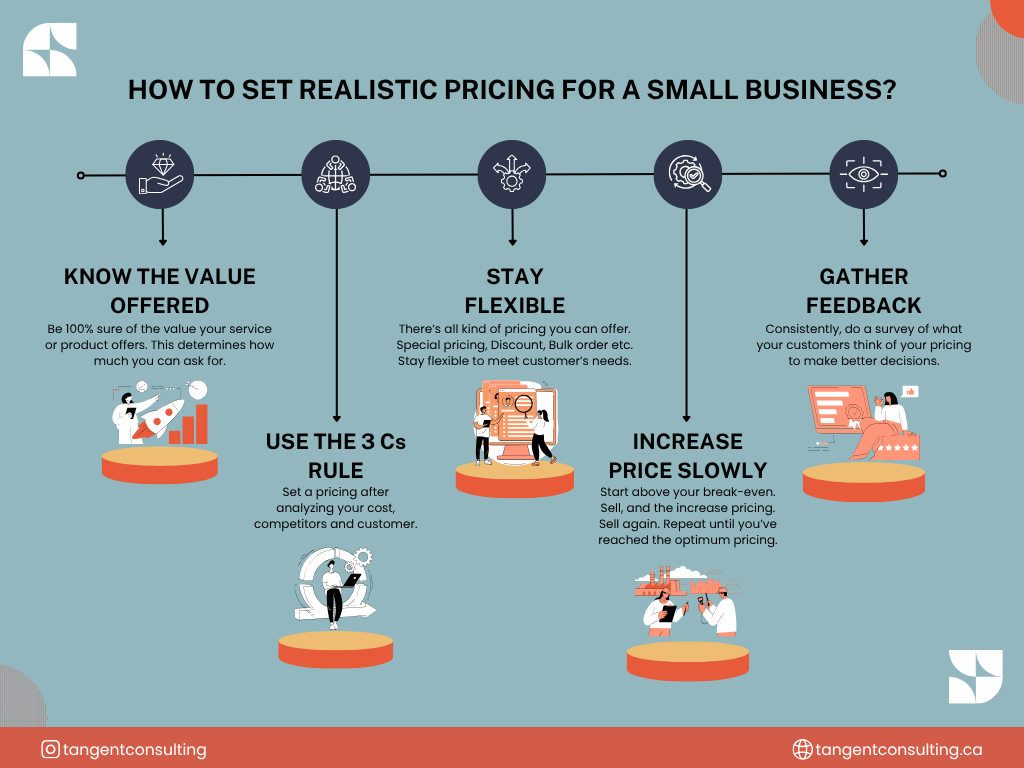

How to Build a Realistic Pricing Strategy?

Now that you’ve seen the different pricing methods, the next step is figuring out which one is suitable for your business. Here’s a step-by-step way to build a pricing strategy:

1. Determine Your Value

Before you consider pricing, clarify what you’re offering and how customers experience that value. This is called your value metric—it’s the basic unit your customers pay for.

Ask yourself: If I sold just one unit of what I offer, what would that look like? This helps you understand your product or service from the buyer’s point of view and sets the foundation for pricing it.

2. Evaluate Your Pricing Potential

Next, you want to understand what kind of price range you can realistically charge. This is about what customers are willing to pay and your market.

To figure that out, consider three things:

- How much does it take to deliver one unit of your product or service, including time, tools, and overhead?

- Is your offer solving the problem? How urgent is the need?

- What are competitors charging for similar offerings? Are you positioned as a budget-friendly option or a premium solution?

Let’s say you run a construction company. You check your costs and realize that doing basic work can take 15 hours and $100 in tools.

You also research the local market and see that competitors are charging anywhere from $1,200 to $3,000 for similar services. If your work is high-quality and you offer better support, you may decide to price it at $2,000, covering your costs and reinforcing your value.

3. Review Your Customer Base

Your existing customers can tell you a lot about your pricing. Look at how they’ve responded in the past:

- Are they price-sensitive, or do they pay for value?

- Did raising prices slow down sales or boost revenue?

- Did discounts help move the needle, or just attract bargain hunters who never returned?

These insights help you make smarter decisions moving forward based on customers’ behavior.

4. Determine a Price Range

You need to figure out your ideal pricing window. It is the sweet spot between what covers your costs and what your customers are willing to pay.

Start by asking:

- What’s the lowest price I can charge and still make a profit?

- What’s the highest price I can charge before people start walking away?

Let’s say your service costs you $80 to deliver. That’s your minimum price. If your customers have shown they’re comfortable paying $200 but start hesitating around $250, then your price range likely falls between $80 and $250.

5. Check Out Your Competitors’ Pricing

You need to take time to research how similar businesses are pricing their offerings. Make a list of competitors and their prices, then decide how you want to position yourself.

You’ve got two options here:

Undercut them to win on price (great if you’re going after volume)

Price higher and show why you’re worth it (perfect if you offer more value or a better experience)

Just make sure whatever approach you take lines up with your overall brand and the kind of customers you’re targeting.

6. Consider Your Industry

Pricing trends can vary wildly between industries, so it’s a good idea to study what others in your space are doing. Here are a few examples:

- Apple leans on premium pricing to create a sense of exclusivity and quality.

- Service providers often go with project-based pricing.

7. Consider Your Brand

Your pricing should match your brand personality and how you want people to perceive your business. If your brand is all about affordability and accessibility, economy pricing makes sense.

But if you’re positioning yourself as innovative or high-end, charging premium prices or using a strategy like price skimming can reinforce that image.

8. Experiment with Pricing

Once you’ve done the homework, don’t be afraid to test your prices. Running small pricing experiments can give you powerful insights.

A simple way to do this is through A/B testing. You offer the same product or service at two different prices to different customer segments and see which one performs better.

You can also try positioning your offer alongside competitors in your marketing to observe how customers respond when they compare price and value.

9. Don’t Skip the Numbers

One of the biggest mistakes business owners make is either underestimating their costs or trying to make up for them by overcharging. That’s where having a good accountant on your side makes all the difference.

An experienced accountant can guide you through all the costs you need to factor into your pricing, including:

- Direct costs like materials, labor, packaging, and marketing

- Operating expenses like rent, software, insurance, and admin

- Financing costs: if you’ve borrowed money to grow your business

- Your salary—yes, you need to pay yourself, too

- Returns for investors, future growth capital, and replacing old equipment

Once these are all laid out, you’ll have a much better idea of how much income your business needs. From there, you can build a pricing structure that keeps your business sustainable and profitable.

Final Thoughts

We hope we didn’t take longer than 30 minutes. You probably figured it out; there’s no one perfect approach for setting realistic pricing.

Even if two companies offer similar services, what works for one might not work for the other. That’s why it’s so important to factor in your brand, goals, costs, audience, and market position before creating a pricing model.

If you are on the fence about the right pricing strategy, why not let a pro handle it?

For over a decade, we’ve been helping small business owners like you ditch overwhelm and take control of their finances. We become your full accounting department, so you don’t have to hire people individually.

Let’s get your accounting system working for you!

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind.

FAQs

What’s the best pricing strategy for a small business?

Many small businesses start with cost-plus or value-based pricing to stay profitable and competitive.

What is the most aggressive pricing strategy?

Penetration pricing can be considered the most expensive, as it involves setting prices very low to grab market share immediately, even if you suffer initial losses.

What is the formula for pricing strategy?

A simple pricing formula is Price = Cost + Desired Profit Margin. However, the comprehensive formula also includes market demand, competition, and customer perception.