The A – Z Of Tax Rebate for Visitors to Canada

The A – Z Of Tax Rebate for Visitors to Canada

One of our clients visited a foreign country and looked for a popular coffee place. The experience was worth it, but when she saw the receipt, she felt in awe and said, “What’s this? There’s a tax on my coffee”? Even though the amount was small, she was quite bothered by this.

It shows that when you visit a foreign country, you have to be mindful of the small taxes you can encounter. Since we are in Canada, we thought, why not talk about the tax rebate for visitors to Canada?

If you are planning on visiting the Great White North on a personal or business trip, here’s how you can claim your tax rebates.

What is a Tax Rebate?

A tax rebate is a type of refund by the government if a person has paid more in taxes than they owe. Basically, the government is saying thank you and putting money back into your hands so you can spend, and they can boost economic activity.

For example, if you buy a hybrid car and the government is offering rebates on hybrid cars, you can get a rebate, and in return, you’ll spend money on the economy. Cheeky but nice!

When it comes to visitors in Canada, tax rebates work similarly. They give you something in return for your spending. Let’s get to the bottom of this.

Side Note: A lot of people confuse tax refunds with tax rebates. However, they are slightly different. Tax refunds are tied to deductions and credits on your tax returns. On the flip side, rebates can be issued at any time.

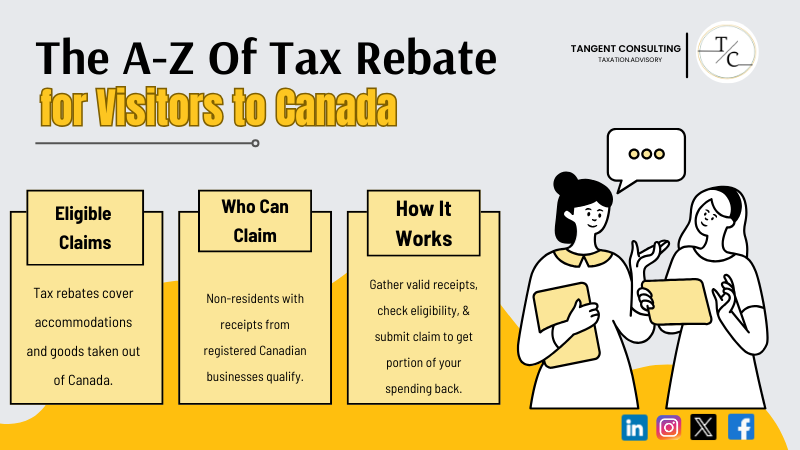

Tax Rebate for Visitors to Canada

You may find the next 2 to 3 minutes boring, as we have to put on our accounting and finance glasses and explain technical details.

Ok so, the Foreign Convention and Tour Incentive Program (FCTIP), administered by the Canada Revenue Agency (CRA), offers GST/HST rebates to certain groups involved in conventions held in Canada.

It includes convention sponsors, organizers, and exhibitors, allowing them to reclaim GST/HST paid on eligible properties or services used during these events.

In some situations, there’s more good news for those dealing with Quebec’s sales tax (QST). A rebate might apply for QST paid on purchases for a foreign convention. You’ll often see this tax listed as TVQ on invoices in Quebec—just the French equivalent of QST (fancy, eh).

However, if you’re a non-resident visitor shopping in Canada, there’s a catch. You can’t claim rebates on the GST/HST paid for your purchases within the country.

But don’t let that dampen your spirit—there are still ways to get rebates on your next visit.

Who is Eligible?

Before we get to the juiciest part of the guide, we need to talk about who’s eligible for tax rebates as a visitor. So, let’s see:

- Non-Resident Individuals on Leisure Trips: If you’re visiting Canada and have purchased eligible goods or short-term accommodations (including camping), you may qualify for certain rebates.

- Non-Residents on Business Travel: Those traveling for business and purchasing eligible goods for personal use might also be eligible.

- Sole Proprietors Combining Business and Leisure: If you own a business solely and have bought eligible goods for personal use, along with short-term accommodations, while on a business trip in Canada, you could qualify as well.

It’s important to note that eligibility criteria can vary, and certain conditions apply. For instance, FCTIP offers specific rebates to non-residents involved in conventions or tour packages in Canada.

However, as we mentioned above, a non-resident visitor cannot claim a rebate for the GST/HST paid on regular purchases made in Canada.

What Qualifies for the Refund?

You may be eligible to claim a refund for the GST/HST you paid on goods if:

- The goods must have been taxed with GST/HST at the time of purchase.

- The items you purchase should primarily be for personal use outside of Canada.

- You need to take the goods out of the country within 60 days of when they were delivered to you.

What purchases are eligible?

Ok, so you bought a cool Canadian Goose Jacket. Is that eligible? Yes, it is. Let’s see what other items are eligible:

- Items like clothing, souvenirs, and gifts purchased during your visit could be eligible for a rebate.

- Expenses for hotel stays, motels, or even camping accommodations might qualify.

- If you’ve purchased a bundled experience that includes accommodations, transportation, or sightseeing, these may also be eligible.

- Meals and drinks from restaurants, cafés, or take-out spots could make the list, too.

However, there are notable exceptions. Certain purchases, such as services, motor vehicles, and tobacco products, are not eligible for rebates. It’s always smart to double-check the eligibility of your items.

What are the Rebate Amounts?

Again, we have to put our nerdy glasses on and explain technical things.

Canada’s federal GST is set at 5%. For eligible purchases, you can claim a 5% rebate if your total eligible expenses meet the minimum threshold, around $200.

In certain provinces, the GST is combined with the provincial sales tax to form the HST. The HST rate varies by province, affecting the rebate amount you can claim. For instance, in Ontario, the HST is 13%, so eligible purchases may qualify for a 13% rebate. Some provinces, like Alberta, only charge the 5% GST and do not have a provincial sales tax, resulting in a total tax rate of 5%.

It’s important to note that the rebate applies only to the federal portion (GST) of the tax paid. Provincial portions of the HST are generally not refundable.

Final Thoughts

Now you know about the tax rebate for visitors to Canada. It can look complicated, and you may think you are solving algebra. However, these tiny savings can be helpful for businesses and individuals.

So, next time you visit Canada and before you leave, take a moment to review your purchases and gather your receipts. For more info, you can visit CRA’s official page.

If you are a business reading this and thinking, “Why the hell I didn’t know about this earlier?” Well, there’s a lot more where it came from. We are talking about our tax-saving repository.

We have years of experience as a tax consultant, CFO, and business coach. With us, you don’t need to hire an accountant or business coach separately; you can get both in one place.

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

How does the Canadian tax refund system work?

The Canadian tax refund system allows eligible visitors to claim a rebate on GST/HST paid for certain goods and services, provided they meet specific criteria.

What are the regulations for VAT refunds in Canada?

Canada does not have VAT but uses GST/HST. Non-resident visitors cannot claim refunds on general purchases but may qualify for rebates under specific programs like FCTIP for conventions or tour packages.

Is the tax higher in Canada or the US?

Canada generally has higher sales tax (GST/HST) than the US. It’s because the US relies more on state-level taxes, which can be lower overall.