Why Outsource Accounting? Glad You Ask

Do you remember the first time you tried to grill a steak?

We do, as if it happened yesterday. We followed Gordan Ramsey’s perfect steak recipe. We watched a video a couple of times before trying it ourselves.

The problem was we didn’t watch it properly. So, the result was that we burnt the sides, and the middle part was cold.

Perhaps you aren’t interested in our cooking adventures. However, what you might be interested in is your business finances. They may look fine, but under the surface, things could be undercooked.

That’s why outsource accounting is a necessary part of saving your business from costly mistakes.

If you haven’t outsourced your business accounting yet, this guide can help you out.

What Does Outsourced Accounting Look Like?

When we say outsourcing accounting, it means having an accounting department without the need for chairs, payroll costs, or management headaches.

When you outsource, you hire experts who become your accounting department, allowing you to focus on running your business operations.

Here’s what they do:

- They review your financial reports, prepared by the bookkeeper, to ensure everything is accurate.

- They double-check that your financial records comply with local and federal regulations so you can stay at peace during tax season.

- They calculate what you owe in taxes and prepare your returns.

- They take a deeper look into your books and accounting systems.

- They keep your records organized and clean, going beyond just what a bookkeeper might do.

- They help you make smarter money moves, like when to invest in new equipment or where you might be losing money during slow seasons.

- They give you advice on how to cut costs, boost income, and improve your bottom line.

- If you need an audit, they can help you with that.

- They help in figuring out the financial future of your business with solid projections.

- When tax laws change (as they always do), they inform you of what matters and how to stay compliant.

Let’s illustrate this with an example.

Suppose you run a small construction business. You don’t have an idea or don’t want to reconcile accounts or figure out your quarterly tax installments.

With outsourced accounting, a CPA-level professional prepares your taxes and also identifies instances where you’ve been overpaying on equipment depreciation. They help you restructure your purchases for next year and set up a clearer cash flow system.

Don’t Let Business Numbers Hold You Back 🚀

Most business owners know they should get a grip on their finances — but don’t know where to start. That’s where we come in. Book a free 1-on-1 call with Tangent Consulting and let’s untangle your numbers together.

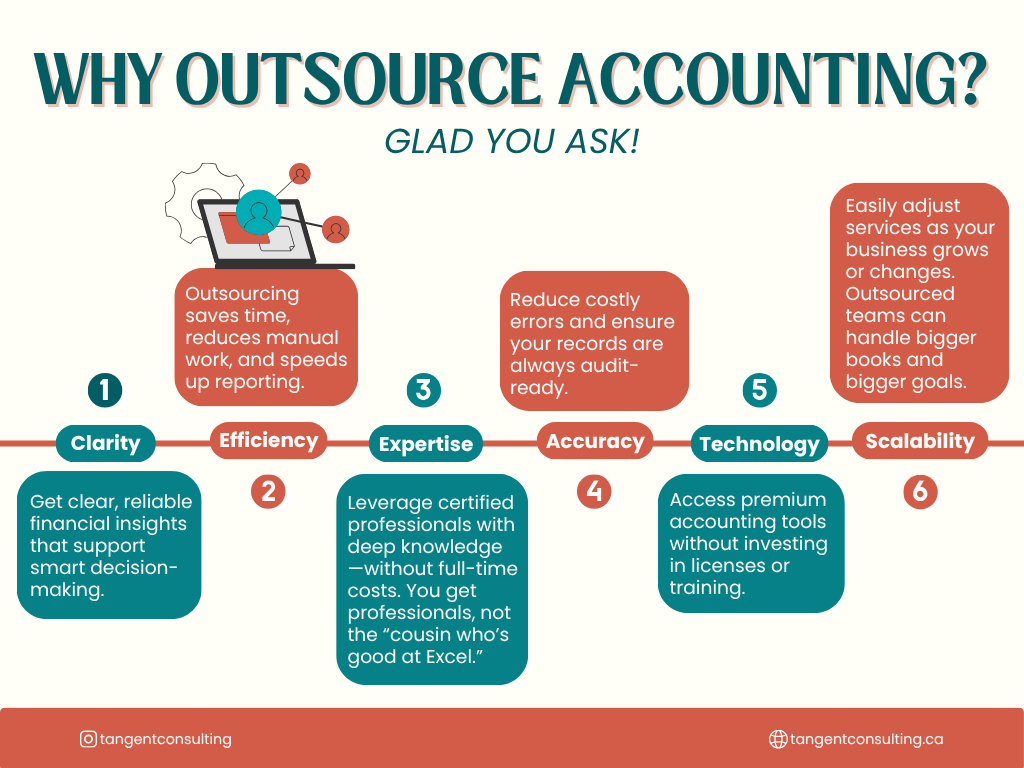

Why Outsource Accounting?

According to Accounting Today’s 2024 Top 100 Firms survey, outsourced accounting is the top area in which firms are investing. It’s not a new fad in town; it’s what businesses are doing to stay ahead of their competition.

So, here’s why outsource accounting can be beneficial for your business:

1. Get More Hours Back

Outsourcing your accounting frees up mental space, allowing you to reclaim your time. When you work with an outsourced accountant, they take care of the nitty-gritty, such as payroll, budgeting, reconciliations, and managing debt. You receive accurate and timely info that helps you make smart decisions.

The best part is that as your business grows, outsourcing accounting support can grow with you. It provides flexibility without requiring a full in-house team.

2. Cut Down on Overhead Costs

You may ask, “Oh Tangent, outsourcing can be expensive for my business.”

No, it isn’t.

When you hire an external accounting team, it can help you save on overhead costs. It’s because you pay for the service you need, nothing more, nothing less.

In comparison, when you hire in-house, you have to cover the benefits, payroll taxes, and office space.

📊 Monthly ROI Calculator

Find out how much you could be saving by outsourcing your accounting.

3. Tap Into Expert-Level Skills

When you outsource, you’re not just hiring an accountant; you’re getting access to expertise. These professionals have spent years, sometimes decades, working with businesses like yours. They’ve seen the pitfalls, identified the patterns, and know what works and what doesn’t.

In addition, since they’ve worked with companies across different industries and sizes, they bring insights that go way beyond the numbers. That kind of experience is hard to match with an in-house hire, especially for a small business.

4. Say Goodbye to Staffing Headaches

Hiring in-house can come with its own set of complications, including office politics, personality clashes, or biases. With an outsourced accountant, you don’t have to worry about any of that.

They’re not involved in day-to-day office dynamics, so their advice stays objective and strictly focused on what’s best for your business.

Also, they’re not buried in internal noise. They can step back, look at the bigger picture, and offer a fresh perspective, something that’s hard to do when you’re too close to the day-to-day grind.

5. Get Accurate Financial Reports

Outsourced accounting firms are made up of pros who know what they are talking about. They don’t engage in guesswork and late-night number crunching (a common issue for small business owners).

You’ll get financial reports that are accurate, detailed, and easy to understand. These reports provide reliable insights you can count on when it’s time to file taxes or check your business’s health.

6. Be Proactive, Not Reactive

When your accounting is in good hands, you plan with confidence. Outsourced firms often use streamlined systems that give you a real-time look at your finances. So, instead of wondering what went wrong last quarter, you’ll know what’s coming next.

This kind of visibility helps you make confident decisions, like when to invest, when to hold back, or how to scale without risking your cash flow.

When Should You Think About Outsourcing Accounting?

Before outsourcing, take a step back and ask yourself: Does outsourcing make sense for my business right now?

After answering that question, you need to consider the costs and the service provider.

Hiring a big firm to manage might not be realistic if you’re running a small business with tight margins. That kind of full-service package can eat into your profits, just like hiring a full-time, in-house employee would.

Still With Us?

If you’ve scrolled this far, chances are you’re serious about getting your business on track.

Book a free 15-minute strategy call — tailored to your industry — and let’s figure out what’s holding you back.

Book My Strategy Call ×That’s why it’s important to weigh the costs. Look at what you’re currently spending (or would spend) on accounting, including your time and energy.

Then, compare it to the cost of an outsourced service. If outsourcing helps you save time, reduces stress, and gives you better financial insight without draining your budget, it can be a smart move.

Final Thoughts

No matter what kind of business you run, managing your finances properly is a must. And while you could bring someone on staff, outsourcing your accounting might be the smarter (and cheaper) move.

Instead of paying a full-time salary, benefits, and overhead, you get expert help when you need it. For many business owners, that switch alone can save thousands each year while freeing up time and reducing stress.

Speaking of reducing stress, at Tangent, we become your fully outsourced accounting department. For over a decade, we’ve been helping businesses like yours ditch the overwhelmed and take control of their finances.

Let’s get your accounting system working for you!

P.S. If you are reading this, it means you can have access to our free consultation for your business. Avail this for free today before we change our mind 😉

FAQs

Who benefits the most from outsourcing?

Small to mid-sized business owners benefit the most from outsourcing. They save time, reduce costs, and gain expert financial insights without hiring full-time staff.

What are the 4 factors to consider before outsourcing?

Cost, quality of service, scalability, and data security are key factors before outsourcing.

Is it cheaper to outsource accounting?

Yes, outsourcing is usually more cost-effective than hiring in-house staff when considering salaries, benefits, and overheads.